Bombay High Court

'Denying Residence To Brother's Wife In Shared Household Amounts To Domestic Violence': Bombay High Court

The Bombay High Court has held that preventing a woman from residing in her shared household amounts to domestic violence within the meaning of Section 3 of the Protection of Women from Domestic Violence Act, 2005. The Court emphasised that the right to reside in a shared household under Section 17 of the Act exists irrespective of any right, title or beneficial interest in the same.According...

'Promise Of 10-15% Profit Per Month Shows Prima Facie Dishonest Intention': Bombay HC Declines Anticipatory Bail Plea In Trading Scam Case

The Bombay High Court has held that an assurance of abnormally high and guaranteed profits in intra-day share trading demonstrates prima facie dishonest intention at the inception, thereby attracting criminal liability. The Court observed that no genuine business can yield assured profits of 10–15% per month, and such inducements cannot be brushed aside as mere civil disputes.Justice...

Bombay High Court Monthly Digest: August 2025

Citations: 2025 LiveLaw (Bom) 316 To 2025 LiveLaw (Bom) 355State of Maharashtra v Sanjay, 2025 LiveLaw (Bom) 316Shankar Govindrao Lang vs State of Maharashtra, 2025 LiveLaw (Bom) 317Salim Baig vs Sayyad Nawid, 2025 LiveLaw (Bom) 318Krishnagopal B. Nangpal vs Dy. Commissioner of Income Tax Special Range – 3, Pune, 2025 LiveLaw (Bom) 319Zilla Parishad, Ahmednagar vs Sandip Madhav Khase,...

'Denial Of Hearing In Externment Proceedings Amounts To Violation Of Constitutional Values': Bombay High Court

The Bombay High Court has held that denial of an effective opportunity of hearing to a proposed externee under Section 59 of the Maharashtra Police Act, 1951, amounts to a violation of constitutional values and vitiates the entire externment proceedings. The Court observed that personal liberty guaranteed under Article 19 of the Constitution cannot be curtailed except by following due process...

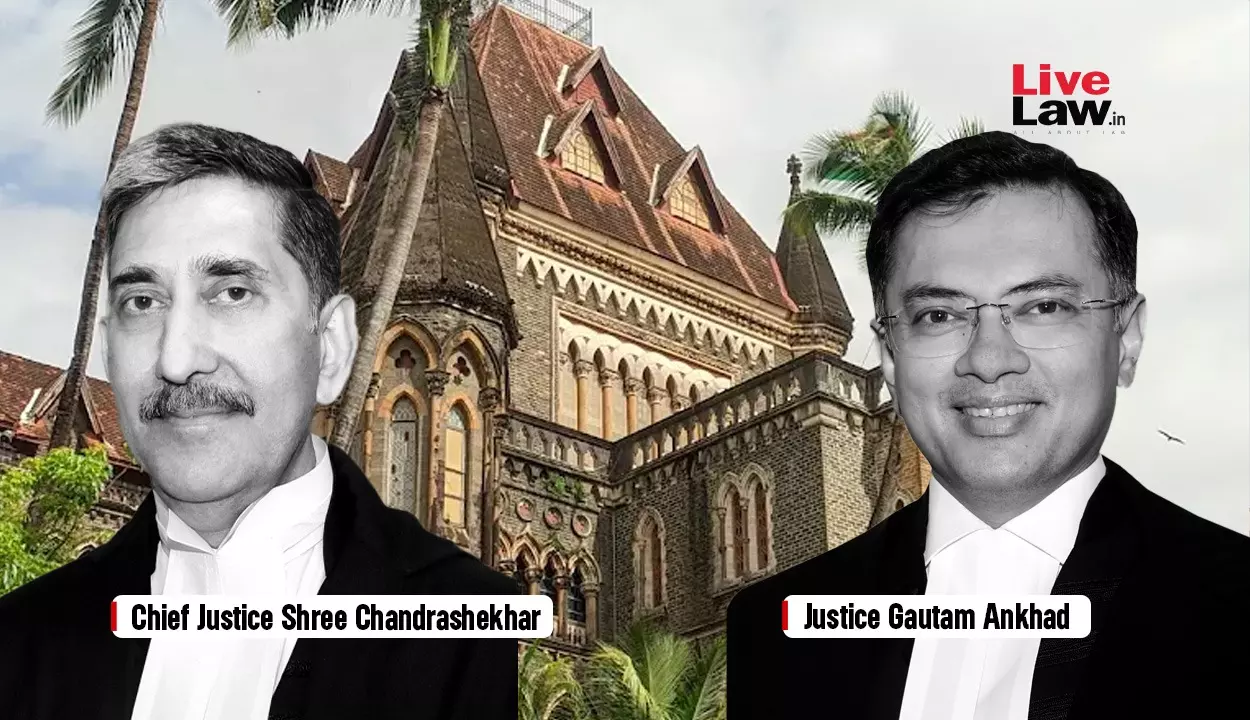

Being 'Bright Student' No Grounds To Quash FIR: Bombay HC In Student's Plea Seeking Relief Over Allegedly Objectionable Post On Op Sindoor

