Latest News

Codified Law Empowering Agencies To Undertake Surveillance Subject To Constitutional Mandate Needed : Justice MM Sundresh

Supreme Court judge Justice MM Sundresh on Saturday spoke about the need to have codified law regarding surveillance.“There must be a codified law that empowers the agency to undertake acts of surveillance. Such a law must be subject to constitutional mandate. It'll prevent arbitrary action preserving the privacy of individuals", Justice Sundresh said, while delivering a lecture on the...

Manufacturing Defect In Car : Supreme Court Directs Ford India To Pay Rs 42 lakhs To Owner Of Ford Titanium Endeavour

The Supreme Court recently directed Ford India Ltd. to pay Rs. 42 lakhs as compensation to a consumer who purchased a car which had manufacturing defects. The issue related to a Ford Titanium Endeavour 3.4L owned by the consumer.The owner had filed a consumer complaint before the Punjab State Consumer Commission pointing out various defects, including oil leakage from the very beginning...

Supreme Court Stays Delhi HC Judgment Holding That Old Pension Scheme Is Applicable To Paramilitary Forces

The Supreme Court has stayed the Delhi High Court judgment which held that Old Pension scheme would be applicable to Para military forces. However, the bench comprising Justices Sanjiv Khanna and Bela Trivedi clarified that the petitioners shall abide by the Office Memorandum no. 57/05/2021-P&PW(B) dated 03.03.2023 issued by the Department of Pension and Pensioners’ Welfare, Ministry...

Can UAPA Accused Be Taken Into Police Custody After 30 Days Of First Remand? NIA Urges Supreme Court To Reconsider 'Gautam Navlakha' Judgment

The 2021 Gautam Navlakha ruling of the top court required reconsideration to the extent that it dealt with the power of an investigating officer to take a terror accused into police custody from judicial custody, Additional Solicitor General Aishwarya Bhati told the Supreme Court of India on Friday A bench of Justices BR Gavai and JB Pardiwala was hearing an appeal by the central...

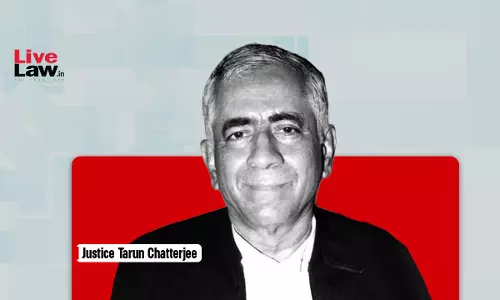

Former Supreme Court Judge Justice Tarun Chatterjee Passes Away

Former Supreme Court Judge, Justice Tarun Chatterjee has passed away.Born to former Calcutta High Court Judge Justice Purshottam Chatterjee in January 1945, Justice Tarun Chatterjee enrolled as an Advocate in 1970 at Calcutta and practiced in the High Court in Civil, Criminal and Revenue cases. He was appointed as a permanent Judge in the Calcutta High Court on August 6, 1990 and as the...

[BAIL] Questions & Answers By Justice V. Ramkumar- Anticipatory Bail [Part-V]

Q.21 Can anticipatory bail be granted to an accused when on similar allegations two other co-accused in the case had been granted similar relief ? Ans. Yes. (Vide para 2 of Kamaljit Singh v. State of Punjab 2003 supp(4) SCR 785 – Doraiswamy Raju, Arijit Pasayat - JJ; Deepak Singchi v. State of Rajashtan – (2007) 14 SCC 583 - Arijit Pasayat, D. K. Jain - JJ). In State v....

Are Customs/DRI Officers 'Police Officers'? Whether CrPC Applicable To Customs Act Proceedings? Supreme Court To Decide

The Supreme Court is set to decide whether Custom Officers are police officers and whether CrPC would be applicable with respect to proceedings under Customs Act?The Bench comprising Justice JB Pardiwala and Justice Manoj Misra was hearing a Special Leave Petition arising from a judgment of the Telangana High Court disallowing the custody of respondents to the Directorate of...

Senthil Balaji Case: Madras High Court Frames Points Of Difference In Split Verdict, To Hear Arguments On July 11

Justice CV Karthikeyan of the Madras High Court on Friday framed the points of difference of opinion in the split verdict delivered by a division bench of the Court on July 4th in the habeas corpus petition filed by Megala, wife of Tamil Nadu Minister Senthil Balaji against his arrest by the Enforcement Directorate on June 14, in a money laundering case under PMLA.Justice Karthikeyan...

Supreme Court Is Protector Of Multi-Cultural Ethos & Diversity Of India And Embodiment Of Its Diverse Civilization: Justice Krishna Murari

Judge of the Supreme Court Justice Krishna Murari speaking at the farewell function organised by the Supreme Court Bar Association (SCBA) on the occasion of his retirement on Friday said that the Supreme Court is not only the protector of the multi cultural ethos and diversity of India but is in itself an embodiment of its multi-cultural and diverse civilization. “This Court consists of...

Law Commission Of India Cautions Public Against Fraudulent Whatsapp Messages On Uniform Civil Code

The Law Commission of India has cautioned the general public against the fraudulent WhatsApp text, messages, and calls being circulated on the platform regarding the Uniform Civil Code. The Commission has clarified that it has no involvement or connection with any texts which are being circulated.In its disclaimer, the Law Commission has stated that there have been certain WhatsApp texts,...

BBC Documentary On PM Modi: Delhi Court Issues Fresh Summons To BBC, Others On BJP Leader’s Defamation Suit

A Delhi Court on Friday issued fresh summons to British Broadcasting Corporation, Wikimedia Foundation and Internet Archive in a defamation suit filed BJP leader Binay Kumar Singh seeking to restrain them from publishing the recent documentary on Prime Minister Narendra Modi or any other material related to RSS and Vishwa Hindu Parishad.Additional District Judge Ruchika Singla of Rohini...

![[BAIL] Questions & Answers By Justice V. Ramkumar- Anticipatory Bail [Part-V] [BAIL] Questions & Answers By Justice V. Ramkumar- Anticipatory Bail [Part-V]](https://www.livelaw.in/h-upload/2023/05/27/500x300_473872-questions-answers-by-justice-v-ramkumar-anticipatory-bail.webp)