Latest News

Bar Association Undertakes To Not Obstruct Work Of Legal Aid Defence Counsel; Supreme Court Closes Contempt Proceedings

The Supreme Court on Monday closed the contempt proceeding initiated against the officer bearers of the Bharatpur Bar Association, Rajasthan, who had allegedly obstructed the work of legal aid defence counsel appointed by the Legal Services Authority. Previously, the Apex Court had stayed the letter issued by Bharatpur Bar Association Committee suspending three legal aid defence counsels...

District Judges Selection | Interviews Meant To Test Practical Understanding Of Candidates : CJI DY Chandrachud

Chief Justice of India Dr DY Chandrachud on Wednesday shared his experiences as a High Court judge while discussing the selection process for district judiciary candidates. The CJI's remarks came during a hearing before a constitution bench he was presiding, which was reviewing a set of petitions filed by eleven aspirants seeking selection as District judges in the State of Kerala.The...

Supreme Court Says Kerala HC Erred In Fixing Cut-Off For Viva-Voce In 2017 District Judge Selection; Refrains From Unseating Selected Candidates

A Constitution Bench of the Supreme Court on Wednesday held as illegal the process followed by the Kerala High Court in fixing a cut-off mark on the basis of viva-voce for the selection of District Judges in March 2017. The Court noted that cut-off was fixed by the High Court after the conduct of the viva voce, which was "manifestly arbitrary".The Supreme Court further noted that the...

Can Ineligible Person Appoint Arbitrator? Supreme Court Defers Hearing As Centre Is Considering Reforms To Arbitration & Conciliation Act

A Constitution Bench of the Supreme Court on Wednesday decided to defer for two months the hearing of a reference which raises the issue whether a person, who is ineligible to be appointed as an arbitrator, can appoint an arbitrator. The matter was listed before a bench comprising Chief Justice of India DY Chandrachud, Justice Hrishikesh Roy, Justice PS Narasimha, Justice Pankaj Mithal,...

'There Has To Be An Enduring Solution' : Supreme Court On Stray Dog Issue In Kerala

The Supreme Court on Wednesday orally said that there has to be an enduring solution to the issue of stray dogs in Kerala. The Court was considering the plea filed by the Kerala State Commission for Protection of Child Rights (KeSCPCR) citing increase in stray dog attacks in Kerala, especially against children, seeking directions to curb the menace. The statutory body has filed an...

Gurugram Prime Plot 'Sold' Through Fake GPA : Supreme Court Forms SIT To Probe Land Scam; Questions Role Of Sub-Registrar's Office

The Supreme Court, recently, directed the Commissioner of Police, Gurugram to constitute a Special Investigation Team (SIT) to investigate a land scam that involves officials at the office of land Registering Authorities and other accused persons allegedly duping an elderly NRI couple. The Apex Court categorically stated that the Commissioner of Police, Gurugram is personally responsible...

Empowering Women In Sports: Justice Hima Kohli Calls For Legal Reforms And Equal Opportunities

Supreme Court Judge Justice Hima Kohli recently advocated for legal reforms and equal opportunities to empower women in sports and address the persistent challenges they face. Justice Kohli made these remarks while delivering the inaugural address at the National Seminar on Women Empowerment through Sports: Issues and Challenges, hosted by her alma mater Campus Law Centre, University of Delhi...

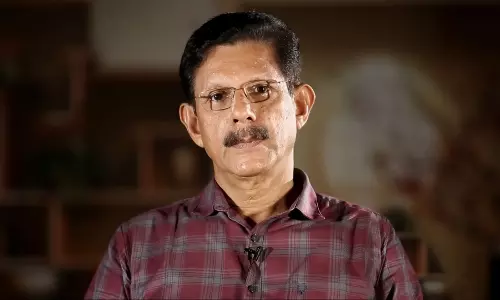

Professor TJ Joseph Hand Chopping Case: NIA Court Finds 6 Guilty; Acquits 5 In Second Phase Of Trial

The National Investigation Agency Court, Kochi, on Wednesday found 6 of the 11 accused persons guilty in the sensational Professor T.J. Joseph hand-chopping case of 2010. Judge Anil Bhaskar pronounced the verdict in the second phase of the trial today.The matter arose when a question in an exam set by Professor Joseph, the former Head of the Malayalam Department of Newman College,...

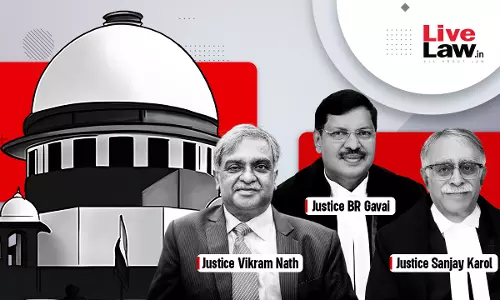

Supreme Court Rejects Argument That 'Piecemeal’ Extensions Will Affect Independence Of Directors Of CBI & ED; Upholds Amendments To CVC Act & DSPE Act

The Supreme Court of India on Tuesday, while upholding the validity of the 2021 amendments to the Central Vigilance Act and the Delhi Special Police Establishment Act, rejected the argument that granting extensions of only one year at a time to the terms of the heads of the Directorate of Enforcement and the Central Bureau of Investigation would threaten the independence of the agencies....

Supreme Court Adjourns Hearing In Umar Khalid's Bail Plea After Delhi Police Seeks More Time to File Counter-Affidavit

The Supreme Court on Wednesday adjourned the hearing in the bail plea of former JNU scholar and activist Umar Khalid, who has been arrested under the Unlawful Activities (Prevention) Act for his alleged involvement in the larger conspiracy surrounding the communal violence that broke out in February 2020 in the Indian capital. Khalid has been behind bars since September 2020,...

'Adipurush' Movie Makers Approach Supreme Court Against Allahabad HC Direction For Their Personal Appearance

The makers of 'Adipurush' movie have approached the Supreme Court challenging the direction of the Allahabad High Court seeking the personal appearance of the director, producer and the dialogue writer of the movie while hearing petitions seeking a ban on the film.The counsel for the petitioners mentioned the matter before Chief Justice of India DY Chandrachud for urgent listing."This is...

Persons With Disability Act 1995 Mandated Reservation In Promotions Too : Supreme Court Grants Relief To RBI Employee

Recently, the Supreme Court invoked Article 142 of the Constitution of India to direct RBI to extend the benefit of reservation in promotion to an employee with disability, who was denied the same for a long time(Reserve Bank of India v. A.K. Nair And Ors).The challenge in the petition pertained to securing promotion to the post of Assistant Manager in the RBI under Persons with...