The Bombay High Court on Friday orally remarked that it cannot quash an FIR lodged against a 19-year-old female engineering student for reposting an objectionable 'Operation Sindoor' post on social media, just because she has apologised, is a bright student or has passed her exams with "flying colours."A division bench of Chief Justice Shree Chandrashekhar and Justice Gautam Ankhad heard...

Income Tax Act | Payment To Consulting Doctors Appointed On Probation Is Not Salary; TDS Deductible U/S 194J, Not U/S 192: Bombay High Court

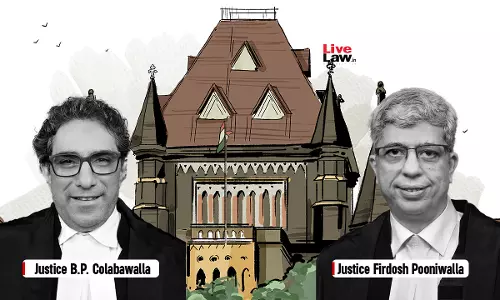

The Bombay High Court has held that payments to consultant doctors are not salary. Hence, TDS is deductible under section 194J and not under section 192 of the Income Tax Act. Justices B.P. Colabawalla and Firdosh P. Pooniwalla stated that there does not exist an employer-employee relationship between the assessee and consultant doctors, and the payments made to them by the...

"Can't Permit Multiplicity": Bombay High Court Refuses To Entertain PIL Against 'Kunbi' Status To Marathas

The Bombay High Court on Thursday dismissed a Public Interest Litigation (PIL) challenging a Government Resolution (GR) issued by the Maharashtra Government to provide "Kunbi" caste certificates under the Other Backward Class (OBC) category to the members of Maratha Community, who identify themselves of having Kunbi origins.A division bench of Chief Justice Shree Chandrashekhar and Justice...

Income Tax Act | Draft Assessment Order Not Permissible U/S 144C(1) When TPO Makes No Variation: Bombay High Court

The Bombay High Court has held that a draft assessment order is not permissible under section 144C(1) of the Income Tax Act when the TPO (transfer pricing officer) makes no variation. Section 144C(1) of the Income Tax Act, 1961, provides that the Assessing Officer should forward a draft of the proposed assessment order to the eligible assessee if any variation of the income or...

Six Additional Judges Of Bombay High Court Made Permanent

Six Additional Judges of the Bombay High Court on Thursday (September 18) were sworn-in as Permanent Judges after the Central Government approved their appointments last week. Justices Sanjay Deshmukh, Vrushali Jadhav, Abhay Mantri, Shyam Chandak, Neeraj Dhote and Somasekhar Sundaresan were administered oath of the office. Presently, Justices Chandak and Sundaresan are sitting at the...

'Magistrate Not Required To Pass Preliminary Order U/S 145 CrPC When Inquiry Is Directed By HC Or SC': Bombay High Court

The Bombay High Court has held that where an inquiry under Section 145 of the Code of Criminal Procedure [Section 164 in the BNSS] is specifically directed by the High Court or the Supreme Court, the Magistrate is not required to pass a separate preliminary order under Section 145(1). The Court observed that in such cases, the satisfaction as to the existence of a dispute likely to cause...

Bombay HC 5-Judge Bench Initiates Additional Criminal Contempt Proceedings Against Lawyer For 'Scandalous' Remarks In Plea Against Judge

The Bombay High Court on Wednesday initiated another suo motu criminal contempt of court case against advocate Nilesh Ojha, who made 'scandalous and scurrilous' allegations against a sitting judge, while defending himself in another criminal contempt of court case, which was initiated by a five-judge bench for levelling similar allegations against the same judge. For context, suo motu...

Fraud Loan Accounts Row: Bombay High Court Grants Interim Relief To Anil Ambani, Stays Coercive Action By Bank Of Baroda

In a temporary relief, the Bombay High Court on Wednesday restrained the Bank of Baroda from taking any coercive action in furtherance of its September 4 order classifying the loan accounts of industrialist Anil Ambani's Reliance Communications as 'fraud.'A division bench of Justice Riyaz Chagla and Farhan Dubash asked the Bank not to take any action till further hearing in the matter, which...