NCLAT Upholds Eligibility Of NTPC As A Resolution Applicant For Jhabua Power Ltd. : NCLAT Delhi

Pallavi Mishra

6 July 2022 3:48 PM IST

Next Story

6 July 2022 3:48 PM IST

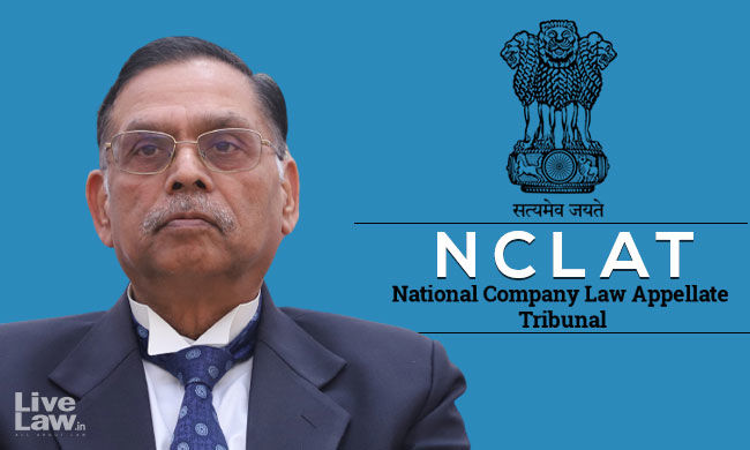

The National Company Law Appellate Tribunal ("NCLAT") Principal Bench comprising of Justice Ashok Bhushan (Chairperson), Ms. Shreesha Merla (Technical Member) and Mr. Naresh Salecha (Technical Member), while adjudicating an appeal filed in Avantha Holdings Limited v Mr. Abhilash Lal, has upheld the eligibility of NTPC Ltd. under Section 29A of the IBC to submit Resolution Plan for...