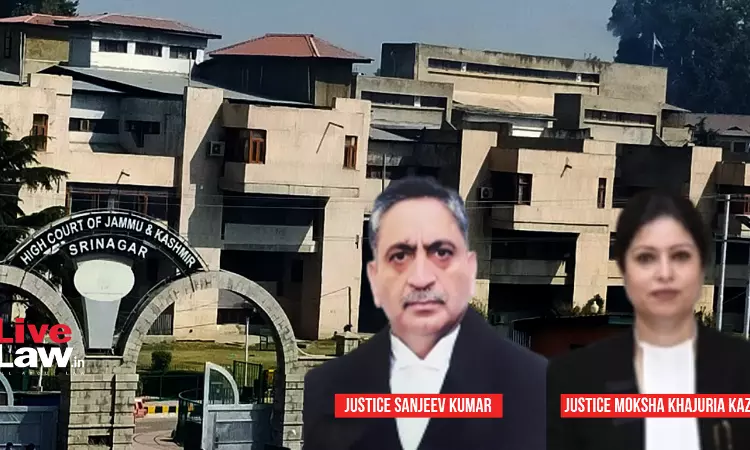

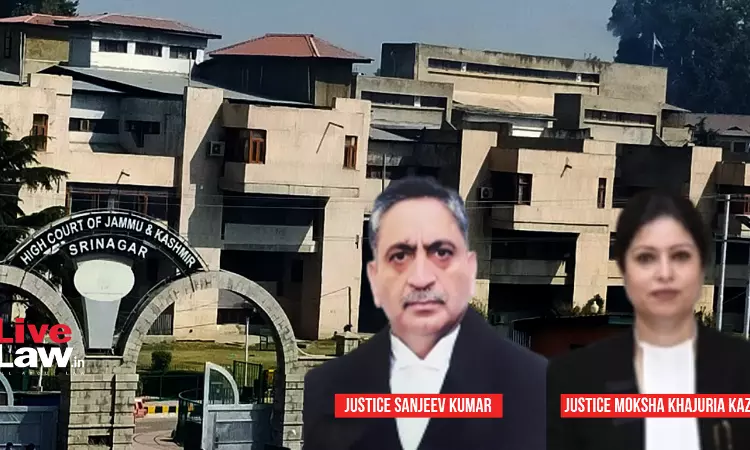

The Jammu and Kashmir and Ladakh High Court on Friday clarified that 'cause of action' in an insurance case can also accrue on the date the claim lodged by the insured is repudiated by the insurance company.The court said the Supreme Court in Kendimalla Raghavaiah & Co. V.s Nationa Insurance Co. and ors has held that with reference to a fire insurance policy, the date of accrual of cause...