News Updates

Medical Negligence, NCDRC’s Revisional Power Is Limited To Illegality, Material Irregularity Or Jurisdictional Error

The National Consumer Dispute Redressal Commission (NCDRC) bench comprising presiding members Dr. S.M. Kantikar and Mr. Binoy Kumar upheld the State Commission’s award in favour of the patient who died due to medical negligence by the doctors while performing an operation to remove the gall bladder stone. While the petitioners argued over different facts, the court held that it was...

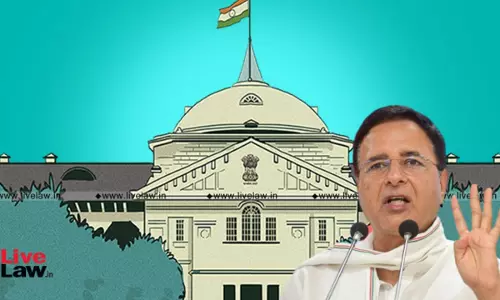

Right To File Discharge Plea In Trial Court Available: Allahabad HC Refuses To Quash 23 Yr Old Case Against Congress MP Randeep Surjewala

The Allahabad High Court on Monday refused to quash a 23-year-old criminal case pending before the Varanasi Court against Congress' Rajyasabha MP Randeep Singh Surjewala as it noted that he has a remedy to move a discharge plea before the Trial Court.The bench of Justice Rajiv Gupta also directed that in case the Congress MP files a discharge plea before the local court within a period of...

NCLT Admedabad Orders Closure Of Liquidation Of M/s Mehta & Associates Fire Protection Systems Pvt. Ltd.

NCLT Admedabad bench comprising of Dr. Madan B. Gosavi (Judicial Member) and Shri Ajai Das Mehrotra (Technical Member) has ordered for closure of liquidation of M/s Mehta & Associates Fire Protection Systems Pvt. Ltd. (‘Corporate Debtor’) under Regulation 44(1), 45(1), and 45(3)(a) of the IBBI (Liquidation Process) Regulations, 2016 (‘Liquidation...

Karnataka High Court Orders Forest Authorities To Respond To PIL Over Wildlife Killed By Overspeeding Trains

The Karnataka High Court has asked the Forest authorities to file their replies to a PIL seeking to reduce speed limit of trains passing through dense forest during the night time on the Hospet-Vasco and Londa-Miraj railway line, to avoid wildlife being hit by speeding trains. A division bench of Chief Justice Prasanna B Varale and Justice Ashok S Kinagi directed the Deputy Conservator of...

"Triple Test" To Pass Preventive Detention Order Against Person Already In Judicial Custody? Andhra Pradesh High Court Reiterates

The Andhra Pradesh High Court has set aside the preventive detention order against an alleged sandalwood smuggler lodged in judicial custody, stating that the satisfaction of detaining authority, necessary as per the triple test, was not recorded in the detention order.The Division bench of Justice D.V.S.S.Somayajulu and Justice V. Srinivas reiterated that an order of preventive detention...

NCLT Ahmedabad Order Liquidation Of Tradeohub B2B Limited Under Section 33 Of IBC

NCLT Ahmedabad bench comprising of Dr. Madan B Gosavi (Judicial Member) and Shri Kaushalendra Kumar Singh (Technical Member) has ordered the liquidation of Tradeohub B2B Limited (‘Corporate Debtor’) under Section 33(1) of Insolvency and Bankruptcy Code, 2016 (‘IBC’). The Corporate Debtor was admitted into Corporate Insolvency Resolution Process (‘CIRP’) on 16.11.2021. and...

Corporal Punishment In Prisons Unconstitutional, 'State Sponsored Terrorism': PIL In Delhi High Court

A public interest litigation has been moved before Delhi High Court challenging various provisions of the Prisons Act, 1894, that relate to corporal punishment of inmates for acts of indiscipline. The plea argues the provisions are ultra vires of Articles 14, 19(1)(a), 20(2) and 21 of the Constitution of India.A division bench of Chief Justice Satish Chandra Sharma and Justice Subramonium...

'Not In Good Taste, Apex Court Seized Of Matter': Karnataka High Court Refuses To Hear Plea For Postponing 5th, 8th Standard State Board Exams

The Karnataka High Court on Tuesday refused to hear a matter seeking postponement of Board exams for 5 and 8th standard students of the State board, which is scheduled to be held on March 27. Advocate A Velan mentioned the matter before a bench led by Chief Justice Prasanna B Varale seeking urgent hearing. It was submitted that the Apex court is seized of the matter challenging the interim...

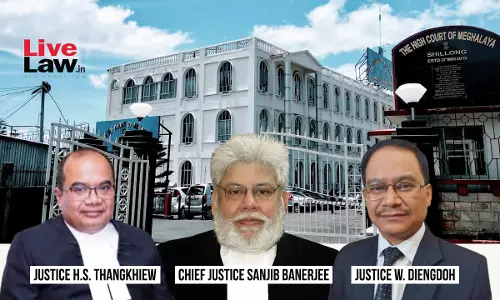

Meghalaya High Court Asks CISF To Indicate Its Readiness On Deployment For Curbing Illegal Coal Mining

The Meghalaya High Court on Monday asked the Central Industrial Security Force (CISF) to indicate within fortnight as to how its deployment can be ensured within four weeks in order to check illegal transportation of coal in the State.A Full bench comprising Chief Justice Sanjib Banerjee and Justices H. S. Thangkhiew, W Diengdoh was hearing a suo motu PIL to curb the menace of Illegal...

High Court Seeks Delhi Govt’s Response On PIL Seeking Release Of Ex-Gratia Compensation To Families Of Cops Who Died On COVID-19 Duty

The Delhi High Court on Tuesday sought Delhi government’s response on a public interest litigation seeking release of the ex-gratia compensation of Rs. 1 crore to families of police officers who died on duty during COVID-19 pandemic.A division bench of Chief Justice Satish Chandra Sharma and Justice Subramonium Prasad issued notice on the plea moved by two advocates and a law student and...

Can You Feed Stray Dogs In Housing Society? Centre Notifies Rules

Observing that the Animal Birth Control Rules, 2023 formulated by the Central Government notified on March 10, 2023 answers the question of feeding strays or community dogs inside a housing society “optimally”, the Bombay High Court disposed of a petition involving warring management of Seawoods Estate Limited and dog lovers from the society.Clause 20 of the Rules published by the...

Plea In Kerala High Court Challenges Delay By Lok Ayukta In Passing Verdict On Matter Reserved For Orders One Year Ago

A plea has been filed in the Kerala High Court challenging the "unexplained" delay by the Lok Ayukta in passing verdict in a matter which was heard and reserved for orders on March 18, 2022. The petitioner, R.S. Sasikumar, had approached the Lok Ayukta under Section 9(1) of the Kerala Lok Ayukta Act, challenging the Cabinet decision taken on July 27, 2017, to give financial aid to the families...