Gauhati High Court

Challenge To Wrong Pay Fixation Not Barred By Limitation As It's A Continuing Wrong: Gauhati High Court

A challenge to wrong pay fixation cannot be rejected solely on the ground of delay where the grievance discloses a continuing or recurring wrong, the Gauhati High Court has held, while directing reconsideration of a claim raised by an Auxiliary Nurse and Midwife (ANM) seeking parity in pay with similarly situated employees.Justice Kardak Ete, presiding over the case, held, “I am of the...

Mere Touching Of Hand Not 'Criminal Force': Gauhati High Court Quashes Sexual Harassment Case Against IIT Professor

The Gauhati High Court recently quashed the sexual harassment case registered against an IIT Professor for allegedly touching the hands of a woman who had approached him seeking mentorship for her startup idea.Justice Sanjeev Kumar Sharma noted that mere 'touching' of hands does not satisfy the definition of 'force' to attract the offence of Outraging woman's modesty by assault or use of...

Proper Notice Under Section 18 Assam Land & Revenue Regulation Mandatory Before Evicting Occupants From Govt Land: Gauhati High Court

The Gauhati High Court has clarified that where persons are in illegal occupation of Government land, and the authorities seek to make the land encroachment-free, a proper notice under Section 18 of the Assam Land and Revenue Regulation, 1886 must be issued.Justice Sanjay Kumar Medhi, presiding over the case, observed, “...it appears that the petitioners are in possession of certain lands...

Gauhati High Court Quashes Case Against Influencer For Allegedly Linking Assamese Women To Black Magic

The Gauhati High Court has quashed the CID Cyber Case registered against influencer Abhishek Kar for linking Assamese women to black magic in a YouTube video.Justice Pranjal Das held that the statement attributed to him does not fulfill the essential ingredients to invoke offences under Section 196 (Promoting enmity between different groups) of the Bharatiya Nyaya Sanhita, Section 67...

Gauhati High Court Weekly Round-Up: February 02 - 08, 2026

Nominal Index [Citations: 2025 LiveLaw (Gau) 20-24] Anil Narzary v Union of India & Ors 2026 LiveLaw (Gau) 20Bhupendra Choudhury & Anr. v Arun Choudhury 2026 LiveLaw (Gau) 21Abu Ansar Azad & Ors. v. State of Assam & Ors. 2026 LiveLaw (Gau) 22Burhan Ali v State of Assam & Ors. 2026 LiveLaw (Gau) 23Md. Shah Alam v. State of Assam & Anr. 2026 LiveLaw (Gau) 24Judgments/...

S.138 NI Act | Initial Defect In Authorisation To File Cheque Bounce Case Is Curable Defect: Gauhati High Court

The Gauhati High Court has reiterated that a complaint under Section 138 of the Negotiable Instruments Act cannot be invalidated merely because there was a defect in authorisation at the time of its institution, as such a defect is curable and can be rectified even during trial or at the appellate stage. Justice Sanjeev Kumar Sharma, presiding over the case, reiterated, “any initial defect...

POCSO Probes Must Be Child-Friendly; Sensitise Investigators To Ensure 'Truth Emerges Without Ambiguity': Gauhati High Court

The Gauhati High Court has stressed that investigations under the Protection of Children from Sexual Offences (POCSO) Act must be conducted with sensitivity and strict adherence to child-friendly procedures, observing that failure to provide counselling support, appoint support persons and record clear, specific statements may defeat the very cause of justice. The Court cautioned that...

Six Members In First Meeting Fulfills Quorum To Elect President Of Village Council Under Assam Panchayat Rules: Gauhati High Court

The Gauhati High Court has held that the presence of 6 ward members would fulfill the quorum of the first meeting to elect President to a Gaon (Village) Panchayat as required under Rule 46 (3) of Assam Panchayat (Constitution) Rules after amendment to the state panchayat law. The court said that the quorum requirement must be understood in light of amendment to Section 6 of the Assam...

'Fixing Cut-Off Date Not Per Se Illegal': Gauhati High Court Upholds Assam Govt's SOP On Compassionate Appointment Claims

The Gauhati High Court has refused to interfere with Assam Government's Executive Order (Standard Operating Procedure) for compassionate appointment cases fixing a cut off date as criteria, holding that State is entitled to prescribe a uniform mechanism for dealing with such claims and fixing a cut-off date is not per se illegal.Justice Kaushik Goswami, presiding over the case, observed,...

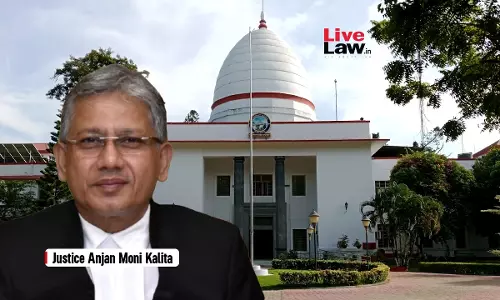

Magistrate Must Examine Complainant, Witnesses On Oath Before Issuing Notice To Accused U/S 223 BNSS: Gauhati High Court

The Gauhati High Court has held that under Section 223(1) of the Bharatiya Nagarik Suraksha Sanhita, 2023 (BNSS), a Magistrate cannot issue notice to the accused before examining the complainant and witnesses on oath, and that doing so violates the statutory mandate. Justice Anjan Moni Kalita, presiding over the ruling, held, “issuance of notice to the accused prior to examination of...

Police Encounter Was Avoidable Had State Acted Earlier: Gauhati High Court Awards ₹25 Lakh Compensation To Victim's Family

The Gauhati High Court has awarded compensation to the family of a cultivator from Chirang district who died during a police operation in December 2016, after holding that despite prior intelligence inputs, the authorities failed to act in a timely and documented manner, making the incident avoidable and resulting in infringement of Article 21.The division bench comprising Justice Kalyan...

Gauhati High Court Weekly Round-Up : January 26 - February 01, 2026

Nominal Index [Citations: 2025 LiveLaw (Gau) 13-19]Hem Bahadur Pradhan @ Newar and Anr. v The State of Assam and 3 Ors. 2026 LiveLaw (Gau) 13Md. Kari alias Md. Jiyauddin v Union of India 2026 LiveLaw (Gau) 14Tufazzul Hussain v. Fulmala Khatun 2026 LiveLaw (Gau) 15Kurban Ali v Union of India & Ors. 2026 LiveLaw (Gau) 16Sri Madhu Ram Deka v. The State of Assam & Anr. 2026 LiveLaw...