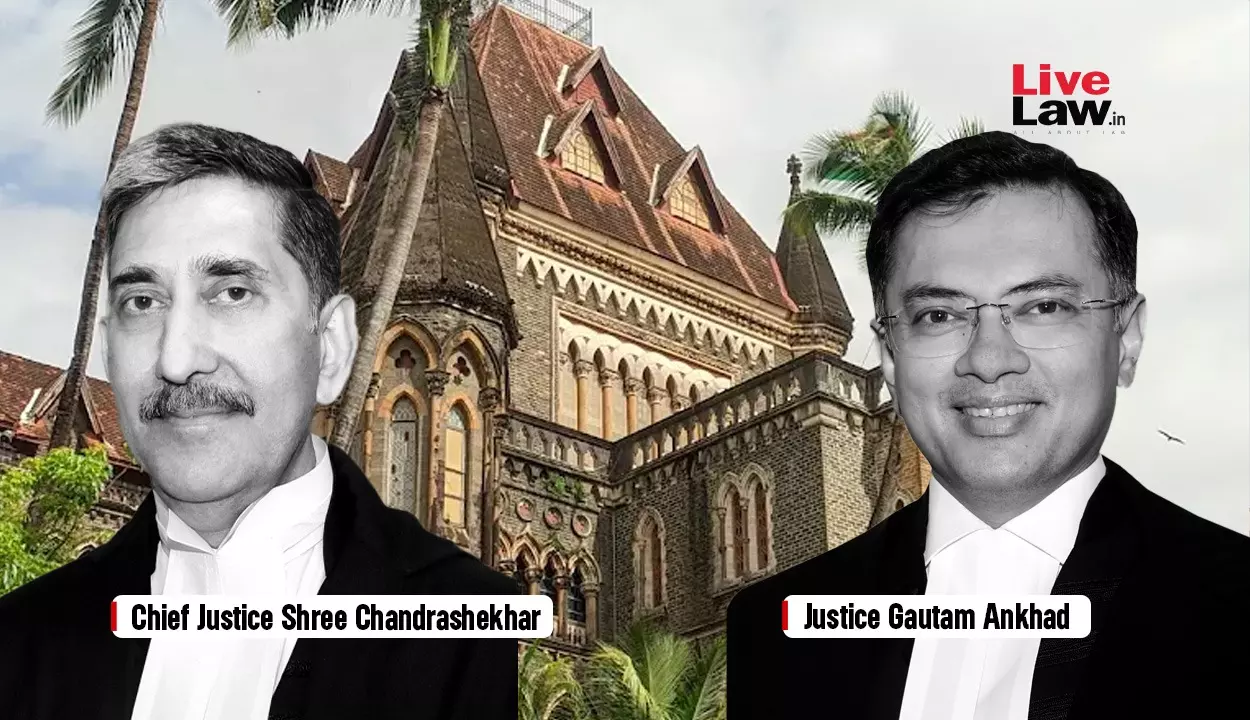

Bombay High Court

Circumstantial Evidence Sufficient To Prove “Untoward Incident” Under Railways Act: Bombay High Court

The Bombay High Court held that circumstantial evidence can be relied upon to determine whether an “untoward incident” occurred under Section 123(c) of the Railways Act, 1989, especially since the Act is a beneficial legislation intended to provide compensation to victims and their families. The Court observed that non-reporting of the incident to railway authorities at the earliest...

Mumbai Air Pollution: Bombay High Court Appoints Five-Member Team To Monitor Pollution Due To Construction Sites

The Bombay High Court on Friday constituted a five member team to conduct an independent inspection of two areas within Mumbai to check if the construction sites are duly complying with the Brihanmumbai Municipal Corporation's (BMC's) guidelines to bring down air pollution in the city.A division bench of Chief Justice Shree Chandrashekhar and Justice Gautam Ankhad said this team will verify...

Income Tax Act | Mechanical 'Rubber-Stamp' Approval U/S 153D Vitiates Entire Search Assessment: Bombay High Court

The Bombay High Court has held that prior approval under Section 153D of the Income Tax Act is not a mere technical or procedural formality, and that mechanical, en masse sanction without application of mind vitiates the entire assessment under Section 153A. A Division Bench of Justice M.S. Sonak and Justice Advait M. Sethna, while deciding a batch of over 60 Income Tax Appeals filed...

