Latest News

Supreme Court Weekly Round Up (24th April to 30th April 2023)

With another week gone at the Supreme Court of India, Live Law is back with its Supreme Court Weekly Digest to keep our readers up to date with the latest legal developments in the Apex court of the country.Judgments/OrdersS.17 Registration Act | High Court Cannot Exercise Writ Jurisdiction To Alter Or Amend Registered Lease Deed: Supreme Court[Case Title: Gwalior Development Authority And...

‘Treated Like Criminals’: Adult Sex Workers Not Allowed to Leave Protective Homes in Most States, Amicus Curiae Tells Supreme Court

Adult sex workers are being treated like criminals in most states and not being allowed to leave the protective homes under the Immoral Traffic (Prevention) Act despite the Supreme Court’s directions to the contrary, amicus curiae and senior advocate Jayant Bhushan told the top court on Thursday. The senior counsel said:“Adult women wanting to leave cannot be held against their will...

Rule 5 Of Cenvat Credit Rules, 2004 Cannot Be Invoked To Sanction The Refund Of Unutilized Cenvat Credit Lying With The Assessee: CESTAT

The Delhi Bench of the Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has observed that Rule 5 of the Cenvat Credit Rules, 2004 cannot be invoked to sanction the refund of unutilized cenvat credit lying with the assessee.The bench of Rachna Gupta (Judicial Member) has observed that despite the fact that manufacturing was closed in the financial year 2016–2017 and the appellant...

Customary Amongst Married Women To Keep On Changing The Jewellery As And When New Designs Come In The Market: ITAT Deletes Income Tax Addition

The Delhi Bench of the Income Tax Appellate Tribunal (ITAT) has deleted the addition and held that it is customary amongst married women to keep on changing the jewelleryas and when new designs come on the market.The bench of Anubhav Sharma (Judicial Member) and N. K. Billaiya (Accountant Member) has observed that the assessee has given an item-wise reconciliation of Wealth Tax Return items...

CA, CS And CWAs Covered Under The Ambit Of PMLA If Financial Transactions Executed On Behalf Of Client

The Government has notified that the practicing chartered accountants (CA), Company Secretary (CS) and Cost And Works Accountancy (CWAs) are covered under the Prevention of Money Laundering Act, 2002 (PMLA) if financial transactions are executed on behalf of a client.In accordance with Section 2(1)(sa)(vi) of the PMLA, the Central Government notified a select few activities when they...

Co-Operative Banks Are Also Registered Co-Operative Societies: ITAT Allows Section 80P(2)(d) Deduction

The Ahmedabad Bench of the Income Tax Appellate Tribunal (ITAT) has allowed the income tax deduction under Section 80P(2)(d) of the Income Tax Act on the grounds that cooperative banks are also registered cooperative societies.The bench of Suchitra Kamble (Judicial Member) has observed that the provision of Section 80P(2)(d) does not make any distinction in regard to the source of the...

No Excise Duty Payable On Amortization Cost Of The Cylinder: CESTAT

The Ahmedabad Bench of the Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that no excise duty is payable on the amortization cost of the cylinder.The bench of Ramesh Nair (Judicial Member) and C.L. Mahar (Technical Member) has observed that for the purpose of valuation of the packaging material, the amortization cost of the cylinder needs to be included in a...

‘No Evidence Of Handling Of Arms Or Joining Classes For Radical Teaching On Religious Lines’: Delhi Court Grants Bail To Kashmiri Youth In UAPA Case

A Delhi Court has granted bail to a 22-year-old Kashmiri Youth in a UAPA case, observing that there was no evidence of handling of arms or joining of any classes for radical teaching on religious lines by him. Special NIA judge Shailendar Malik of Patiala House Courts granted bail to Mateen Ahmed Bhatt who was arrested on October 13, 2021.“…I find that accusation against the accused does...

Schools Fees : Supreme Court Stays Allahabad HC Order Directing Schools To Refund/Adjust 15% Fees Paid During COVID-19

The Supreme Court on today stayed an order of the Allahabad High Court which had directed the schools in Uttar Pradesh to refund or adjust 15% of excess fees charged during the 2020-21 academic session, amid the COVID-19 period. The schools were forced to remain shut during the pandemic. A Bench of Justices Sanjiv Khanna and MM Sundresh passed the order today in a plea moved by...

Inspection Charges Received In Connection With The Sale Of Goods Are Not Includible In Assessable Value: CESTAT

The Kolkata Bench of the Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that inspection charges received in connection with the sale of the goods are not includible in the assessable value in the absence of evidence.The bench of P.K. Chaudhary (Judicial Member) and K. Anpazhakan (Technical Member) observed that pre-delivery inspection charges are included in the...

Plea Against Artificial Insemination Of Indigenous Cows Using Exotic Breeds : Supreme Court Allows Petitioners To Make Representation To Centre

In a PIL seeking directions to Centre and States to take steps for the artificial insemination of non-descript indigenous Cows using the semen from pure/descript Indigenous Breeds as opposed to 'Exotic' Foreign Breeds, the Supreme Court remarked that an appropriate remedy may be approaching the competent government departments. Accordingly, a bench comprising CJI DY Chandrachud, Justice...

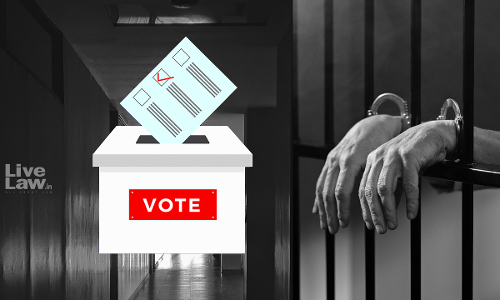

Supreme Court Rejects Challenge To Section 62(5) RP Act Which Denies Prisoners Right To Vote

The Supreme Court on Thursday refused to entertain a PIL challenging Section 62(5) of the Representation of the People Act, 1951 and seeking for right to vote for prisoners. The court noted that Section 62(5) had already been upheld by the Supreme Court on two separate occasions. In view of the same, the bench comprising CJI DY Chandrachud, Justice PS Narasimha, and Justice JB Pardiwala...