Delhi High Court

Family Court's Approach Can't Be Like Ordinary Civil Proceeding: Delhi HC Sets Aside Order Closing Wife's Right To File Reply In Divorce Plea

The Delhi High Court has said that while dealing with matrimonial matters, family courts must adopt an approach which is different from ordinary civil proceedings. “While dealing with disputes concerning the family, the Courts ought to adopt an approach radically different from that adopted in ordinary civil proceedings,” Justice Ravinder Dudeja said. The Court was dealing with a wife's...

[POCSO Act] Lying Very Close To Minor Victim Amounts To 'Outraging Modesty' But Not 'Aggravated Sexual Assault' If No Overt Sexual Intent: Delhi HC

The Delhi High Court has held that pressing lips of a minor victim and lying very close to her may amount to offence of outraging her modesty under Indian Penal Code but the same may not amount to offence of aggravated sexual assault under POCSO Act if overt sexual intent is absent. “The act of touching and pressing lips or lying down next to the victim, though may result in violation of...

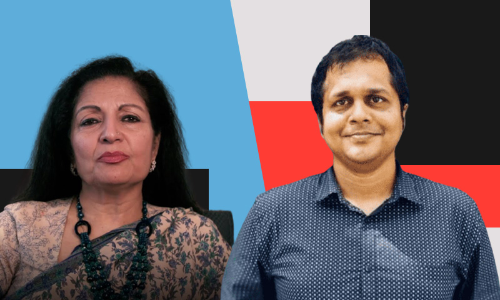

'Highly Undesirable Practice, Wastes Judicial Time': Delhi High Court Laments Frequent Non-Appearance Of Govt Counsel In Customs Matters

The Delhi High Court recently expressed its displeasure at the frequent non-appearance of government counsel in customs related matters.A division bench comprising Justices Prathiba M. Singh and Rajneesh Kumar Gupta observed, “It is noticed that in a large number of customs matters, the Counsels are either not appearing or appear without proper instructions. In cases of nonappearance, the...

'Extra Duty Deposit' Different From Customs Duty, Limitation For Seeking Refund U/S 27 Of Customs Act Is Inapplicable: Delhi High Court

The Delhi High Court has held that an Extra Duty Deposit (EDD) does not constitute a payment in the nature of customs duty under the scope of Section 27 of the Customs Act, 1962 and thus, the period of limitation for seeking a refund of customs duty under the provision would not apply qua EDD.Section 27 deals with a person/entity's claim for a refund of Customs duty in certain...

Need To Drive Criminal Law Forward With Data And Evidence, Hope Young Lawyers Will Willingly Join The Field: CJI Sanjiv Khanna

Chief Justice of India Sanjiv Khanna on Thursday said that he hopes many youngsters and young lawyers would join the field of criminal law as their first career choice and not as a second choice or compulsion. CJI said that even though many new lawyers do not want to take up criminal practice, the fact of the matter is that most of the litigation in the district courts is criminal...

Survey Report On Existence Of 'Permanent Establishment' In Tax Year Not Relevant For Previous/Future AYs: Delhi HC Grants Relief To Swiss Co

The Delhi High Court has held that the existence of a foreign entity's Permanent Establishment (PE) in India is required to be determined in law for each year separately on the basis of the scope, extent, nature and duration of activities in each year.A division bench of Justices Yashwant Varma and Ravinder Dudeja made the observation while dealing with a Swiss company's case, which was...

'Ego Issue': Delhi HC Disapproves Of Tax Commissioner Seeking Declaration Against Appointments Committee Of Cabinet Over Delay In Promotion

The Delhi High Court rejected the petition filed by the Principal Commissioner of Income Tax, seeking a declaration against the Appointments Committee Of Cabinet (ACC) which promoted him to the post with purported delay.Calling the petition to have stemmed from the officer's “ego issue”, the division bench of Justices C. Hari Shankar and Ajay Digpaul fell one step short of imposing costs...

CESTAT Can't Reject Appeal Merely Because Pre-Deposit Was Made In Wrong Account, Especially When Rules Were Unclear: Delhi High Court

The Delhi High Court has held that merely because a pre-deposit prescribed under Section 35F of the Central Excise Act, 1944, for preferring an appeal is made in the wrong account, that too when the integrated portal might not have been fully functional, cannot result in rejection of appeal on the ground of defects.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta...

Making Two Applications For One Recruitment Examination, Concealing One, Delhi High Court Dismisses Writ Petition

A Division Bench of the Delhi High Court comprising Justices C.Hari Shankar and Anup Kumar Mendiratta dismissed a Petition whereby the Petitioner sought quashing of a notice by which her candidature was rejected. The Bench held that since the Petitioner had filed two application forms and had also concealed her educational qualifications before the Tribunal as well as the Court, she...

Saket Gokhale Moves Delhi High Court Seeking Recall Of Order Asking Him To Apologize, Compensate Lakshmi Puri For Defamation

The Delhi High Court on Thursday issued notice on an application filed by Trinamool Congress MP Saket Gokhale in relation to a ruling asking him to put an apology on social media and pay Rs. 50 lakh damages to Lakshmi Puri, former Indian Assistant Secretary-General to the United Nations, in her defamation suit against him.Gokhale has sought recall of an order passed by a coordinate bench on...

Delhi HC Issues Summons In Moti Mahal's Trademark Infringement Suit Against Restaurant In City's Diplomatic Area

Moti Mahal Delux Management Services Private Limited, which owns the popular Moti Mahal restaurant chains, has filed a trademark infringement suit in the Delhi High Court against a restaurant running by the name of “Moti Mahal Delux” in city's Malcha Marg area in Chanakyapuri. Justice Amit Bansal issued summons in Moti Mahal's suit and listed the matter for hearing on May 21. The Court...

Delhi HC Asks CESTAT To Decide If Tax On Services Purchased By Prepaid Mobile Subscribers From Existing Balance Would Amount To Double-Tax

The Delhi High Court has asked the Customs Excise & Service Tax Appellate Tribunal to decide whether levy of tax on the services purchased by a prepaid subscriber of Tata Teleservices, using the existing mobile balance on which tax was already paid, would amount to double taxation.Considering that the matter would involve factual evaluation of the manner in which services are provided...

![[POCSO Act] Lying Very Close To Minor Victim Amounts To Outraging Modesty But Not Aggravated Sexual Assault If No Overt Sexual Intent: Delhi HC [POCSO Act] Lying Very Close To Minor Victim Amounts To Outraging Modesty But Not Aggravated Sexual Assault If No Overt Sexual Intent: Delhi HC](https://www.livelaw.in/h-upload/2023/03/20/500x300_464453-pocso-act-is-gender-neutral-misleading-to-argue-it-is-gender-based-legislation-and-is-being-misused-delhi-high-court.webp)