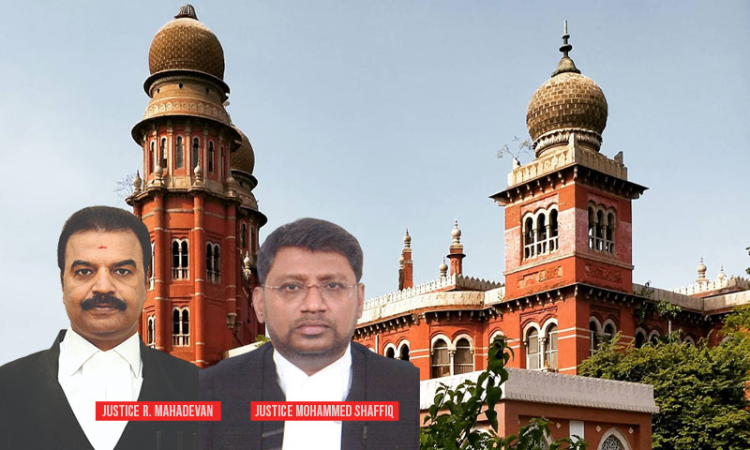

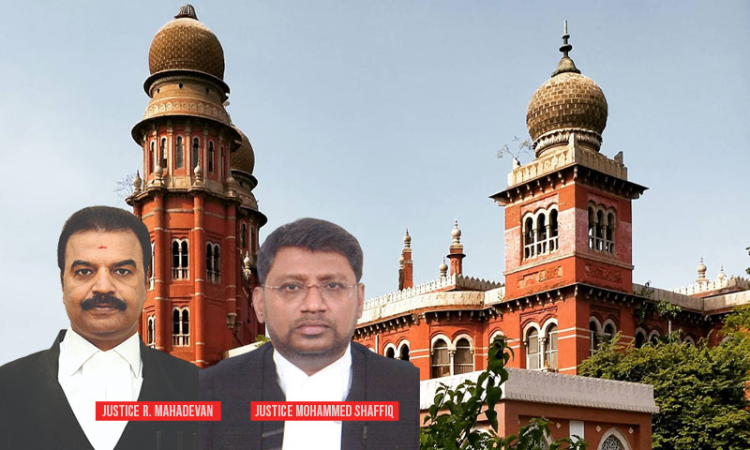

The Madras High Court on Monday deprecated the practice of receiving capitation fee in exchange of admissions. The bench of Justice R Mahadevan and Justice Mohammed Shaffiq held that such practice of receiving capitation fee is against the Tamil Nadu Educational Institutions (Prohibition of Collection of Capitation Fee) Act, 1992. It is therefore beyond the pale of any doubt that education...