Allahabad High Court

UP Revenue Code 2006 | Land For Public Use Cannot Be Exchanged By Encroacher With His Own Land: Allahabad High Court

The Allahabad High Court has held that land recorded for public use cannot be exchanged by encroacher with his own land.The bench comprising Justice Rajnish Kumar held that restoring the pond and maintaining it is beneficial for the villagers and for maintaining ecological balance. The Court further observed that under Section 101 (Exchange) of UP Revenue Code a bhumidar can exchange land held...

Allahabad HC Upholds 'Ex-Parte' Divorce Decree Passed On Wife's Continued Absence, Says Natural Justice Can't Be Used To Defeat Ends Of Justice

The Allahabad High Court has held that even though opportunity of hearing before passing an order is non-negotiable, the same cannot be used to defeat the ends of justice. The Court held that if delay has been negligently or deliberately caused by one party, it cannot be allowed to take advantage of the delay.The bench comprising Justice Saumitra Dayal Singh and Justice Shiv Shanker...

UP VAT Act | Enhancement Of Turnover Not A Necessary Consequence To Rejection Of Books Of Accounts: Allahabad High Court

The Allahabad High Court has held that turnover cannot be enhanced merely based on rejection of books of accounts. There has to be material as to suppression of turnover by the assesee to indicate evasion of tax.Relying on various judgments of the Allahabad High Court, Justice Piyush Agrawal held “Once the findings of fact has been recorded in favour of the petitioner, there is no cogent...

Rejection Of Books Of Accounts Under UPVAT Act Will Not Necessarily Lead To Rejection Of Books Under Central Sales Tax Act: Allahabad HC Reiterates

The Allahabad High Court has reiterated that in absence of any material on record, rejection of books of accounts under local laws cannot be the sole ground for rejection of books of accounts under Central Sales Tax Act.“Merely because books of account under local sales have been rejected, the same will not necessarily be the ground for rejecting the books of account under Central Sales Tax...

Allahabad HC Directs A DSP To Tender An Unconditional Apology In Person To A Judicial Magistrate For Disrespecting Her

The Allahabad High Court on Monday directed a Deputy Superintendent of Police, for showing disrespect to a Judicial Magistrate, to personally appear before the concerned Presiding Judge, and submit his unconditional apology. A bench of Justice Ashwani Kumar Mishra and Justice Syed Aftab Husain Rizvi passed the order while dealing with a contempt matter concerning the incident....

Section 19 Family Courts Act 1984 | Order Of Family Court Under Section 125 CrPC Not Appealable: Allahabad High Court

The Allahabad High Court has held that order passed by the Family Court under Section 125 of Code Of Criminal Procedure, 1973 is not appealable before the High Court under Section 19 of the Family Courts Act, 1984.While referring to Section 19 of the Family Courts Act, 1984, the bench comprising of Justice Saumitra Dayal Singh and Justice Shiv Shanker Prasad held “By using the words "Save...

Early Disposal Of Cases Against MPs/MLAs | Allahabad HC Registers Suo Moto Case, Issues Directions To Special Courts Across State

The Allahabad High Court on Friday registered a suo moto case, in compliance with the Supreme Court's recent direction, to expedite the disposal of criminal cases pending against the Members of Parliament and Legislative Assemblies across the state. It may be noted that in the Supreme Court's November 9, 2023 order, inter alia, High Court Chief Justices were directed to register a suo motu...

UPVAT Rules | Stricter Approach To Be Followed Before Giving Benefit Of Exemptions/ Deductions: Allahabad High Court

The Allahabad High Court has held that though in case of doubt, taxing statues are to be interpreted in favour of the assesee. However, a stricter approach needs to be followed before giving the benefit of exemptions and deductions.“The general rule of law in taxing statutes is that in case of any doubt the benefit should be given to the assessee. However, in case of exemption and deduction...

Department Required To Serve Notice Upon Legal Representative Of Deceased Before Proceeding Under GST Act: Allahabad High Court

The Allahabad High Court has held that the Goods and Service Tax Department is required to serve notice upon the legal representative of a deceased before proceeding against the deceased under the Central Goods and Service Tax Act, 2017.Petitioner’s husband was the sole proprietor of the firm was engaged in providing services as a Consultant. A show cause notice was issued in the name...

'Huge Cache Of Arms & Ammunition Found In His Residence': Allahabad HC Denies Bail To UP MLA Abbas Ansari In Arms Licence Case

The Allahabad High Court (Lucknow Bench) on Monday denied bail to Uttar Pradesh MLA Abbas Ansari, son of the gangster-turned-politician Mukhtar Ansari, in an arms license case. In its order, a bench of Justice Subhash Vidyarthi stated that huge quantities of arms and ammunition had been recovered from Ansari’s premises in New Delhi. The bench also cited a potential risk of...

UP Prevention of Cow Slaughter Act 1955 Doesn't Bar Or Restrict Transportation Of Beef: Allahabad High Court

The Allahabad High Court has observed that the UP Prevention of Cow Slaughter Act 1955 and its associated Rules apply specifically to the transportation of cows, bulls, or bullocks into Uttar Pradesh from outside the state and thy do not prohibit the transportation of beef, as there is no provision within the Act or rules restricting the movement of beef. The observation was made by...

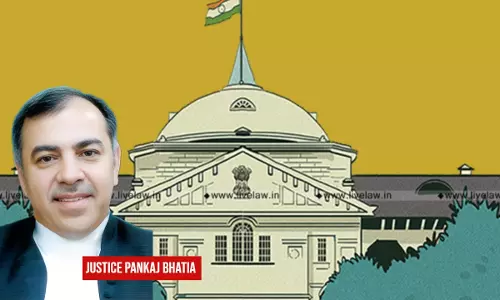

'Degrades' AG's Office: Allahabad HC Strikes Down Amendment Shifting Appointment Powers From Advocate General To Law Secretary

The Allahabad High Court has struck down the Uttar Pradesh Advocate General and Law Officer Establishment Service (Fourth Amendment) Rules, 2022 to the extent that they replace the Advocate General of Uttar Pradesh with the Principal Secretary (Law), State of Uttar Pradesh as the appointing authority of various posts.The principle Rules which govern the service conditions of the employees of...