IBC News

NCLT Can Allow Date Of Default To Be Amended In CIRP Proceedings: NCLAT

The National Company Law Appellate Tribunal (NCLAT) bench of Justice Rakesh Kumar Jain (Judicial Member), Mr. Naresh Salecha (Technical Member) and Mr. Indevar Pandey (Technical Member) has held that the NCLT is empowered to allow the parties to amend the pleadings before the final orders in Corporate Insolvency Resolution Process (CIRP) proceedings are passed. In other words, the...

Deposit In Pursuance Of One Time Settlement Proposal Remains Corporate Debtor's Asset If Settlement Fails: NCLAT

The NCLAT New Delhi bench of Justice Yogesh Khanna (Judicial Member) and Mr. Ajai Das Mehrotra (Technical Member) has held that the amount deposited with the bank by the corporate debtor in pursuance of an One Time Proposal to show bonafides will remain assets of the corporate debtor and can be taken into custody by the RP under section 18 of the code when the said proposal...

Secured Creditor Is Liable To Pay Liquidator's Fees Under Rule 21A Of Liquidation Regulations If Option U/S 52 Of IBC Is Exercised: NCLAT

The NCLAT New Delhi bench of Justice Ashok Bhushan (Judicial Member), Barun Mitra( Technical Member) and Arun Baroka (Technical Member) has held that the fee of the liquidator has to be paid within 90 days from the liquidation commencement date as provided under Regulation 21A of the Liquidation Regulations if the secured creditor opts to realise its security interest under section 52 of...

Petition U/S 7 Of IBC Cannot Be Barred For Default Committed Prior To S.10A Period: NCLAT

The NCLAT New Delhi bench of Justice Ashok Bhushan (Judicial Member), Barun Mitra( Technical Member) and Arun Baroka (Technical Member) has held that when default has been committed by the Corporate Debtor prior to Section 10A period, any default committed during the Section 10A period cannot be held to bar the application which is filed on the basis of default prior to Section 10A...

Amount Seized By Income Tax Department And Adjusted Against Demand Prior To Initiation Of CIRP Is Not Asset Of CD: NCLAT

The NCLAT New Delhi bench of Justice Rakesh Kumar Jain (Judicial Member) and Mr. Naresh Salecha (Technical Member) Has held that an amount seized by the Income Department and adjusted against demand prior to initiation of the CIRP cannot be considered as assets of the corporate debtor. Brief Facts This appeal has been filed against an order passed by the NCLT by which an IA filed...

Security Interest Shall Stand Relinquished If Liquidation Costs Is Not Paid As Per R. 21A(3) Of Liquidation Regulations: NCLAT

The NCLAT New Delhi bench of Justice Ashok Bhushan (Judicial Member) and Barun Mitra (Technical Member) has held that if the secured creditor fails to pay the liquidation costs within 90 days after its intention to realise the security interest, the security interest shall stand relinquished under Regulation 21A(3) of the Liquidation Regulations, 2016. Brief Facts The Suraksha...

Raising Money Through Optional Convertible Debentures Can Be Considered As Financial Debt U/S 5(8): NCLAT

The NCLAT New Delhi bench of Justice Ashok Bhushan (Judicial Member), Barun Mitra (Technical Member) and Arun Baroka (Technical Member) has held that raising money by issuance of convertible debentures with an option to be later converted into equity shares can be classified as a financial debt if a default is committed by the corporate debtor. Brief Facts Financial assistance...

IBC Weekly Round Up [2nd December To 8th December, 2024]

Nominal Index: Harsh Mehta Versus Securities and Exchange Board of India and Ors., WRIT PETITION NO. 4844 OF 2024 Prabhat Jain, Liquidator of Narmada Cereal Pvt. Ltd. vs MP Industrial Development Corporation Limited and Ors.,Comp. App. (AT) (Ins.) No. 697 of 2023 & I.A. No. 2322 of 2023 Decor Paper Mills Ltd. Versus Mahashakti Plasto Pvt. Ltd., Company Appeal...

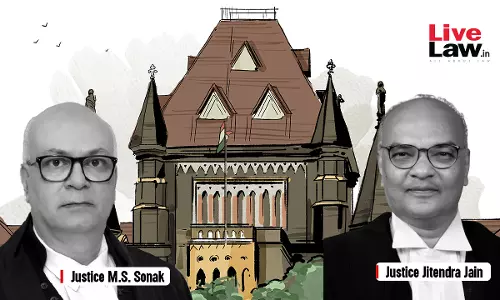

Delisting Regulations Of SEBI Not Applicable To Delisting Of Equity Shares Under Resolution Plan: Bombay High Court

The Bombay High Court bench of Justices M.S.Sonak and Jitendra Jain has held that Delisting Regulations framed by the SEBI would not be applicable to the delisting of shares of the company in pursuance of the approval of a Resolution Plan under section 31 of the code. Brief Facts In this case, the petitioner challenges the vires of Regulation 3(2)(b)(i) of the SEBI...

Section 43 Of IBC Cannot Be Attracted When No Transaction Was Made By Corporate Debtor: NCLAT

The NCLAT New Delhi bench of Justice Ashok Bhushan (Judicial Member) and Barun Mitra (Technical Member) has held that section 43 of the code can be attracted only when the transaction in question is made by the corporate debtor and not when it is made by the third party in pursuance of a statutory demand. Brief Facts The corporate debtor was admitted into the insolvency on June...

Approval Of Resolution Plan By CoC Cannot Be Interfered With Unless Section 30(2) Of Code Is Breached: NCLAT

The NCLAT New Delhi bench of Justice Ashok Bhushan (Judicial Member) and Barun Mitra (Technical Member) has held that approval of Resolution Plan by the Committee Of Creditors (CoC) cannot be interfered with unless it is violative of section 30(2) of the Code. Brief Facts The Corporate debtor was admitted into insolvency on December 19, 2019. In the absence of a viable...

Declaration Of Loan Account/ Debt As NPA Can Be Considered As Date Of Default To File Petition U/S 7 Of IBC: NCLAT

The NCLAT New Delhi bench of Justice Ashok Bhushan (Judicial Member) and Barun Mitra (Technical Member) has held that upon declaration of the loan account/ debt as NPA that date can be reckoned as the date of default to enable the Financial Creditor to initiate action under Section 7 of the Code. Facts The Corporate Debtor, M/s. I World Business Solutions Pvt. Ltd...

![IBC Weekly Round Up [2nd December To 8th December, 2024] IBC Weekly Round Up [2nd December To 8th December, 2024]](https://www.livelaw.in/h-upload/2024/08/01/500x300_552807-weekly-digest-of-ibc-cases.webp)