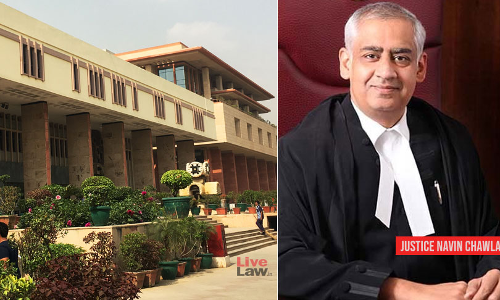

Delhi High Court

Delhi High Court Orders ₹10.5 Lakh Compensation To Minor Who Was Sexually Abused By Father, Calls It Essential Part Of 'Curing Justice'

The Delhi High Court has recently directed the DSLSA to pay Rs. 10.5 lakh of compensation to a minor rape victim who was sexually abused and assaulted by her father in 2018. The minor was 17 years of age at the time of the incident.“Compensation to the victim is an essential part of curing justice. Compensation not only provides monetary relief but is also an act which seeks to make a...

Delhi High Court Directs MCD To Pay ₹10 Lakh Compensation To Parents For Death Of Their Son Due To Its Negligence

The Delhi High Court has directed the Municipal Corporation of Delhi (MCD) to pay Rs. 10 lakh as compensation to the parents of a minor child, who passed away after a lantern/slab fell on him from the premises owned by MCD.A single bench of Justice Purushaindra Kumar Kaurav found the MCD to be negligent in maintaining safe conditions of its premises and invoked the maxim 'res ipsa loquitur'...

Land For Jobs Scam: Delhi High Court Grants Bail To Lalu Yadav's Aide Amit Katyal In PMLA Case

The Delhi High Court on Tuesday granted bail to RJD chief Lalu Prasad Yadav's close aide Amit Katyal in a money laundering case related to the alleged land-for-jobs scam case.Justice Neena Bansal Krishna observed that the investigations qua Katyal already stood concluded and the Prosecution Complaint was also filed by the Enforcement Directorate (ED). “He is in judicial custody...

Liquor Policy: Delhi High Court Grants Bail To Amandeep Singh Dhall, Amit Arora

The Delhi High Court on Tuesday granted bail to businessmen Amandeep Singh Dhall and Amit Arora in the money laundering case connected to the alleged excise policy scam case.Justice Neena Bansal Krishna pronounced the judgment and allowed the regular bail pleas filed by Dhall and Arora. Arora was granted interim bail on medical grounds in August. He is the director of Gurugram-based company...

Plea In Delhi High Court Challenging S.14(1)(d) Of Delhi Rent Control Act Over Differentiation Between Residential And Non-Residential Premises

A petition has been filed in the Delhi High Court challenging Section 14(1)(d) of the Delhi Rent Control Act (DRC Act).Section 14(1)(d) prohibits any court/controller from passing an order or decree in favour of the landlord against a tenant, for recovery of possession of any premises, if the premises were let out to be used as a residence and if neither the tenant nor his family members...

Delhi High Court Orders Interim Restraint On Transfer Of Late Oberoi Group Chairman's Company Shares In Daughter's Suit Against Family Members

In an interim order passed last week, the Delhi High Court has restrained the transfer of Oberoi group's former chairman late PRS Oberoi's shares in EIH Limited–which runs the Oberoi and Trident hotel chain–and its two holding companies, except one specific class of shares, after Oberoi's daughter moved a lawsuit seeking an injunction on the said transfer. A single-judge bench of...

Treaty Provisions Prevails Over Income Tax Act – Receipts From Aircraft Leasing Is Not Taxable As Royalty: Delhi High Court

The Delhi High Court held that consideration received by Assessee from aircraft leasing activity is not taxable as royalty either u/s 9(1)(vi) of Income Tax Act or under India-Ireland DTAA. Under section 9(1)(vi) of the Income tax Act, royalty payable by the Indian Government to any non-resident, shall always be deemed to accrue or arise in India, without any exception. In such a...

No Vested Legal Right To Allotment Of Public Site By Merely Making Online Booking: Delhi High Court

The Delhi High Court has observed a vested legal right for allotment of a public site/public park does not arise merely because the site has been booked online by paying the required amount.“There is no vested legal right to allotment of a public site or park by merely applying 'online' followed by payment of the booking amount.”The petitioner, Purvi Delhi Vaidehi Trust has booked a...

In Absence Of Specific Reasons, GST Registration Can't Be Cancelled With Retrospective Effect : Delhi High Court

Finding that the Show Cause Notice (SCN) did not mention any particulars, which would provide any clue to the taxpayer/ petitioner as to the reasons for cancellation of its GST registration, the Delhi High Court quashed the SCN as well as the order, by which the GST Commissioner had cancelled the GST registration of petitioner with retrospective effect. The Division Bench of...

By Participating In Selection Process, Candidates Do Not Get Indefeasible Right To Get Appointment, Delhi High Court Reiterates

The Delhi High Court has dismissed a Writ Petition which challenged a judgement of the Central Administrative Tribunal. The Petitioner had sought seniority from the year 2007 despite being appointed in the year 2009, contending that he was entitled for appointment in the year 2007 itself.The Division Bench of Justices Suresh Kumar Kait and Girish Kathpalia held that the petitioner...

Income Tax Refund Can't Be Denied To Taxpayer For Discrepancy In Form 26AS Filed: Delhi High Court

While observing that tax was duly deducted by the Land Acquisition Collector but was not disclosed for some reasons and hence the credit was not reflected in Form 26AS, the Delhi High Court held that the assessee/ petitioner cannot be penalized for the mere reason that the Form 26AS suffered from a discrepancy. Therefore, condoning the delay u/s 119 of the Income tax Act, the High...

Detention Under Customs Act – Authority Must Specify Nature Of Infraction/ Violation, For Tentative Denial Of Preferential Duty Treatment: Delhi HC

The Delhi High Court held that the Proper officer under Customs Act cannot detain the goods or stall the process of importation, without forming a requisite opinion regarding any forgery in import. The High Court clarified that the proper officer does not have any unfettered power to initiate a verification process, and it is incumbent upon him to form a requisite opinion in support...