Latest News

No Mandatory Requirement Of Aadhaar For MSME Udyam Registration: Centre To Gujarat High Court

The Ministry of Micro, Small and Medium Enterprises (MSME) on Monday informed the Gujarat High Court that there is no mandatory requirement of Aadhaar Number for registration of businesses with MSME Udyam Registration.The Court was hearing a PIL seeking quashing of the part of the Notification dated June 26, 2020 issued by MSME, so far as it allegedly mandatorily demands Aadhaar Number from...

EPF Pension | Kerala High Court Seeks Response Of PF Authorities On Plea Against Limiting Higher Pension For Not Exercising 'Fresh Joint Option'

The Kerala High Court on Wednesday sought the response of the Central Government and the Provident Fund authorities in the plea challenging the initiation of steps by the PF Commissioner to curtail/limit/stop the higher pension that is being received by the retired employees of KELTRON on the ground that they had not exercised a fresh joint option. Justice Raja Vijayaraghavan V. posted the...

Air India Urination Case: Delhi High Court Directs DGCA To Constitute Appellate Committee To Hear Appeal Against ‘Unruly Passenger’ Tag

The Delhi High Court Thursday directed the Director General of Civil Aviation (DGCA) to constitute an appellate committee to hear the appeal of Shankar Mishra, accused in the Air India urination case, against the airline’s inquiry committee's order designating him as an “unruly passenger” and banning him from flying for four months.Justice Prathiba M Singh permitted Mishra to file...

LiveLaw Brings To You Special Holi Offer: Get 3 Years Premium subscription At INR 3600 + GST And Get 6 Months Subscription Free!

Avail LiveLaw's Special Holi Offer Buy Three Year Subscription For Just INR 3,600 +GST And Get 50% Discount + 6 Months Subscription Free Limited time offer ! Subscribe Now! Visit: livelaw.in/pricing Subscribe to LiveLaw Premium and get access to the following benefits: 1. Unlimited access to our archives, orders, etc. 2. Free copies of judgments with an option...

Karnataka High Court Permitted Superintendent of Central Tax To Pass Orders For Revoking Cancellation Of GST Registration On Filing Returns

The Karnataka High Court has permitted the Superintendent of Central Tax to pass suitable orders for revocation of the cancellation of the GST registration, if the petitioner/assessee files returns.The single bench of Justice B. M. Shyam Prasad has observed that the cancellation of GST registration was without due opportunity and was arbitrary.The petitioner submitted that the respondent...

Appellate Court Becomes Functus Officio After Disposing Main Appeal, Cannot Decide Injunction Application Thereafter: Gauhati High Court

The Gauhati High Court recently held the dismissal of an injunction application by a District Judge, 5 days after disposal of the main title appeal, to be bad in law. The single judge bench of Justice Justice Parthiv Jyoti Saikia observed:“The Title Appeal was disposed of on 23.02.2022 and the connected injunction petition was disposed of 5 days later, i.e. on 28.02.2022. With the delivery...

Airport Metro Arbitral Award: DMRC Seeks Review Of High Court Ruling, Says Attachment Of Statutory Expenses Will Cause Chaos On Delhi Roads

Seeking a review of Delhi High Court's recent decision on the execution petition filed by Reliance Infra-promoted Delhi Airport Metro Express Private Limited (DAMEPL), the Delhi Metro Rail Corporation (DMRC) has told the court that the attachment of its statutory expenses will result in immediate stoppage of the entire metro network in National Capital Region and cause inconvenience to more...

Surat Court Convicts Rahul Gandhi In Defamation Case Over 'Modi Surname' Remark, Gets 2-Year Jail Term

A Court in Gujarat's Surat District today convicted Congress leader and MP Rahul Gandhi in a defamation case for his remarks “why all thieves share the Modi surname” made during a political campaign in Karol in April 2019.BREAKING: Surat Court Convicts Rahul Gandhi In Defamation Case Over 'Modi Surname' Remark @RahulGandhi #SuratCourt #RahulGandhi #ModiSurnameremark...

Order 6 Rule 17 CPC | Party Can’t Be Refused Relief Merely Over Inadvertence Or Infraction Of Procedural Rules: Patna High Court

A bench comprising Justice Sunil Dutta Mishra of the Patna High Court, while allowing a civil miscellaneous petition held that a party cannot be refused just relief merely because of some mistake, negligence, inadvertence or even infraction of the rules of procedure.In this case, the Civil Miscellaneous application was preferred for setting aside the order passed by Sub-Judge, Gaya in a...

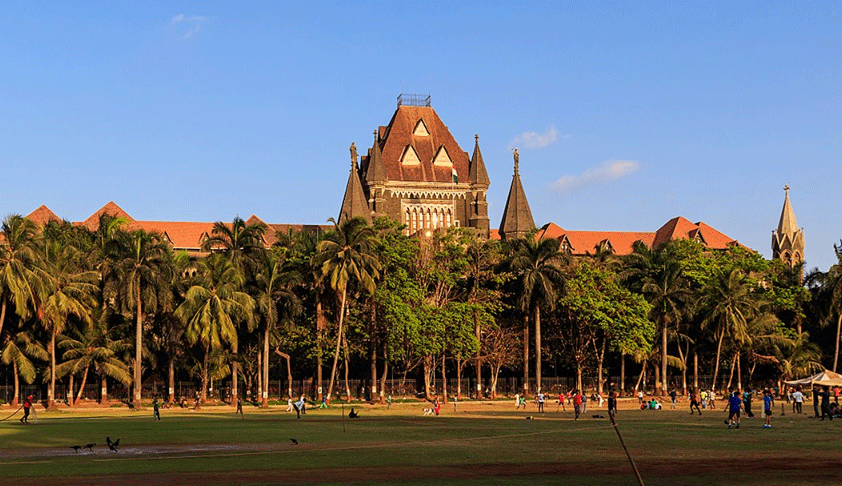

Facilitation Council Under MSMED Act Has No Jurisdiction To Conduct Arbitration Dispute Arising Under A Works Contract: Bombay High Court

The Bombay High Court has set aside an arbitral award passed by the Facilitation Council by invoking statutory arbitration under Section 18(3) of the Micro, Small and Medium Enterprises Development Act, 2006 (MSMED Act), while holding that the Council could not have exercised jurisdiction to conduct arbitration in a dispute arising under a works contract. The bench of...

'SCBA Cannot Assert Right Over Entire Land Allotted To SC' : Supreme Court Refuses To Consider Association's Plea On Judicial Side

The Supreme Court on Thursday held that it cannot consider on the judicial side the plea of the Supreme Court Bar Association to convert the entirety of 1.33 acres of the land allotted to the Top Court by the Central Government as space for lawyers' chambers."SCBA cannot assert a right over the entirety of the 1.33 acres of land allotted to Centre for converting to lawyers chambers", a...

Debts Arising From Different Work Orders Can Be Clubbed To Satisfy The Minimum Threshold Under IBC: NCLT Mumbai Reiterates

The National Company Law Tribunal, Mumbai Bench, comprising Shri Kishore Vemulapalli (Judicial Member) and Shri Prabhat Kumar (Technical Member), while adjudicating an application under Section 9 of Insolvency and Bankruptcy Code, 2016 (“IBC”) in Wam India Private Limited Vs SN Engineering Services Pvt. Ltd. has held that debts arising from different work order(s) can be clubbed...