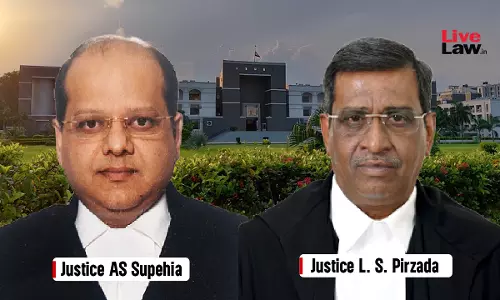

Gujarat High Court

Gujarat High Court Directs Authority To Consider Kuwaiti Resident's Passport Renewal Plea Put On Hold Over Rash Driving FIR

The Gujarat High Court on Tuesday (November 25) granted relief to an Indian man working in Kuwait, whose application for renewal of passport was put on hold in view of an FIR registered against him for rash and negligent driving at Lunawada police station. The court asked the authorities to process the petitioner's passport renewal plea within 4 weeks after noting that the petitioner is...

“Forced To Sit Idle”: Gujarat High Court Summons Registry Officer After Only One File Sent In Batch Of 200 GST Confiscation Petitions

The Gujarat High Court on Wednesday (November 26) asked the Registrar (Judicial) to explain why only one file was sent to the court in a batch of 200 petitions concerning confiscation proceedings under the GST Act, remarking that due to non-supply of the petitions the court was forced to sit idle waiting for the appropriate file. The court has asked the registry to send an officer at...

Deesa Warehouse Fire: Gujarat High Court Seeks State's Response On PIL For Compensation To Victims, Regulation Of Fire Cracker Units

The Gujarat High Court on Tuesday (November 25) sought the response of the State government and the Gujarat Pollution Control Board on a PIL concerning a fire incident which had occurred in two alleged illegal fire cracker manufacturing warehouses in Deesa town in April this year leading to the death of 21 persons. For context, a petition on the issue was transferred to the High Court by...

Gujarat High Court Issues Notice On Asaram's Plea To Relax Condition Enforcing Police Surveillance During Suspended Sentence

The Gujarat High Court issued notice on Asaram's plea seeking modification/deletion of condition requiring presence of three police officials in his vicinity, during the 6-month period wherein his life sentence has been suspended in a rape case. For context, on November 6 the high court had granted six-month suspension of sentence to Asaram who is convicted in a 2013 rape case by a sessions...

MMCB Scam: Gujarat High Court Rejects ICAI's Proposal To Debar CA For 5 Years For Alleged Misconduct Citing Non-Application Of Mind

The Gujarat High Court rejected a 20-year-old recommendation made by the Institute of Chartered Accountants of India's Council to remove a chartered account from membership for 5 years, who was appointed as central registrar of a cooperative bank and was accused of misconduct in connection with the 2001 alleged MMCB scam. The court was hearing a 2005 reference by the Council of the ICAI which...

Gujarat High Court Quashes Order Refusing Condonation Of Delay In Filing Income Tax Return By Co-op Society In View Of 'Genuine Hardship'

The Gujarat High Court quashed an order passed by tax department refusing to condone delay of 29 days by a Co-operative Housing Society in filing income tax return for Assessment Year 2018-19, after noting that the audit report was belatedly filed as the auditor was not appointed within time.In doing so the court said that the filing of the audit report in 2019 belatedly by the Sub-auditor...

Part-Time Employees Working Four Hours Or More Entitled To Fixed Pay Under State's 2019 Circular: Gujarat High Court

The Gujarat High Court recently re-affirmed that the state government's 2019 circular granted benefits and consolidated fixed pay of Rs. 14,800 to those part-time employees who had worked for four hours a day. In doing so the court said that the expression used in the state government's 2019 Circular granting such benefits stating that, “part-time employees who are working upto four...

Complaint Under Minimum Wages Act Not Police Case: Gujarat High Court Quashes Firm's Debarment For Not Disclosing Info In Tender Process

The Gujarat High Court quashed Surat Municipal Corporation's order debarring a firm for two years for allegedly filing a false affidavit in the tender process, noting that the firm not disclosing cases filed against it under Minimum Wages Act would not amount to a "police case". The Corporation had argued that several criminal complaints were filed against the petitioner firm under Section...

Edible Crude Palm Kernel Oil Qualifies For Duty Exemption, End-Use Condition Inapplicable: Gujarat High Court

The Gujarat High Court in a writ petition has quashed a show cause notice creating duty demand of about Rs. 464 crores on import of Crude Palm Kernel Oil (Edible Grade). The Division Bench, comprising Justice Bhargav D. Karia and Justice Pranav Trivedi ruled on whether Oil even if of edible grade but required refining before human consumption qualified for customs duty exemption...

S.153C Income Tax Act | Gujarat High Court Quashes Assessment Proceedings Lodged 4-Years After Search Citing 'Inordinate Delay'

The Gujarat High Court quashed a notice under Section 153C Income Tax Act issued to a person other than the searched person for assessment of income, noting that the proceedings were initiated nearly 4 years after search was conducted observing that there was an "inordinate delay" by the authorities in recording the satisfaction note. The court rejected the reasons for delay in issuing the...

Gujarat High Court Grants Relief To 82-Yr-Old Lady For Failing To File Income Tax Return, Takes Note Of Age & Ailments

The Gujarat High Court recently granted relief to a senior citizen woman who had failed to file income tax return for Assessment Year 2017-18, taking note of her age as well as the fact that she was suffering from various ailments including Alzheimer disease along with hyper tension and diabetes.The court observed that the tax authority had while exercising revisional powers under Section...

Gujarat High Court Restores MBBS Student's Admission But Imposes 6 Months Additional Rural Service For Failing To Follow Procedure

The Gujarat High Court has allowed the petition of a meritorious student, whose admission in MBBS course was cancelled because she failed to follow the required procedure, subject to the condition that she would serve an additional 6 months in a rural area after completing her course. In doing so, the bench of Justice Nirzar S Desai observed that the 18-year-old student had a brilliant...