All High Courts

BJP Leader Subramanian Swamy Moves Allahabad HC Against UP Govt's Action Declaring Fairs Of State's Temples As Govt 'Melas'

Bharatiya Janata Party (BJP) leader Subramanian Swamy has approached the Allahabad High Court challenging the Uttar Pradesh government's 2017 decision to take over the management of Melas and festivals associated with state temples. Swamy's Public Interest Litigation (PIL) petition, which will be heard by a bench of Chief Justice Arun Bhansali and Justice Vikas Budhwar on...

Delhi High Court Quashes Rape FIR Citing Misuse Of Section 376 IPC, Says It's Used As Weapon By Some To Unnecessarily Harass Males

The Delhi High Court has recently quashed a rape FIR against a man citing misuse of Section 376 of Indian Penal Code, 1860, observing that it was a classic example of how an innocent person had faced undue hardships due to misuse of the penal provision.“It is true that the provision under which the FIR has been lodged is one of the most heinous crimes against women, however, it is also...

'Alarming Escalation': Punjab & Haryana High Court Lays Down Guidelines For Curbing VISA Fraud & False Implications

Observing that visa fraud if left unchecked could "tarnish the nation's reputation on a global scale and undermine the integrity and legality of immigration systems, where one can already feel the headwinds," the Punjab & Haryana High Court said that when such a case is registered the concerned agency must verify the claim and the complainant's credentials. The Court said, "whenever an FIR...

Student Moves Madras High Court Challenging CBFC Certificate To Amaran Movie, Claims Compensation For Using His Phone Number

An engineering student has approached the Madras High Court challenging the Censor Certificate issued to the Tamil Movie “Amaran” starring Sivakarthikeyan and Sai Pallavi. The student has also sought damages claiming that his personal phone number had been used in the movie leading to him getting continuous calls. When the matter was taken up by Justice S Sounthar on Friday,...

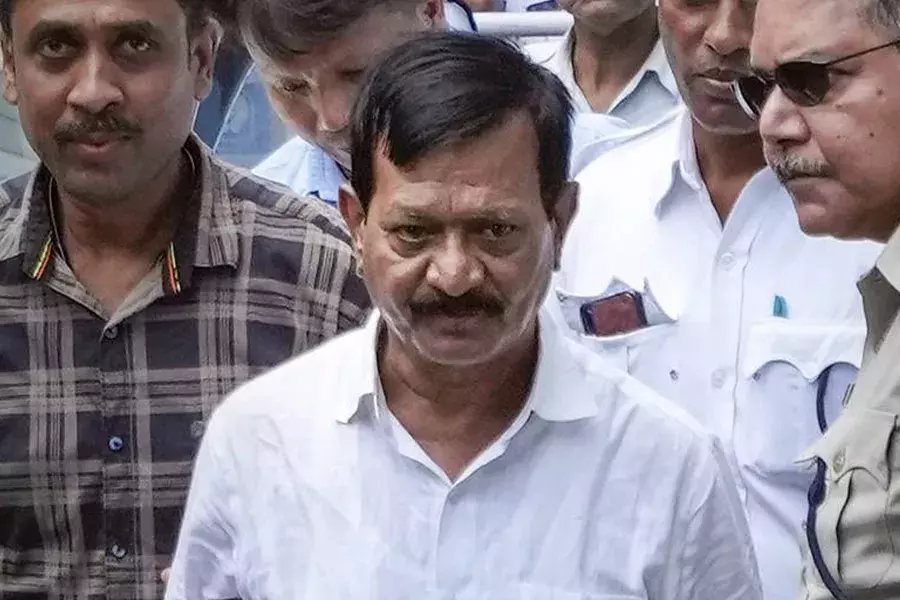

Prosecution Can't Commence With Statement Of Co-Accused U/S 50 PMLA: Calcutta HC Grants Bail To Recruitment Scam Accused Sujay Krishna Bhadra

The Calcutta High Court has granted bail to recruitment scam accused Sujay Krishna Bhadra. Bhadra's firm was linked with transfer of proceeds of crime to M/S Leaps & Bounds Pvt Ltd, a company linked with AITC MP Abhishek Banerjee.Justice Suvra Ghosh granted bail and held: The case essentially hinges on the statement of the petitioner and the co-accused and recovery made pursuant to the...