Bombay High Court Grants Interim Relief To 'JIO'; Restrains Taxi Operator From Using 'JIO Taxi' Mark

The Bombay High Court has barred a Jharkhand-based taxi operator from using the name “JIO TAXI” after finding that it prima facie infringes Reliance Industries Ltd.'s well-known “JIO” trademark. A single bench of Justice Sharmila U Deshmukh passed the order on November 24, 2025, granting an ad-interim injunction in Reliance's favour. The restriction will remain in force until...

State Can Verify Caste Certificates Of Central Employees Availing Reservation: Bombay High Court

The Bombay High Court has held that the State Legislature is fully competent to enact provisions requiring verification of caste certificates under Sections 6(1) and 6(3) of the Maharashtra Caste Certificate Act, 2000, even in respect of employees of the Central Government, where such employees derive reservation benefits on the strength of caste certificates issued by State authorities....

Wrong To Say Mumbai's Air Quality Worsened Due To Ethiopian Volcanic Eruption: Bombay High Court To Maharashtra Govt

The Bombay High Court on Thursday refused to accept the contention of the Maharastra Government that the air quality in Mumbai has deteriorated due to the ash clouds from the volcanic eruption in Ethiopia.A division bench of Chief Justice Shree Chandrashekhar and Justice Gautam Ankhad pointed out that the volcanic eruption took place only on November 23 while there has been low visibility in...

Five Years Passed Since Disha Salian's Death, Why Investigation Still Not Over? Bombay High Court Questions Mumbai Police

The Bombay High Court on Thursday questioned the Maharashtra Government over its slow paced investigation in the death of Disha Salian, the manager of late Bollywood actor Sushant Singh Rajput.A division bench of Justices Ajay Gadkari and Ranjitsinha Bhonsale sought to know why the Mumbai Police could not complete its investigation in the case even 5 years after Salian's death. "Five years...

Importer Not Liable To Pay Customs Duty On Goods Not Received By Him: Bombay High Court Grants Refund

The Bombay High Court has held that an importer cannot be made liable to pay customs duty on goods that were never cleared for home consumption and were never received by the importer. The Court observed that, under Sections 13, 23 and 27 of the Customs Act, 1962, duty paid in anticipation of clearance becomes refundable once it is established that the goods were short-landed or lost...

Employees Provident Fund Act | EPFO Cannot Issue Prohibitory Order U/S 8-F Without Prior Notice To Debtor: Bombay High Court

The Bombay High Court held that the Employees Provident Fund Organisation cannot issue a prohibitory order under Section 8-F of the Employees Provident Funds and Miscellaneous Provisions Act, 1952, without first issuing a notice to the debtor of the employer and giving an opportunity to file a statement on oath, as mandated under Section 8-F(3)(i) and (vi). The Court observed that the...

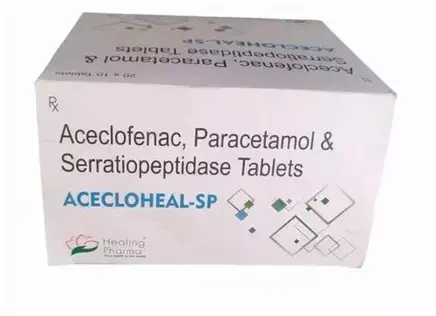

Drug Names Based On International Non-Proprietary Names Cannot Be Monopolised: Bombay High Court Reaffirms

The Bombay High Court has refused to grant an interim injunction to Aristo Pharmaceutical Pvt. Ltd. in its trademark infringement and passing-off suit against Healing Pharma India Pvt. Ltd., ruling that pharmaceutical companies cannot claim exclusivity over trademarks derived from International Non-Proprietary Names (INNs). Justice Sharmila U Deshmukh held that Aristo's registered...

Shilpa Shetty Moves Bombay High Court For Protection Of Her Personality Rights

Bollywood actor Shilpa Shetty has moved the Bombay High Court seeking protection of her personality rights from being illegally commercialised by several known and unknown platforms which are using Artificial Intelligence (AI) version of her voice, deepfake images etc and earning profits.Shetty has highlighted that she is one of the most celebrated and internationally recognised personalities...

Pre-CIRP Tax Claims Extinguished After Plan Approval, Bombay High Court Quashes Tax Notices To V Hotels

The Bombay High Court has recently reaffirmed that income-tax assessment proceedings for any period prior to the approval of a resolution plan under the Insolvency and Bankruptcy Code (IBC) stand extinguished once the National Company Law Tribunal (NCLT) approves the plan, ruling that the tax department cannot initiate or continue such proceedings thereafter.A Division Bench of Justice B...