Bombay High Court

'Consumer Cannot Claim Interest On Statutory Deposit Made U/S 127(2) Of Electricity Act': Bombay High Court

The Bombay High Court has held that a consumer has no enforceable statutory right to claim interest on the mandatory pre-deposit made under Section 127(2) of the Electricity Act, 2003, when the assessment of unauthorised use of electricity is set aside in appeal. The Court observed that the deposit under Section 127(2) is a condition precedent for maintaining the statutory appeal and is not...

Income Tax Act | Bombay High Court Allows Treaty-Based Cap Of 10% On DDT For Foreign Shareholder; Sets Aside BFAR Ruling

The Bombay High Court (Goa Bench) has held that Dividend Distribution Tax (DDT) paid by an Indian subsidiary to its foreign shareholder must be restricted to the treaty rate of 10% under Article 11 of the India-UK India Double Taxation Avoidance Agreement (DTAA) A Division Bench of Justice Bharati Dangre and Justice Nivedita P. Mehta allowed the appeal filed by the assessee,...

Trimurti Films Sues Dharma, Saregama In Bombay High Court Over 'Saat Samundar Paar' Song In Upcoming Film

Trimurti Films Pvt. Ltd., the producer of the 1992 film Vishwatma, has moved the Bombay High Court seeking to restrain the use of its iconic song “Saat Samundar Paar” in the upcoming Hindi film "Tu Meri Main Tera Main Tera Tu Meri", alleging unauthorised remixing and incorporation of the song without its consent. The suit has been filed against Dharma Production, Namah Pictures...

'Cut-Off Date In Welfare Scheme Not Sacrosanct': Bombay High Court Allows Monetary Benefit Claim By Heirs Of Deceased COVID Frontline Staff

The Bombay High Court has held that the cut-off date prescribed under a welfare scheme meant for COVID-19 frontline workers cannot be applied in a rigid or technical manner so as to defeat the very object of the scheme. The Court observed that such schemes must receive a liberal and beneficial interpretation, particularly where a frontline worker contracted COVID-19 during the currency of...

Bombay High Court Quashes Tax Notices Issued Against Mumbai Company After SVLDRS Settlement

The Bombay High Court has held that once a dispute is settled under the Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019 and a Discharge Certificate is issued, tax authorities cannot reopen the matter. A Division Bench of Justice M S Sonak and Justice Advait M Sethna set aside two show cause notices issued by officers of the Central GST Audit-II wing, Mumbai, after the dispute was...

Bombay High Court Upholds Validity Of ODR Clause, Refuses Substitution Of Arbitrator Appointed Through ODR Platform

The Bombay High Court has upheld the validity of an Online Dispute Resolution (“ODR”) clause as well as the arbitrator appointment process conducted through an ODR platform. The Petitioner i.e. Amit Chaurasia (“Chaurasia”) filed an application for substitution of arbitrator. The Bench of Justice Somasekhar Sundaresan reviewed the contract between the parties and observed that...

Patanjali Foods Moves Bombay High Court Against YouTube Channel For Making Defamatory Video, Demands ₹15.5 Crores In Damages

Patanjali Foods has approached the Bombay High Court against popular YouTube Channel 'Trustified Certification' demanding Rs 10.5 crores as damages for loss of reputation and Rs 5 crore as 'special damages' for causing injury to their brand by uploading an allegedly 'defamatory' video against its product 'Nutrela Soya Chunks.'The suit filed through advocate Apoorv Srivastava was listed before...

Bombay High Court Bars Sale of Cough Syrup Under 'CEFDON' Mark, Citing Similarity With 'CEDON'

The Bombay High Court has permanently barred an Ahmedabad-based drug company from selling a cough syrup under the name “CEFDON”, ruling that it is too similar to an existing and well-known brand, “CEDON.” In a judgment delivered on December 16, 2025, Justice Arif S Doctor ruled in favour of Blue Cross Laboratories Private Limited, which owns the registered trademark “CEDON.”...

Bombay High Court, Magistrate Courts In Mumbai Vacated Following Bomb Scare

The Bombay High Court and various Magistrate Courts in Mumbai have received Bomb threats, leading to the courts premises being vacated.Court complexes at Andheri, Bandra and Esplanade (at Fort) were vacated, court work has been discharged for the day and Bomb Squad has reached the courts.Evacuation at High Court is also ongoing. Session is likely to resume post-lunch, after...

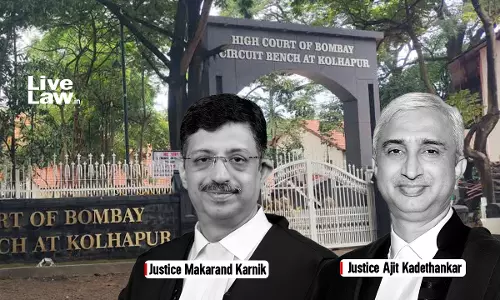

'Facilitates Access To Justice' : Supreme Court Dismisses Plea Challenging Formation Of Bombay High Court's Kolhapur Bench

The Supreme Court today(December 18) dismissed a writ petition filed by advocate Ranjeet Baburao Nimbalkar, challenging the August 1 notification of the Bombay High Court issued under Section 51(3) of the States Reorganisation Act, 1956, for the creation of the recent Kolhapur Circuit Bench, which became effective from August 18. A bench comprising Justice Aravind Kumar and Justice NV...

'Crimes By Police Undermine Integrity Of Entire Justice System': Bombay High Court Denies Bail To 5 Cops From Daman

Observing that crimes by law enforcers undermine the integrity of the entire justice system, the Bombay High Court on Tuesday denied bail to five policemen from Daman and Diu Union Territory, who were booked for illegally detaining young boys from Surat, physically abusing them and demanding Rs 25 lakhs as 'ransom' to release them and releasing them subsequently after receiving Rs 5 lakhs...

[Goa Succession Act] 'Inventory Court Cannot Re-open Entire Proceedings U/S 446 To Create Fresh Allotment': Bombay High Court

The Bombay High Court has held that the Inventory Court has no jurisdiction under Section 446 of the Goa Succession, Special Notaries and Inventory Proceedings Act, 2012, to re-open concluded inventory proceedings for the purpose of creating a fresh allotment of shares. The Court clarified that Section 446 permits only limited amendments by consent of parties or correction of clerical...

![[Goa Succession Act] Inventory Court Cannot Re-open Entire Proceedings U/S 446 To Create Fresh Allotment: Bombay High Court [Goa Succession Act] Inventory Court Cannot Re-open Entire Proceedings U/S 446 To Create Fresh Allotment: Bombay High Court](https://www.livelaw.in/h-upload/2025/07/30/500x300_612843-justice-valmiki-menezes.webp)