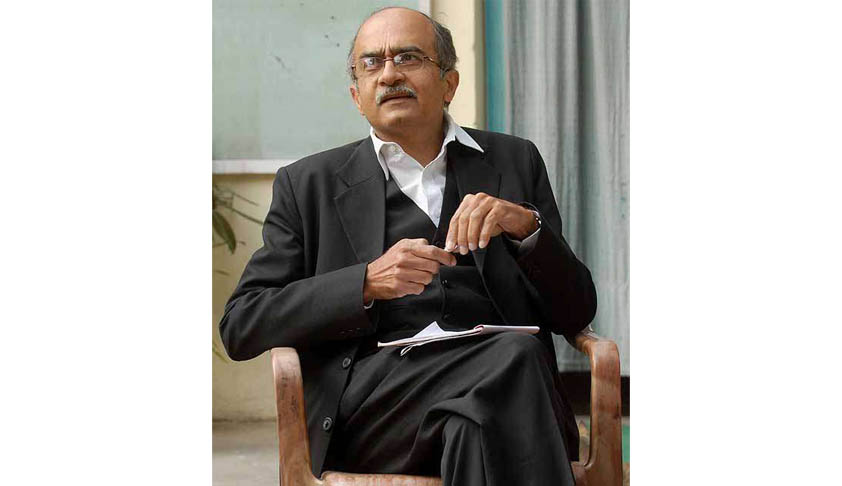

Prashant Bhushan submits suggestions to SIT on black money; suggests disclosure of names and mandatory prosecution

Apoorva Mandhani

23 Jan 2015 9:36 PM IST

Next Story

23 Jan 2015 9:36 PM IST

In a letter addressed to the SIT on black money, advocate and activist, Prashant Bhushan has submitted certain suggestions pursuant to the Supreme Court order dated 20.01.2015, wherein, the Court had permitted all the parties and intervenors to put their suggestions before the SIT within a period of 2 weeks. Read the LiveLaw story here.He suggests curbing anonymous investments. According to...