Informal Opinion Rendered By Expert Not Binding On Court: Madras High Court Grants Bail To Man Found In Possession Of Magic Mushrooms

The Madras High Court recently held that while considering bail applications, an informal opinion rendered by an expert was not binding on the court. It reiterated that while exercising bail jurisdiction, the court had to consider the language adopted in the enactment and only had to be prima facie satisfied whether there was a reasonable chance of conviction.Justice Anand Venkatesh made...

[Income Tax] No Substantial Question Of Law Arises If Perversity Cannot Be Shown In Order Passed By Tribunal: Allahabad High Court

The Allahabad High Court has held that no substantial question of law arises in a case where no perversity can be shown in the order passed by the Income Tax Tribunal in appeal under Section 260A of the Income Tax Act, 1961. Section 260A of the Income Tax Act, 1961 provides for an appeal to be filed before the High Court against the decision of an Appellate...

Allegation of Manufacturer 'Clandestinely' Clearing Goods To Escape Tax Must Be Based On 'Tangible Evidence': Delhi HC

The Delhi High Court has held that where a manufacturer is booked by the tax authorities for clandestinely clearing its goods to escape tax, the charge must be based on “tangible evidence”. A division bench of Justices Yashwant Varma and Ravinder Dudeja further observed, “In adjudication proceedings to establish the charge of clandestine removal and under valuation, Revenue is...

Pendency Of Dispute Regarding Excess Payment Does Not Bar Release Of Retiral Benefits In Timely Manner: Calcutta HC

A single judge bench of the Calcutta High Court comprising of Saugata Bhattacharyya, Justice, while deciding a writ petition held that a retired government employee is entitled to receive retiral benefits (including pension) in a timely manner, even when there is a pending dispute regarding alleged excess salary drawn during the service period. Background Facts The...

Laying Down Optical Fibre Cables To Enhance Communication Network For Defence Forces Is Exempt From Service Tax: Delhi High Court

The Delhi High Court recently declared that Telecommunications Consultants India Limited, a central public sector undertaking which secured a Project floated by BSNL for laying down Optical Fibre Cable Network, is exempt from service tax since the service is in the nature of setting up a civil infrastructure so as to benefit the defence forces in having a better communication...

'Monster Like Conduct': Punjab & Haryana High Court Confirms Death Penalty Of Man Convicted For Rape And Murder Of Minor Girl

The Punjab & Haryana High Court on Thursday confirmed death sentence of a man convicted for the rape and murder of a 3-year-old girl in 2018, observing that the "gruesome murder" of a girl child after committing rape upon her is an example of "monster like conduct of the convict."A division bench of Justice Sureshwar Thakur and Justice Sudeepti Sharma agreed with the reasoning given by...

Renewal Commission Of LIC Agent Is Hereditary: Jharkhand High Court Affirms Compensation Of ₹1.14 Crores To Widow

The Jharkhand High Court has recently ruled that the renewal commission earned by a deceased LIC agent is hereditary and payable to the widow irrespective of whether the death is natural, homicidal, or accidental.The court held that this commission cannot be deducted from the loss of dependency amount in compensation claims.Justice Subhash Chand, presiding over the case, observed, “The...

![[Income Tax] No Substantial Question Of Law Arises If Perversity Cannot Be Shown In Order Passed By Tribunal: Allahabad High Court [Income Tax] No Substantial Question Of Law Arises If Perversity Cannot Be Shown In Order Passed By Tribunal: Allahabad High Court](https://www.livelaw.in/h-upload/2024/10/31/500x300_568956-allahabad-high-court-prayagraj.webp)