Latest News

BREAKING: Varanasi Court Allows Hindu Worshippers' Plea Seeking ASI Survey Of Gyanvapi Mosque Premises

The Varanasi District Court today allowed an application filed by 4 Hindu women worshippers seeking a SCIENTIFIC survey of the entire Gyanvapi mosque premises (except for Wuzukhana) by the Archaeological Survey of India (ASI) to find out as to whether the Mosque had been constructed over a pre-existing structure of the Hindu templeThe court of District Judge AK Vishwesha today pronounced...

Manipur Sexual Assault Video | After SCAORA, Supreme Court Bar Association Condemns Inaction Of State Police For Two Months

The Supreme Court Bar Association (SCBA) has passed a resolution expressing its concern and condemnation over the violence witnessed by the north-eastern state of Manipur, especially referring to a video depicting two women being paraded naked and assaulted in broad daylight. This graphic video went viral on the internet recently, shocking the nation and bringing renewed attention...

Supreme Court Dismisses PIL Seeking Inclusion Of Rajasthani Language In Eighth Schedule

The Supreme Court on Friday dismissed a Public Interest Litigation (PIL) seeking the inclusion of "Rajasthani" language in the Eighth Schedule of the Indian Constitution. The petition was filed by Advocate Ripudaman Singh who argued before a bench comprising CJI DY Chandrachud, Justice PS Narasimha, and Justice Manoj Misra.At the very outset, the bench expressed its disinclination...

Supreme Court Judges Shocked To See Kashmiri Separatist Leader Yasin Malik, Who Is Serving Life Sentence In Tihar, Appear Before Them In Person

On Friday, Supreme Court Judges were taken aback that Kashmiri separatist leader Yasin Malik, who is undergoing life sentence in Tihar jail after being convicted in a terror funding case, was present in the Apex Court to appear before it in person.The matter in which Malik was appearing is an appeal filed by the Central Bureau of Investigation assailing orders of Special Court in Jammu...

SCAORA Condemns Manipur Sexual Violence, Objects To 'Illegal' FIRs Against Advocates & Activists

The Supreme Court Advocates-on-Record Association (SCAORA) has condemned the ongoing ethnic clashes in the north-eastern state of Manipur. This development comes after a graphic video depicting two women being paraded naked and assaulted went viral, shocking the nation and bringing renewed attention to the allegations of human rights violations emerging from the State of...

'Everybody Is Getting Touchy About Everything Now, Tolerance For Films, Books Going Down' : Supreme Court Dismisses Plea Against 'Adipurush' Movie

The Supreme Court on Friday, dismissed a Public Interest Litigation (PIL), seeking the revocation of the certificate granted by the Central Board of Film Certificate (CBFC) for the movie "Adipurush". The bench comprising Justice SK Kaul and Justice Sudhanshu Dhulia stated that it was inappropriate for the Supreme Court to interfere with film certifications based on the "sensitivities of...

Supreme Court Issues Notice On TN Minister Senthil Balaji's Plea Against Madras HC Allowing ED To Take Him Into Custody

The Supreme Court on Friday issued notice on the petitions filed DMK leader and Tamil Nadu minister V Senthil Balaji and his wife Megala challenging the verdict of the Madras High Court holding that the Directorate of Enforcement (ED) was entitled to take him into custody in connection with a cash-for-jobs scam in the state.A bench of Justices AS Bopanna and MM Sundresh posted the matter...

Supreme Court Grants Interim Relief To "Adipurush" Makers; Stays Proceedings In High Courts Against Movie

The Supreme Court, on Friday, granted interim relief to the makers of the film "Adipurush", by staying all High Court proceedings against the movie makers and issued notice in the makers' plea challenging the direction of the Allahabad High Court seeking the personal appearance of the director, producer and the dialogue writer of the movie. The Supreme Court also issued notice on a...

Additional Solicitor General Devang Girish Vyas To Also Hold Charge Of Bombay High Court ASG

The Appointments Committee of the Cabinet has approved the assignment of the charge of Additional Solicitor General of India (ASGI), Bombay High Court to Devang Girish Vyas, who was last month re-appointed as ASGI of Gujarat High Court.According to an order issued by the Department of Personnel & Training, the appointment shall be valid for a period of six months w.e.f. the date of...

Krishna Janmabhoomi Case : Won't It Be Better If HC Decides Instead Of Trial Court?Supreme Court Asks Shahi Masjid Idgah Committee

The Supreme Court, on Friday, sought details from the Registrar of the Allahabad High Court the civil suits filed in respect of the Krishna Janmabhoomi-Shahi Idgah dispute at Mathura, which were sought to be consolidated and transferred to the High Court from the trial court.A Bench comprising Justice SK Kaul and Justice Sudhanshu Dhulia was hearing a plea challenging the order passed by...

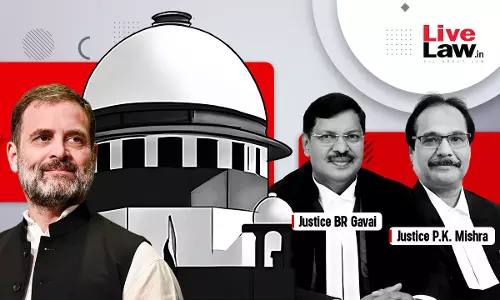

Supreme Court Issues Notice On Congress Leader Rahul Gandhi's Plea To Stay Conviction; Posts For Hearing On August 4

The Supreme Court on Friday issued notice on a petition filed by Congress leader and former Member of Parliament (MP) Rahul Gandhi seeking suspension of his conviction in a criminal defamation case over 'Modi thieves' remark, which resulted in his disqualification from the Lok Sabha.The Court posted the matter for hearing on August 4. A bench of Justices BR Gavai and Prashant Kumar Mishra...

Can Parliamentary Law Under Article 239AA(7) Alter Constitutional Powers Of Delhi Govt? Issue Referred To Supreme Court Constitution Bench

While referring the Delhi Government's challenge against the Centre's Ordinance on services to a Constitution Bench, a 3-judge bench of the Supreme Court observed that contours of the powers of the Parliament under Article 239AA(7) of the Constitution were not considered in either of the earlier Constitution Bench judgments of 2018 and 2023 in the GNCTD vs Union of India cases.Article 239AA...