Bombay High Court

CPI(M) Granted Permission To Conduct Peaceful Protest Condemning Gaza Genocide: Mumbai Police Tells High Court

The Bombay High Court on Tuesday (12 August) recorded the Mumbai Police's decision to allow the Communist Party of India (Marxist) to hold a peaceful protest to condemn the ongoing genocide in Gaza.A division bench of Justices Ravindra Ghuge and Gautam Ankhad accepted the statement made by the Mumbai Police that the protest would be held at Azad Maidan, a designated site for demonstrations...

Candidate's Involvement In Gambling-Related Activities Is Moral Turpitude, Cannot Direct Consideration For Public Service: Bombay High Court

A candidate's involvement in an activity associated with gambling certainly amounts to moral turpitude and writ courts cannot order an employer to consider such a person for public service, especially in judiciary, the Bombay High Court held recently. A division bench of Justices Shree Chandrashekhar and Manjusha Deshpande dismissed the petition filed by one Jayesh Limje, who challenged...

Bombay High Court Seeks Mumbai Police's Stand On CPI(M)'s Plea To Hold Peaceful Protest Against Genocide In Gaza

The Bombay High Court on Monday (August 11) ordered the Mumbai Police to specify its stand on the plea filed by the Communist Party of India (Marxist) to hold peaceful protests and call for a ceasefire in Palestine and condemn the ongoing genocide in Gaza. Notably, this is the second time when the CPI(M) has knocked the doors of the High Court seeking permission to protest the genocide in Gaza...

Insurance Claimant Can Restrict Claim Amount To Pay Lesser Court Fees U/S 166 Of Motor Vehicles Act: Bombay High Court

The Bombay High Court has held that a claimant can restrict the claim amount while filing an appeal under Section 166 of the Motor Vehicles Act to avail the benefit of lower court fees at the initial stage, without being compelled to pay court fees on the full amount claimed in the original proceedings. Justice Shailesh P. Brahme was hearing an appeal filed challenging the award passed...

Bombay High Court Weekly Round-Up: August 4 - August 10, 2025

Nominal Index [Citations: 2025 LiveLaw (Bom) 320 to 2025 LiveLaw (Bom) 326]Zilla Parishad, Ahmednagar vs Sandip Madhav Khase, 2025 LiveLaw (Bom) 320Pune Municipal Corporation vs Assistant Commissioner of Income Tax, 2025 LiveLaw (Bom) 321Sumanbai vs State of Maharashtra, 2025 LiveLaw (Bom) 322Sachin Malpani vs Nilam Patil, 2025 LiveLaw (Bom) 323FICCI vs State of Maharashtra, 2025 LiveLaw...

Serving Order On Chartered Accountant Doesn't Count As Service On Assessee: Bombay High Court

The Bombay High Court held that serving order on chartered accountant doesn't count as service on assessee. The issue before the bench was whether the copy of the order passed by the Tribunal when served upon the Chartered Accountant is sufficient service and whether it can be construed as 'copy received by the assesse/applicant'. Justices Bharati Dangre and Nivedita P. Mehta...

'Delay In Deciding Reference Cannot Be Grounds To Deny Relief': Bombay High Court Orders Reinstatement Of Workers Terminated In 1995

The Bombay High Court has held that delay in adjudication of an industrial reference cannot, by itself, be a ground to deny just relief to workmen whose services were illegally terminated. The Court observed that when the delay is not attributable to the workmen and the termination is found to be in violation of law, reinstatement is the appropriate remedy.A bench of Justice Milind N Jadhav...

'No Distinction Between Online Movie Ticket Booking & Offline Ticket Booking For Entertainment Tax Purposes': Bombay High Court

The Bombay High Court has upheld the constitutional validity of the seventh proviso inserted into Section 2(b) of the Maharashtra Entertainments Duty Act, which brings within its ambit the additional amount charged by cinema proprietors for online booking of movie tickets. It observed that the activity of online booking is not different from an offline booking and can be taxed under Entry 62...

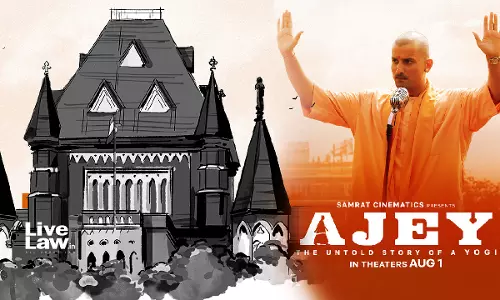

Bombay High Court Directs CBFC Not To Insist On Film Makers Getting NOC From Yogi Adityanath For Certification Of 'AJEY' Movie

The Bombay High Court was today informed that the Central Board of Film Certification (CBFC) has rejected the plea for certification by makers of a movie titled "Ajey: The Untold Story of a Yogi," based on a book written on the life of UP Chief Minister Yogi Adityanath.During the hearing, it was submitted by the petitioners that the CEO of the CBFC had told the makers that they should go and...

Maintenance Charges Under Maharashtra Apartment Ownership Act Cannot Be Modified By Flat Owners' Resolution: Bombay High Court

The Bombay High Court has held that apartment owners in a condominium must pay maintenance charges for common areas in proportion to their undivided interest, as required under Section 10 of the Maharashtra Apartment Ownership Act, 1970. It ruled that this statutory requirement cannot be modified or overridden by resolutions passed by the association of apartment owners seeking to impose...

[Land Acquisition Act] Reference Application Can Be Filed U/S 28A If Earlier Application U/S 18 Was Not Decided On Merits: Bombay High Court

The Bombay High Court has held that an application under Section 28-A of the Land Acquisition Act is maintainable even if the claimant had previously filed a reference under Section 18, provided that the said reference was not decided on merits. The Court ruled that a dismissal of a reference on technical grounds, without adjudication, does not bar the landowner from seeking...

Income Tax | S.194C & S.194LA Would Not Apply When TDR Certificates Are Issued In Lieu Of Compensation: Bombay High Court

The Bombay High Court held that Section 194C and Section 194LA of the Income Tax Act would not apply when TDR Certificates are issued in lieu of compensation. Justices B.P. Colabawalla and Firdosh P. Pooniwalla agreed with the assessee that the words “or by any other mode” appearing in Section 194C would have to be read ejusdem generis to the words “payment thereof in cash or...

![[Land Acquisition Act] Reference Application Can Be Filed U/S 28A If Earlier Application U/S 18 Was Not Decided On Merits: Bombay High Court [Land Acquisition Act] Reference Application Can Be Filed U/S 28A If Earlier Application U/S 18 Was Not Decided On Merits: Bombay High Court](https://www.livelaw.in/h-upload/2022/07/16/500x300_426138-bombay-high-court-calls-for-a-swift-legal-process-to-avoid-prolonged-incarceration.jpg)