News Updates

Delhi High Court Stays Trial Against BJP Leaders Hans Raj Hans, Manjinder Singh Sirsa In Defamation Case By Manish Sisodia

The Delhi High Court on Thursday stayed the trial court proceedings against Bhartiya Janata Party leaders Hans Raj Hans and Manjinder Singh Sirsa in a defamation case filed by deputy Chief Minister Manish Sisodia.Justice Dinesh Kumar Sharma also issued notice on the pleas moved by the two BJP leaders challenging the trial court order dated November 28, 2019 summoning them in the matter....

Court Cannot Send Notice To Governor: Madras High Court Rejects Plea Against Tamil Nadu Governor Over ‘Office Of Profit’ Claim

The Madras High Court on Thursday rejected a plea by Thanthai Periyar Dravidar Kazhagam challenging Governor RN Ravi's authority to continue to hold office.Holding the petition to be non-maintainable, the bench of Acting Chief Justice T Raja and Justice D Bharatha Chakravarthy observed that the court cannot issue notice to the Governor as he enjoys immunity under Article 136 of...

Bar Under Section 108 (2) M.P. Panchayat Raj Adhiniyam Will Not Apply Against Suit For Recovery Of Amount Legally Due From Local Body: High Court

The High Court of Madhya Pradesh, Indore Bench recently held that a suit for recovery would not be barred under Section 108 (2) of the Madhya Pradesh Panchayat Raj Adhiniyam, 1993 if the sum was legally due on the part of the local body. Section 108(2) of the Adhiniyam bars institution of suit against a rural local body or its official after six months from the date of the accrual of...

Prima Facie No Representation To Customer That Paneer Is Pure: MP High Court Grants Anticipatory Bail To Vendor Accused Of Selling "Unfit" Paneer

The Madhya Pradesh High Court, Gwalior Bench recently granted anticipatory bail to a vendor who was alleged to have been selling paneer that was unfit for human consumption. The bench comprising Justice Atul Sreedharan observed that there was nothing on record to suggest that the customers purchased the paneer under the pretext that the it was pure but later found it to...

'Pita Dharma, Pita Swarga': Gujarat High Court Reminds Sanskrit Shloka To Father Accused Of Molesting 12-Yr Old Daughter, Denies Bail

The Gujarat High Court has denied bail to a man accused of physically molesting his 12 year-old daughter on several occasions. The accused-father allegedly wanted to marry the victim-daughter and had even threatened to kill the entire family, should the mother of the victim reveal the incidents of molestation to anyone. A single bench of Justice Samir J. Dave, while denying bail...

‘Unfortunate That Delhi Police Yet To Probe Complaint Even After 3 Yrs’: Court Asks DCP To Ensure Speedy Probe Into 2020 Delhi Riots Complaints

Questioning Delhi Police for failing to probe a complaint relating to a 2020 North-East Delhi riots case even after almost three years of the alleged incident, a Delhi Court has asked the DCP to ensure that all complaints received in respect of the riots are investigated and concluded at the earliest.Additional Sessions Judge Pulastya Pramachala “reminded” the police that it is their duty...

Forces Not Bastion Of Only Males: Karnataka High Court Suggests Gender Neutral Nomenclature For Term 'Ex-Servicemen'

The Karnataka High Court has called for changes in the nomenclature employed to refer to retired army, navy and air force personnel; suggesting the Union and the State Government to use the term ‘ex-service personnel’ in place of the term ‘ex-servicemen’ in its policy making endeavours. A single bench of Justice M. Nagaprasanna of the High Court said that: “There...

Chandigarh Consumer Commission Orders 24Seven Store To Pay ₹25k For Charging Extra Money For Carry Bags

The District Consumer Disputes Redressal Commission-II, Chandigarh has ordered a store of grocery chain ‘24Seven’ to pay ₹25,000 for billing ₹10 and ₹20 from a consumer towards the expenses for carry bags upon purchase of grocery items. The Commission further ordered the store to pay ₹100 to the complainant as compensation for causing harassment and mental agony and ₹1100...

May Be Treated As Child By Owners But Dogs Aren’t Human Beings: Bombay High Court Quashes Rash Driving Case Against Swiggy Delivery Partner

The owners may treat dogs as their children but dogs aren’t human beings and hence a person cannot be booked under Sections 279 and 337 of the IPC pertaining to endangering a human’s life for a dog’s death, the Bombay High Court has held.A bench of Justices Revati Mohite Dere and Prithviraj Chavan quashed an FIR against a Swiggy food delivery partner who met with an accident with a...

Punjab & Haryana High Court Orders ₹50 Lakh Compensation To Gurugram Teacher Couple Illegally Terminated By Private School

The Punjab and Haryana High Court has recently ordered G.D. Goenka School, Gurugram to pay ₹50 Lakh as compensation to a teacher couple, who were illegally terminated by the school in violation of the rules and without following proper procedure for disciplinary action. The dispute arose when in 2015, a notice was issued to the couple, Parveen Shekhawat and Ajay Singh Shekhawat,...

Justice Indira Banerjee To Join NUJS Kolkata As Visiting Professor; To Teach Constitutional, Family Laws

Former Supreme Court judge Justice Indira Banerjee has accepted the invitation to join West Bengal National University of Juridical Sciences (NUJS) as a distinguished visiting professor.In a LinkedIn post, NUJS has said: “We are extremely happy to share that Hon'ble Justice Indira Banerjee, Former Judge, Supreme Court of India has graciously accepted our invitation to join the University...

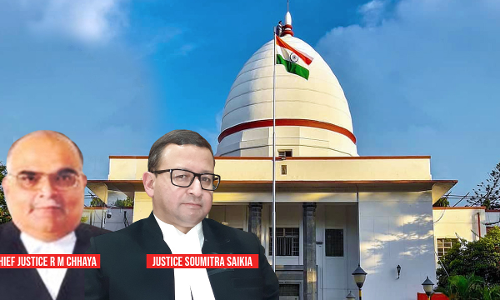

Compensate People Affected By Police’s Illegal 'Bulldozer Action': Gauhati High Court To Assam Govt

Weeks after Gauhati High Court slammed Assam Police for demolishing houses of some accused persons with bulldozers, the State has told the court that a Committee headed by the Chief Secretary is enquiring into the incident and appropriate action will be taken against the erring officers within a period of 15 days.While closing the suo motu proceedings that had been initiated by the court in...