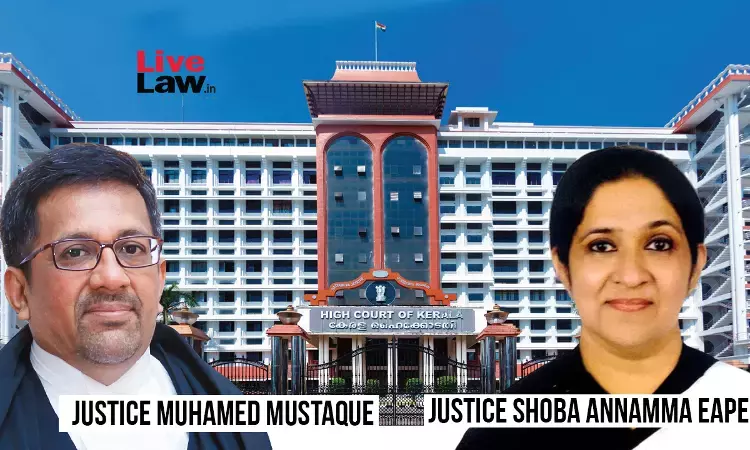

Ad Hoc Service Cannot Be Counted For Financial Upgradation Under Career Progression Schemes: Kerala High Court

Navya Benny

1 Jan 2024 9:03 PM IST

Next Story

1 Jan 2024 9:03 PM IST

The Kerala High Court recently held that an employee without the requisite qualifications for Bosun (Certified) cannot claim promotion to the said post, and that ad hoc service rendered by such employee shall not qualify for fiancial upgradations under the Assured Career Progression ('ACP'), and the Modified Assured Career Progression ('MACP') Schemes. "...we specifically note that the ACP...