News Updates

Gujarat High Court Directs Assistant Commissioner Of CGST To Finalise Assessment Proceedings Within 2 Months On Account Of Severe Delay

The Gujarat High Court has recently issued a writ directing the Assistant Commissioner of CGST and Central Excise to initiate and complete the final assessment proceedings concerning the Applicant company and further release the Bank Guarantees in favour of the Applicant within two months. The Applicant company had also showed monetary losses worth INR 96,87,616 due to the...

Smoking In Public Places Is Prohibited: Karnataka High Court Directs Restaurant To Earmark Hookah Smoking Area, Obtain License

The Karnataka High Court has directed a restaurant, Soho Pub & Grill, to earmark separate area in its premises, after obtaining a licence, for allowing its patrons to smoke hookah. "Smoking of hookah should not cause inconvenience to other customers since smoking has been prohibited in public places, an exclusive area with separate enclosure is required to be reserved for hookah...

S.313 CrPC | Trial Court Should Avoid Posing Long & Arduous Queries To Accused: Gauhati High Court

The Gauhati High Court observed that under Section 313 CrPC, the trial court should avoid posing long and arduous queries to the accused and instead bring to his notice, in a concise form, only the incriminating evidence available on record against him. A Division Bench of Justices Suman Shyam and Malasari Nandi remarked that section 313 CrPC is to afford a fair opportunity to the accused...

'Perverse Order': Calcutta HC Sets Aside WB Speaker's Order Dismissing Suvendu Adhikari's Plea To Disqualify Mukul Roy, Remits Plea Back To Speaker

The Calcutta High Court on Monday set aside West Bengal Assembly Speaker Biman Banerjee's order dismissing a petition by Leader of Opposition Suvendu Adhikari which sought disqualification of TMC lawmaker Mukul Roy as a member of the House on the ground of defection and restored the matter for fresh consideration.On July 9, Mukul Roy had been appointed as the Chairman of Public Accounts...

Petition Under Section 9 Of The A&C Act Is Not Maintainable Against The Order By Arbitral Tribunal On Arbitration Fees: Delhi High Court

The Delhi High Court has ruled that a petition under Section 9 of the Arbitration and Conciliation Act, 1996 (A&C Act) for interim measures of protection, is not maintainable before the Court against the procedural orders passed by the Arbitral Tribunal. The Bench, consisting of Justices Mukta Gupta and Neena Bansal Krishna, held that the procedural orders passed by...

Additions By AO On The Basis Of Suo-Moto Disclosure Before The Settlement Commission, Not Permissible If The Settlement Was Aborted: ITAT Mumbai

The Mumbai Bench of ITAT, consisting of members Kuldip Singh (Judicial Member) and Prashant Maharishi (Accountant Member), has ruled that the Assessing Officer cannot make any addition to assessee's income on the basis of the suo-moto disclosure made by the assessee before the Income Tax Settlement Commission, if the settlement got aborted due to non-fulfilment of conditions by the...

Gujarat High Court Condemns Coercive Steps Taken By Dept. For Recovery Of Dues From Wipro While Appeal Was Pending

The Gujarat High Court bench of Justice J.B. Pardiwala and Justice Nisha M. Thakore has condemned the coercive steps of the department for recovery of dues from Wipro when the appeal was pending before the first appellate authority as well as the Tribunal.The writ petitioner, Wipro Ltd. is in the business of information technology services, including the sale of hardware and...

Grant Of Leave For Dispensation Of Mandated Pre-Institution Mediation U/S 12-A Of Commercial Courts Act Is A Judicial Act: Calcutta HC

The Calcutta High Court has recently held that the grant of leave for dispensation of the mandatory requirement of pre-institution mediation as prescribed under section 12-A of the Commercial Courts Act, 2015 would constitute a judicial act.Section 12-A of the Commercial Courts Act provides that a suit which does not contemplate any urgent interim relief, shall not be instituted unless...

Show Cause Notice Completely Deficient In Material Particulars: Delhi High Court Quashes GST Registration Cancellation Order

The Delhi High Court bench of Justice Rajiv Shakdher and Justice Poonam Bamba has quashed the order cancelling the GST registration as the Show Cause Notice was completely deficient in material particulars.The petitioner/assessee has challenged the order passed by the Appellate Authority (Delhi GST) on the grounds that the show cause notice gave no details as to the date and time on...

Party May Not Press Relief But Can't Prevent Family Court From Finding The Truth: Kerala High Court

The Kerala High Court recently held that the master of the proceedings before the Family Court is the presiding officer of the Family Court and not the parties while reiterating that the Family Court is competent to undertake any enquiry to find the truth.A Division Bench of Justice A. Muhamed Mustaque and Justice Sophy Thomas observed that a party may be able to not press the relief sought,...

GST Payable On Composite Supply Of Work Contract Involving Earth Work: Maharashtra AAR

The Maharashtra Authority of Advance Ruling (AAR), consisting of members Ranji Magoo and T.R. Ramnani, has ruled that GST is payable on the composite supply of work contracts involving earth work.The applicant, M/s. Mahalxmi BT Patil Honai Constructions JV, a GST registered company, is in the business of construction of infrastructure projects, was formed to undertake the construction...

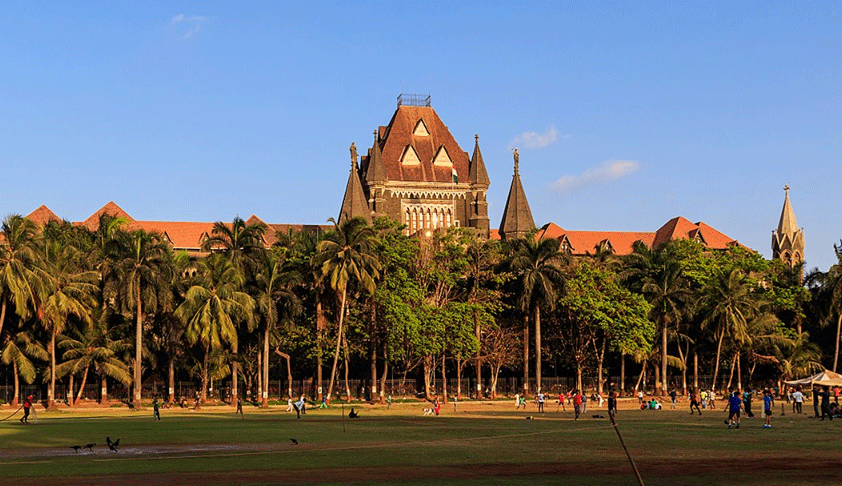

Appeal Against CESTAT Order, On Classification Of Goods, And Determination Of Customs Duty Lies Before The Supreme Court: Bombay High Court

The Bombay High Court has ruled than an appeal from an order passed by the Customs, Excise & Service Tax Appellate Tribunal (CESTAT), involving the question with respect to classification of goods under the Customs Act, 1962, would lie before the Supreme Court under Section 130E of the Customs Act, since it is primarily related to determination of the rate of customs...