Bombay High Court

Harshad Mehta Scam: AO Can't Assess Additions Again If Deleted By CIT(A) In First Round Of Proceedings; Bombay High Court

The Bombay High Court in the Harshad Mehta Scam case, while upholding the ITAT's ruling, held that the Assessing Officer could not have assessed additions again since the CIT (A) had deleted the same in the first round of proceedings and the concerned matters have attained finality. The bench of Justice K. R. Shriram and Justice Dr. Neela Gokhale has observed that various types of...

By 2:1 Majority Bombay High Court Allows Centre To Notify 'Fact Check Unit' Which Can Declare Social Media Content About Its Business As Fake

By a 2:1 majority and in a setback for the petitioners in the 2023 IT Rules Amendment Case, the Bombay High Court -in an interim order – has refused to restrain the Union government from notifying its Fact Check Unit.Rule 3(1)(b)(v) of the IT Rules amendment 2023 empowers the government to establish a Fact check Unit and unilaterally declare online content related to the government's...

Application For Compensation To Landlord During Stay On Eviction Decree Can't Be Entertained When Appeal Is Ready For Final Hearing: Bombay HC

The Bombay High Court recently held that an application for compensation to a landlord in case of interim stay on eviction decree during appeal cannot be entertained after the appeal is ready for final hearing when both parties were heard at the time of admission of the case.Justice Rajesh S Patil, while dealing with a tenant's revision application against an eviction decree, dismissed...

Exgratia Bonus Paid By Indian Express To Employees Over And Above Eligible Bonus Is Allowable As Business Expenditure: Bombay High Court

The Bombay High Court has held that exgratia bonuses paid to employees over and above the eligible bonus under the Payment of Bonus Act are allowable as business expenditures.The bench of Justice K. R. Shriram and Justice Dr. Neela Gokhale has observed that the ITAT was not right in law in holding that the liability for salary and wages arising out of the Justice Palekar Award is not allowable...

Maharashtra Prevention Of Gambling Act | ASP Can Raid Suspected Gambling Houses Without Special Authorization From State: Bombay HC Full Bench

The Aurangabad bench of Bombay High Court held recently that the Assistant Superintendent of Police (ASP) can conduct raids on suspected gambling houses under the Maharashtra Prevention of Gambling Act, 1887 without being specially authorized by the state government.A full bench of Justice Mangesh Patil, Justice NB Suryawanshi and Justice RM Joshi stated that high rank officials and...

Bombay High Court Weekly Round-up: March 4, 2024 To March 10, 2024

Nominal Index [Citation 120 - 135]Mehandi Kasim Jenul Abidin Shaikh @ Mehandi Kasam Shaikh @Bangali Baba v. State of Maharashtra 2024 LiveLaw (Bom) 120G.N. Saibaba v. State of Maharashtra 2024 LiveLaw (Bom) 121Sanjay Pran Gopal Saha v. State of Maharashtra and Ors. 2024 LiveLaw (Bom) 122Shiv Charan v. Adjudicating Authority 2024 LiveLaw (Bom) 123Shell India Markets Private Limited v. Union...

Bombay High Court Orders Release Of Rape Convict Found To Be Juvenile After 19 Yrs Of Imprisonment

The Bombay High Court has ordered the release of a 36-year-old rape convict after 19 years of imprisonment as he was found to be a juvenile at the time of the offence in 2005.The man was convicted and sentenced to life imprisonment for raping a three-year-old girl child in the vicinity under the guise of giving her a chocolate. He approached the High Court in a petition under Article 226 of...

IT Rules Amendment | Prima Facie No Case Made Out For Not Notifying Govt's Fact Check Unit: Bombay High Court Third Judge AS Chandurkar Opines

In a setback for the petitioners in the 2023 IT Rules Amendment Case, the third judge—Justice AS Chandurkar—opined that prima facie, no case was made out to direct the Union government to continue its statement and not notify the Fact Check Unit.Justice Chandurkar ruled that the balance of convenience favours the Union, considering the government's submission about not using the FCU to...

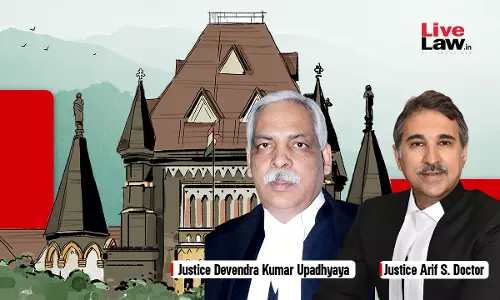

“Officers' Lives Under Peril”: Bombay High Court Ask State To List Steps Taken For Change In Revenue Records For New HC Building In Bandra

The Bombay High Court on Monday expressed displeasure at the lack of progress by the Maharashtra Government in handing over vacant land for the construction of the new Bombay High Court building in Bandra.A division bench comprising Chief Justice Devendra Kumar Upadhyaya and Justice Arif Doctor was informed that the government colony was yet to be shifted and changes were still pending in...

Service Tax Not Liable To Be Paid On Ocean Freight/Sea Transportation Services: Bombay High Court

The Bombay High Court has held that service tax is not liable to be paid on ocean freight or sea transportation services.The bench of Justice G. S. Kulkarni and Justice Firdosh P. Pooniwalla has relied on the decision of the Gujarat High Court in the case of SAL Steel Ltd. vs. . Union of India, in which it was held that no tax is leviable under the Integrated Goods and Services Tax Act, 2007,...

Bombay High Court Monthly Digest: February 2024

Nominal Index [Citation 52 – 117]Dr. Ramchandra Bapu Nirmale v. State of Maharashtra and Ors. 2024 LiveLaw (Bom) 52Kamath Brothers (Dwarka) & Ors v. Municipal Corporation of Greater Mumbai & Ors. 2024 LiveLaw (Bom) 53Amar Sadhuram Mulchandani v. Directorate of Enforcement and Ors. 2024 LiveLaw (Bom) 54Kangana Ranaut v. State of Maharashtra and Anr. 2024 LiveLaw (Bom) 55ABC and Anr....

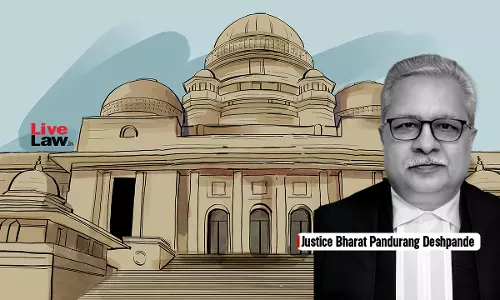

"Illiterate, Unable To Understand Pleadings": Bombay High Court Allows Pardanashin Woman To Add Facts Omitted Earlier In Written Statement

The Bombay High Court recently allowed a pardanashin lady to amend her written statement in a suit against her despite the facts proposed to be introduced via the amendment being already known to her and still not included in the original written statement.Justice BP Deshpande of the Nagpur Bench set aside appellate court's order rejecting her prayer for amendment, observing that though she...