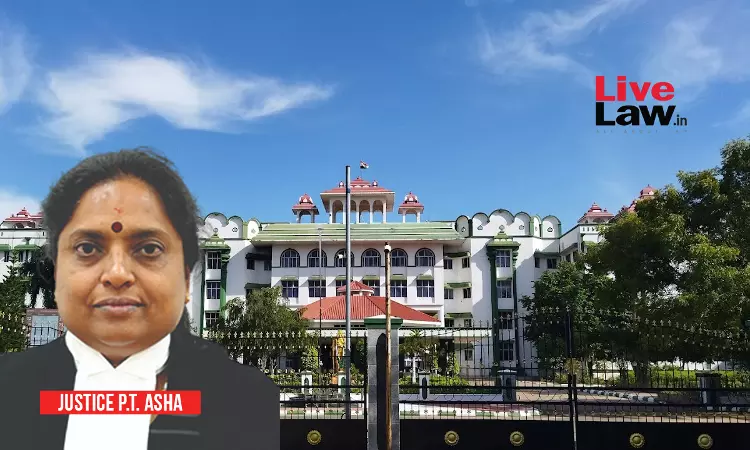

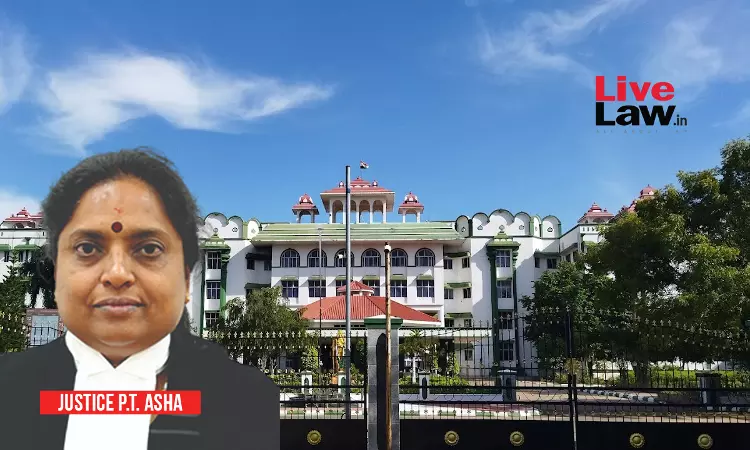

The Madras High Court recently directed authorities to grant exemption from the motor vehicle tax as well as the GST to a visually impaired person in respect of the car purchased by her.Justice PT Asha of the Madurai bench took note of the recommendations made by the Chief Commissioner for Persons with Disabilities to Department of Heavy Industries, Ministry of Heavy Industries and...