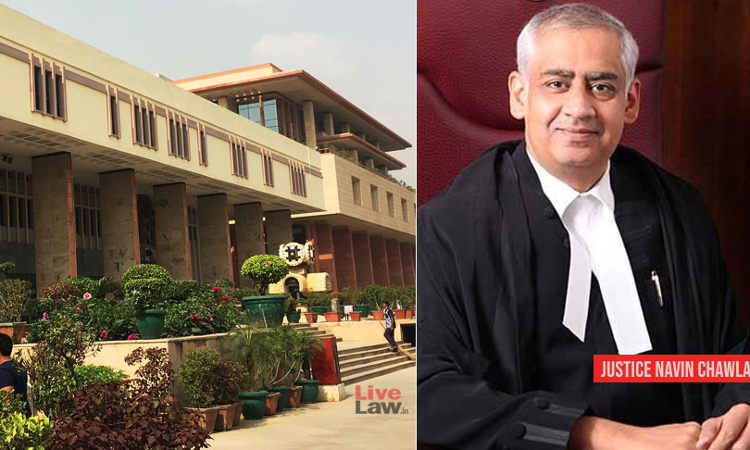

Insurance Company Has No Contractual Or Other Relationship With Transferee Of Offending Vehicle: Delhi High Court

Nupur Thapliyal

18 Dec 2023 11:30 AM IST

Next Story

18 Dec 2023 11:30 AM IST

The Delhi High Court has observed that an Insurance Company has no contractual or other relationship with transferee of the offending vehicle in a road accident.“The registered owner cannot absolve himself of the liability by contending that he had transferred the offending vehicle to a third person prior to the date of the accident,” Justice Navin Chawla said.The court observed...