Madhya Pradesh High Court

Bank Can't Withhold Superannuation Benefits Explicitly Granted In Removal Order Despite Ongoing Service Dispute:MP High Court

Madhya Pradesh High Court: A Division Bench comprising Justice Sunita Yadav and Justice Milind Ramesh Phadke partially allowed a writ appeal challenging the Single Judge's order that had directed the appellant to raise an industrial dispute regarding his superannuation benefits. The Court held that when a removal order explicitly grants superannuation benefits, these cannot be...

Acceptance Of Qualifications At Time Of Appointment Can't be Questioned After 30 Years, Unless Fraud Is Alleged:MP High Court

Madhya Pradesh High Court: A Single Judge Bench of Justice Vivek Jain partially allowed a writ petition challenging an inquiry into a disability certificate submitted for employment three decades ago. The court held that while authorities can investigate allegations of forgery, they cannot question the acceptability of qualifications that were accepted at the time of appointment after...

MP High Court Refuses To Quash Sr Adv Vivek Tankha's Defamation Case Against Union Minister Shivraj Singh Chouhan And Two Others

The Madhya Pradesh High Court dismissed a plea by Union Minister Shivraj Singh Chouhan and two others challenging a magisterial court's order taking cognizance of criminal defamation complaint registered against them by senior advocate and Member of Parliament Vivek Tankha in connection with certain court proceedings from 2021.In doing so, the Jabalpur bench of the high court said that it...

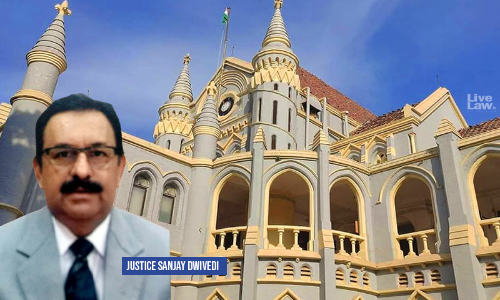

Non-Speaking Dismissal Orders And Procedural Lapses In Disciplinary Proceedings Violate Natural Justice: MP HC

Madhya Pradesh High Court: A Single Judge Bench of Justice Sanjay Dwivedi invalidated the dismissal of a Bhopal Development Authority (BDA) employee, finding significant violations of natural justice principles. The court held that the disciplinary proceedings against Vijay Singh Yadav were fundamentally flawed due to the absence of witness testimony, failure to provide essential...

Power Of Review Under MP Civil Services Rules Must Be Exercised Within Six Months, Delayed Review Of Retired Officer's Exoneration Invalid: MP HC

Madhya Pradesh High Court: A Single Judge Bench of Justice Sanjay Dwivedi invalidated the State's delayed review of a retired Sub Divisional Magistrate's exoneration in a departmental inquiry. The court held that the power of review under Rule 29(1) of the MP Civil Services (Classification, Control and Appeal) Rules, 1966, must be exercised within six months, and any review beyond...

In Absence Of Prayer Can't Grant Relief For Classification, When Claim Is For Regularization: MP High Court In Industrial Dispute Case

While setting aside an industrial court's order, the Jabalpur bench of the Madhya High Court observed that in a claim for regularization, the Industrial Court should not have granted the relief for classification which had not been prayed for by the workman. In doing so the court, reiterated the "basic difference" between regularization and classification, referring to the Supreme...

Merger Into State Education Service Doesn't Nullify Previous Service Benefits: MP HC

Madhya Pradesh High Court: A Division Bench of Justice Vivek Rusia and Justice Binod Kumar Dwivedi upheld the rights of Shikshakarmi teachers to receive benefits equivalent to regular municipal employees. The Court ruled that teachers initially appointed under municipal rules in 1998-99 and subsequently merged into the state education service are entitled to all service...

Madhya Pradesh High Court Seeks Centre, State's Stand In PIL Against Rising Traffic Congestions, Noise Pollution

The Jabalpur bench of the Madhya Pradesh High Court on Wednesday (October 23) sought the stand of the Centre and State in a public interest litigation petition pertaining to noise pollution and Traffic congestion, particularly in the city. A division bench of Justice Sanjiv Sachdeva and Justice Vinay Saraf directed the respondents including Union of India, the State of Madhya Pradesh, and the...

Administrative Error In Pay Fixation Cannot Lead To Post-Retirement Recovery With Interest: MP HC

Madhya Pradesh High Court: A Single Judge Bench of Justice Sushrut Arvind Dharmadhikari quashed a recovery order seeking excess payments with interest from a retired Subedar. The Court held that recovery of excess payments from retired government employees, particularly when there is no misrepresentation or fraud, is impermissible after four years of retirement under Rule 9(4) of M.P....

GST Order Cannot Be Challenged Citing No Personal Hearing If Hearing Not Requested After Receipt Of SCN: MP High Court Dismisses Plea

The Madhya Pradesh High Court at its Indore bench, dismissed a writ petition which was filed by Future Consumer Limited, challenging an order passed by the Deputy Commissioner of State Tax under Section 73 of GST Act. The petitioner stated that they were denied the right to personal hearing under Section 75(4) of the Act. The division bench comprising of Justice Vivek Rusia and Justice...

ID Act | Labour Court Possesses Power To Issue Notice To A Party Which May Not Be Party To The Reference: MP High Court

The MP High Court at its Indore Bench has held that the Labour Court is possessed with the power to issue notice to a party which may not be a party to the reference.The division bench of Justice Sushrut Arvind Dharmadhikari and Justice Binod Kumar Dwivedi observed, “Since reference has been made in earlier round of litigation which is registered as 11/ID/2024 and looking to the fact that...

Monetary Compensation Can Substitute Reinstatement Even In Cases Of Illegal Termination: MP HC

Madhya Pradesh High Court: A Single Judge Bench of Justice G.S. Ahluwalia upheld the Labour Court's decision to award monetary compensation instead of reinstatement to a terminated daily wage worker. The Court held that even when termination violates Section 25-F of the Industrial Disputes Act, reinstatement with back wages is not an automatic remedy. Drawing from Supreme Court...