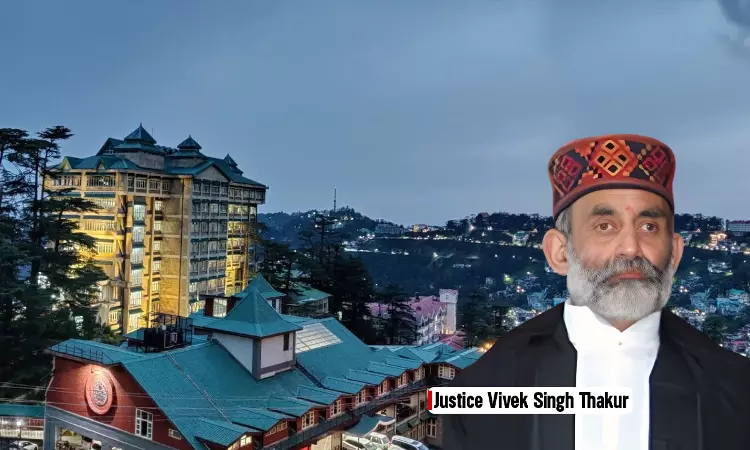

Insurance Company Cannot Use Hidden Or Undisclosed Clauses To Deny Compensation: Himachal Pradesh High Court

Mehak Aggarwal

6 Oct 2025 8:45 PM IST

Next Story

6 Oct 2025 8:45 PM IST

The Himachal Pradesh High Court held that an insurance company cannot rely on clauses to deny compensation which was not revealed to the insured at the time of signing the agreement.Emphasizing on the principle of good faith, the court remarked that it was the duty of the insurance company to inform the insured about all clauses. Applying the Doctrine of Blue Pencil (which strikes off...