News Updates

CBIC Clarification On Time Of Supply Of Spectrum Usage Services Under GST

The Central Board of Indirect Taxes and Customs (CBIC) has issued the clarification on time of supply of services of spectrum usage and other similar services under GST.The Board has received the representations from the trade and the field formations seeking clarification regarding the time of supply for payment of GST in respect of supply of spectrum allocation services in cases where...

CBIC Clarifies GST Council Recommendation On Special Procedure For Manufacturers

The Central Board of Indirect Taxes and Customs (CBIC) has issued clarification on various issues pertaining to special procedure for the manufacturers of the specified commodities as per Notification No. 04/2024 - Central Tax dated 05.01.2024.Based on the recommendation of 50th GST Council meeting, a special procedure was notified vide Notification No. 30/2023-Central Tax dated 31.07.2023 to...

Different Billing And Delivery Address By E-Commerce Portals, CBIC Clarification On Place Of Supply

The Central Board of Indirect Taxes and Customs (CBIC) has issued the clarification on the provisions of clause (ca) of Section 10(1) of the Integrated Goods and Service Tax Act, 2017 relating to the place of supply of goods to unregistered persons.Clause (ca) has been inserted in Section 10(1) of the Integrated Goods and Services Tax Act, 2017 with effect from 01.10.2023. The provision has...

Time Limit For RCM Supplies From Unregistered Persons For ITC To Be Calculated From Issuance Of Invoice, Clarifies CBIC

The Central Board of Indirect Taxes and Customs (CBIC) has issued the clarification on time limit under Section 16(4) of CGST Act, 2017 in respect of RCM supplies received from unregistered persons.The Board has received the representations from trade and industry seeking clarity on the applicability of time limit specified under section 16(4) of Central Goods & Services Tax Act, 2017 for...

Certificates By CA/CMA To Be Treated As Suitable & Admissible Evidence For Section 15(3)(B)(ii): CBIC

The Central Board of Indirect Taxes and Customs (CBIC) has prescribed the mechanism for providing evidence of compliance of conditions of Section 15(3)(b)(ii) of the CGST Act, 2017 by the suppliers.In cases where the discounts are offered by the suppliers through tax credit notes, after the supply has been effected, the said discount is not to be included in the taxable value only if...

Reduction In Govt. Litigation: CBIC Fixes Monetary Limits For Filing Appeals/Applications Before GSTAT, High Courts And Supreme Court

The Central Board of Indirect Taxes and Customs (CBIC) with the objective of reduction in government litigation fixed the monetary limits for filing appeals or applications by the Department before the Goods and Service Tax Appellate Tribunal (GSTAT), High Courts and Supreme Court.The Board referred to the National Litigation Policy which was conceived with the aim of optimising the...

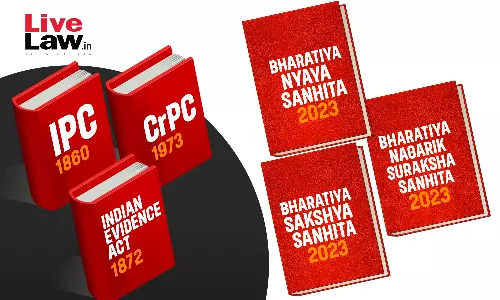

'Anti-People, Undemocratic & Draconian': West Bengal Bar Council Declares 'Black Day' Protest On 1st July Against Implementation Of New Criminal Laws

The Bar Council of West Bengal has declared a 'Black Day' protest on 1st July, against the implementation of the three new Criminal laws by the centre, which would replace the Indian Penal Code, Evidence Act, and Criminal Procedure Code. As per resolution of the Council meeting dated 25.06.2024...the Members of the Council express their unanimous views regarding 1) Bharatiya Nyaya Sanhita,...

Defamation Case Over Remarks On Amit Shah | UP Court Orders Personal Appearance Of Rahul Gandhi On July 2

An MP/MLA Court in Uttar Pradesh's Sultanpur district today directed Congress leader Rahul Gandhi to appear before it on July 2 in connection with a defamation case lodged against him for allegedly making a 'defamatory' statement against present Union Home Minister Amit Shah in 2018.MP/MLA Court Judge Shubham Verma directed Gandhi to appear before it to record his statement in the case.The...

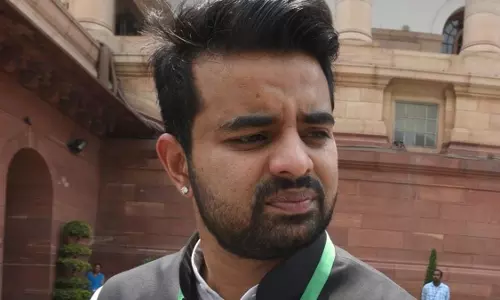

Bengaluru Court Rejects Suspended JD(S) Leader Prajwal Revanna's Bail Plea In Rape Case

A Special Court on Wednesday rejected the bail application filed by rape accused and suspended Janta Dal (S) leader, Prajwal Revanna in connection with the first case registered against him at Holenarasipura police station. The SIT is investigating three cases registered against Prajwal and he is presently in police custody in one of the cases till June 29. Recently another case came to...

District Admin Srinagar Puts J&K High Court Bar Association's Kashmir Elections On Hold Due To Security Concerns

The District Magistrate Srinagar has imposed restrictions under Section 144 of the Criminal Procedure Code (CrPC) on the holding of elections to the J&K High Court Bar Association (JKHCBA) Srinagar and warned of punitive action in case of gathering of four or more people at District Court Complex, Mominabad, Batamaloo, or any other location for the purpose of the HCBA elections until...

Ex-Kashmir High Court Bar Association President Mian Qayoom Arrested In Advocate Babar Qadri's Murder Case

The Jammu and Kashmir State Investigation Agency (SIA) has detained Mian Abdul Qayoom, a prominent lawyer and former president of the Jammu and Kashmir High Court Bar Association (HCBA), for his alleged involvement in the 2020 murder of advocate Babar Qadri.Qayoom had been summoned by the SIA today only to be arrested later in the day today. Advocate Qadri, a lawyer and TV panellist, was...

Bengaluru Court Grants Bail To TN Minister Udhayanidhi Stalin In Case Registered Over His Remarks Against Sanatan Dharma

A city court in Bengaluru on Tuesday granted bail to Tamil Nadu Minister Udhayanidhi Stalin in a case registered against him after his controversial remarks about Sanatana Dharma.Udhayanidhi had made the statements in a seminar organised in Chennai for the eradication of Sanatana Dharma. The Minister had said that Sanatana Dharma was like HIV, AIDS, and Malaria, and rather than opposing it,...