News Updates

Qutub Minar Row: Delhi Court Defers Judgment On Appeals For Temple Restoration, To Hear Fresh Impleadment Application First

A Delhi Court on Thursday deferred judgment in the appeals preferred against a Civil Judge order dismissing the suit which alleged that the Quwwat-Ul-Islam Masjid situated within Qutub Minar Complex was built in place of a temple complex and sought restoration of the same.Additional District Judge Nikhil Chopra had reserved the order on last month. As the Judge was transferred to Rouse...

Court Can Allow Prosecution To Produce Certificate U/S 65-B (4) Evidence Act At A Later Stage During Trial: Allahabad High Court

The Allahabad High Court has observed that the trial court has the power to allow the prosecution to produce the certificates under Section 65-B (4) of the Indian Evidence Act at a later point of time during the trial.The Bench of Justice Dinesh Kumar Singh observed thus as it upheld the order of the trial court allowing an application filed by the prosecution under section 311 CrPC to bring...

Swapna Suresh Moves Kerala High Court For Pre-Arrest Bail In Conspiracy Case, Raises Grave Allegations Against Chief Minister

Swapna Suresh, the prime accused in the infamous gold smuggling case, has moved the Kerala High Court on Thursday seeking anticipatory bail in a case registered against her for allegedly spreading false information against MLA K.T Jaleel, Chief Minister Pinarayi Vijayan and the Government. Although not an accused in the case, Sarith P.S has also moved for pre-arrest bail apprehending arrest....

Gujarat High Court Quashes Non-Speaking And Vague GST Cancellation Order

The Gujarat High Court bench of Justice J.B. Pardiwala as he then was and Justice Nisha M. Thakore has quashed the GST cancellation order as it was non-speaking and vague. The writ applicant/assessee is registered under the Gujarat Goods and Service Tax Act, 2017. A show cause notice was issued by the State Tax Officer on Form GST REG-17/31 under Section 29 of the CGST Act, 2017...

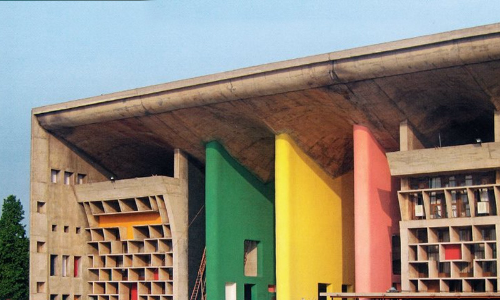

No Reason To Believe That Input Tax Credit Is Fraudulently Availed: Punjab & Haryana High Court

The Punjab and Haryana High Court bench of Justices Tejinder Singh Dhindsa and Pankaj Jain has held that there should be reason to believe that the input tax credit available in the Electronic Credit Ledger was obtained fraudulently or that the assesses are ineligible. The relevant officer must record the reasons, and a speaking order must be issued. The petitioner/assessee is a...

Ansal Properties Pays The Dues Lately, NCLT Delhi Dismisses Insolvency Petition Imposing A Cost Of Rs. 1 Lakh On Ansal

The National Company Law Tribunal ("NCLT"), New Delhi Bench, comprising of Shri. Abni Ranjan Kumar Sinha (Judicial Member) and Shri. L. N. Gupta (Technical Member), in M/s. Dalmia Family Office Trust v M/s. Ansal Properties and Infrastructure Ltd., has dismissed the application filed under Section 7 of the Insolvency and Bankruptcy Code, 2016 ("IBC"), seeking initiation of the...

Municipal Authority Can Rely On Previous Blacklisting Resolution Which Is Set Aside By Court, Must Justify It In Final Order: Gujarat High Court

The Gujarat High Court has permitted the Vadodara Municipal Corporation to rely on a previous blacklisting order passed by it against a Road Contractor, which was set aside by the High Court for being non-compliant with principles of natural justice, while issuing a fresh notice to the contractor in relation to three work orders.However, the Bench comprising Chief Justice Justice Aravind...

Satyendar Jain Money Laundering Case: Delhi Court Extends AAP Minister's ED Custody Till June 13

A Delhi Court on Thursday extended the Enforcement Directorate's custody of Aam Aadmi Party Minister Satyendar Jain till June 13, in connection with a money laundering case.The Minister was produced before Special CBI Judge Geetanjali Goel today on expiry of his 9 days custody in the matter. Jain was arrested last month by the agency. The Enforcement Directorate had then sought 14 days custody...

"Private Interest Litigation": Madras High Court Dismisses Petition Seeking Enquiry Into Water Users Association Elections

The Madras High Court on Wednesday dismissed a petition filed one Sukumar for forming an Investigation Team under the head of a retired High Court Judge for inquiring into the alleged irregularities committed by the Election officer cum Revenue Divisional officer while conducting the elections to the Water User Association.While dismissing the petition, the bench of Chief Justice Munishwar...

Trial Court Cannot Qualify Life Imprisonment Awarded By It To Remainder Of Natural Life: Delhi High Court Reiterates

The Delhi High Court has reiterated the position of law laid by the Apex Court that a Trial Court cannot qualify the imprisonment of life awarded by it to remainder of natural life. A division bench comprising of Justice Mukta Gupta and Justice Mini Pushkarna observed thus while awarding life sentence (for remainder of life) to three men for gang rape and murder of a three year old minor...

Delayed Audit Report Due To the Delay By Statutory Auditors: ITAT Deletes Penalty

The Cuttack Bench of the Income Tax Appellate Tribunal (ITAT) has deleted the penalty where the assessee has sufficient and reasonable cause for delay in obtaining the audit report. The two-member bench of George Mathan (Judicial Member) and Arun Khodpia (Accountant Member) has observed that the delay in submitting the audit report was on account of a delay in obtaining the audit...

GST Payable On Receipt Of Gratuitous Payment From Outgoing Member: AAR

The Maharashtra Authority of Advance Ruling (AAR) consisting of T.R. Ramnani and Rajiv Magoo has ruled that GST is payable on receipt of gratuitous payment from outgoing members. The applicant is a co-operative housing society registered under the Maharashtra Co-operative Housing Society Act (MCHS Act) having 48 flats which charges its members maintenance charges as per flat...