Kerala High Court

'Statutory Right Of Appeal Can't Be Curtailed On Technicalities': Kerala High Court Directs Registry To Accept Appeals U/S 5C Cinematograph Act

The Kerala High Court on Friday (December 12) directed its Registry to accept and entertain appeals under Section 5C of the Cinematograph Act as a miscellaneous first appeal with the nomenclature MFA (Cinematograph Act).The Division Bench consisting of Justice Arvind Sushrut Dharmadhikari and Justice P.V. Balakrishnan made the suggestion while dismissing the writ appeals challenging the...

President Asks Justice Nisha Banu, Who Hasn't Abided By Transfer Order, To Join Kerala High Court By Dec 20

The President has directed Justice Nisha Banu to assume charge at the Kerala High Court on or before December 20, 2025. It may be noted that the Centre had notified her transfer from the Madras High Court to the Kerala High Court on October 14, 2025. In a notification issued on December 12, the centre said"The President, after consultation with the Chief Justice of India, is pleased to...

'Arrest Illegal If Grounds Not Conveyed To Arrestee As Soon As Possible': Kerala High Court

The Kerala High Court has reiterated that failure to communicate the grounds of arrest in accordance with Article 22(1) of the Constitution and Sections 47 and 48 of the Bharatiya Nagarik Suraksha Sanhita (BNSS), 2023 renders the arrest illegal, entitling the accused to be released in Bail.Justice K. Babu made the observation while delivering a common order in four bail applications.“If...

Sabarimala Gold Theft: Kerala High Court Reserves Verdict In Bail Application By Ex-TDB Official

The Kerala High Court on Friday (December 12) reserved its verdict in the regular bail pleas preferred by former Travancore Devaswom Board (TDB) official Murari Babu in the Sabarimala gold theft case.Justice A. Badharudeen heard arguments advanced by Advocate S. Rajeev representing Murari Babu and those of the prosecution.During the course of the hearing today, the Court orally asked for...

'Widespread Filth, Decay & Neglect': Kerala High Court Slams Chottanikkara Temple Authorities, Orders Cleanliness Audit By Suchitwa Mission

The Kerala High Court on Wednesday (10 December) directed Suchitwa Mission— a technical arm of government which empowers local bodies with technical support for waste management, sanitation, and green initiatives— to conduct a detailed cleanliness audit of the Chottanikkara Temple and suggest implementable measures.The Division Bench comprising Justice Raja Vijayaraghavan V and Justice...

Kerala High Court Seeks Status Report On Removal Of Unauthorised Boards, Banners & Election Material

The Kerala High Court on Thursday (11 December) sought reports on removal of illegal boards and election materials by the concerned authorities.Justice Devan Ramachandran was considering a review in a plea against illegal and unauthorized flags and banners.Earlier this year, the Court had disposed of the plea and gave directions declaring installation of unauthorized boards, banners,...

Kerala High Court Rejects Appeals By Centre, Catholic Congress Against 'Haal' Movie

The Kerala High Court on Friday (December 12) dismissed appeals filed by the Union Government and the Catholic Congress challenging the Single Bench's decision quashing the A-certification and cuts to the movie 'Haal'.The Division Bench comprising Justice Arvind Sushrut Dharmadhikari and Justice P.V. Balakrishnan delivered the verdict.In its appeal Catholic Congress had opposed the portrayal...

Co-operative Societies Rules | Managing Committee Can't Oust Co-Opted Member At Pleasure; Must Invoke No-Confidence Procedure: Kerala High Court

The Kerala High Court has recently held that co-opted members of a managing committee cannot be removed at the “pleasure” of the elected board. The Court held that the only lawful method of removing any member of a managing committee, elected or co-opted, is the statutory process under Rule 43-A of the Kerala Co-operative Societies Rules.Justice K. Babu delivered a common judgment...

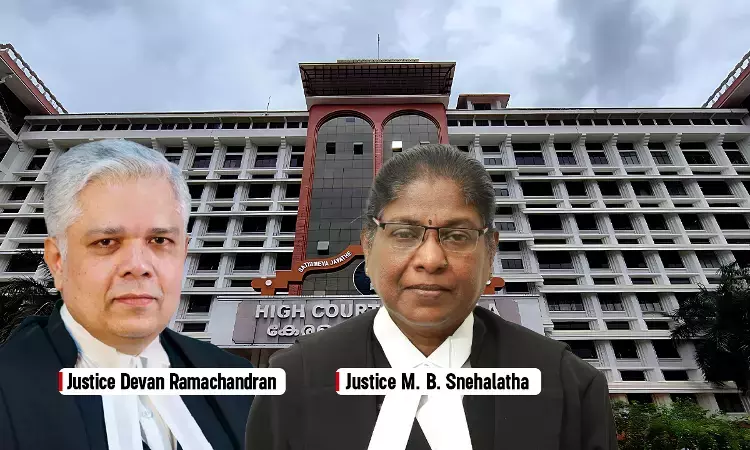

Suraj Lama Missing Case: Kerala High Court Seeks Deportation Documents Of The Missing Person

The Kerala High Court on Thursday (11 December) sought the deportation documents of Suraj Lama, an Indian citizen who has been deported from Kuwait and went missing after arriving at Kochi.The division bench comprising Justice Devan Ramachandran and Justice M B Snehalatha issued the direction while considering the habeas corpus petition filed by the son of the missing person. The Court...

Municipality Must Accept Only Tax Component, Penal Charges Not Required For Filing Appeal Under Municipal Act: Kerala High Court

The Kerala High Court held that under Section 509(11) of the Municipality Act, only the tax component shown in the demand notice is required to be paid for filing an appeal. The bench clarified that the Municipality cannot insist on payment of penal interest or any other additional charges for entertaining the appeal. Section 509(11) of the Municipality Act, 1994, provides that...

Kerala High Court Orders Inspection Of One Tonne Kumkum Stock In Erumeli; Flags Widespread Sale Of Unlabelled Cosmetics

The Kerala High Court on Monday(8 December) directed a multi-departmental team to inspect and draw samples from a large stock of Kumkum stored at an establishment in Erumeli. The Court also observed that the widespread sale of unlabelled and unpackaged Kumkum to pilgrims, calling it a clear violation of statutory standards.The Division Bench comprising Justice Raja Vijayaraghavan V and Justice...

'Shocking; Can Happen To Anyone': Kerala High Court Questions Police, Airport Authorities Over Disappearance Of Deportee From Kuwait

“Even when our citizens are in jail [abroad], we are creating a lot of interest, and rightfully so. But the moment you step into India, their value is gone,” the Court remarked.