Bombay High Court

'Post Doesn't Mention PM Modi, Police Attributing Meanings To It & Criminalising Political Speech': Sangram Patil Tells Bombay High Court

In a development in the criminal proceedings initiated against YouTuber Dr Sangram Patil for allegedly posting 'obscene and defamatory' posts against Prime Minister Narendra Modi, the UK-based doctor has 'categorically' told the Bombay High Court that he has not made any post against the PM and that the Mumbai Police is only trying to 'criminalise' political speech.For context, Patil has...

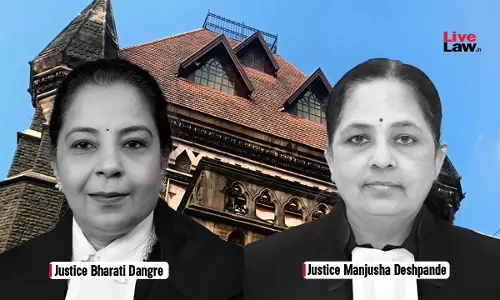

'Trees Are A Poem Which Earth Writes Upon Sky': Bombay HC Says Officers Can Be Prosecuted For Illegal Tree Felling Under Maharashtra Trees Act

Emphasising the need to 'strictly' follow the laws protecting trees and observing that 'trees are a poem which the earth writes upon the sky', the Bombay High Court recently held that even an officer, who fails to adhere to the due procedure for permitting felling or cutting of trees, is liable to be prosecuted under the Maharashtra (Urban Areas) Protection and Preservation of Tress Act, 1975.A division bench of Justice Bharati Dangre and Justice Manjusha Deshpande while noting that the Pune...

'Mere Phone Call With Accused Does Not Connect Person To Crime': Bombay High Court Grants Bail To Co-Accused In Baba Siddiqui Murder Case

The Bombay High Court has held that mere telephonic contact with a co-accused, without any material indicating knowledge of or participation in the organised crime syndicate or the crime itself, is insufficient to prima facie connect an accused to the offence. The Court observed that at the stage of considering bail under the stringent provisions of the Maharashtra Control of Organised Crime Act, 1999 (MCOCA), a bare allegation of having made calls, unaccompanied by evidence of conspiracy,...

Unmarried Women Entitled To Abortion Upto 24 Weeks, Ensure No One Has To Approach Court: Bombay High Court Orders Wide Circulation Of SC Order

The Bombay High Court recently ordered the Maharashtra Government to give wide publicity to the landmark judgment of the Supreme Court in X vs Principal Secretary, Health and Family Welfare Department, Government of NCT of Delhi to ensure that no woman, particularly an unmarried woman, is forced to continue with an 'unwanted' pregnancy.Notably, in the judgment quoted above, delivered by the Supreme Court on September 29, 2022, the apex court had held unmarried women are also entitled to...

[s. 323 CrPC] Magistrate Cannot Commit Case To Sessions Court Merely Due To Higher Punishment, Must Record Reasons: Bombay High Court

The Bombay High Court has held that though a Magistrate is empowered under Section 323 of the Code of Criminal Procedure to commit a case to the Court of Sessions at any stage of the inquiry or trial, such power cannot be exercised mechanically or solely on the basis of the severe nature of the punishment prescribed for the offence. The Court held that the Magistrate must form an...

[Maharashtra Stamp Act] 'Power To Impound Affects Property Rights; Can Only Be Exercised By Registering Officer': Bombay High Court

The Bombay High Court has held that the power to impound an instrument under Section 33A of the Maharashtra Stamp Act, 1958, is a serious statutory power having direct civil consequences on the property rights of a citizen and therefore can be exercised only by the “Registering Officer” before whom the document was registered. The Court observed that Section 33A does not permit any...

'Toilet Facilities Are Basic Human Rights Under Article 21: Bombay HC Directs Civic Body To Improve Sanitation In Mumbai's Slum Areas

The Bombay High Court has held that access to adequate sanitation and toilet facilities constitutes a basic human right forming an integral part of the right to life and dignity guaranteed under Article 21 of the Constitution, even in slum areas created by encroachment on municipal land. The Court observed that once large populations reside in slums, whether authorised or unauthorised,...

"Entire Auction & Bidding Process Was Rigged": Bombay High Court Quashes Sale Of Property, Orders Forfeiture Of Deposit By Bidders

The Bombay High Court has ordered a fresh 'revaluation' of a prime property at Mumbai's Vile Parle area after finding that the initial process of auction of the plot was 'rigged' with bidders coming a 'syndicate' and 'under-bidding' for the property.Single-judge Justice Madhav Jamdar therefore while ordering fresh auction, ordered forfeiture of the Rs 10 lakh each Earnest Money Deposit (EMD)...

'Can't Turn Nelson's Eye To Minor Victim's Ordeal': Bombay High Court Refuses To Reduce Sentence Of 83 Yr-Old Rape Convict

The Bombay High Court (Goa Bench) recently upheld the conviction and refused to reduce the 10-year sentence awarded to an 83-year-old man convicted of sexually assaulting a 9-year-old girl in 2012. A bench of Justice Shreeram V Shirsat said that the age of the Appellant could not be a mitigating circumstance to reduce the sentence in such offences as the Court can't "turn a Nelson's...

Bombay High Court Seeks 'Blueprint' From Administration Over Recruitment Of 2863 Judicial Officers Against Newly Sanctioned Posts

The Bombay High Court has sought from its Administration a 'blue print' for recruitment of nearly 2800 judicial officers against the newly sanctioned posts by the Maharashtra Government for the State's lower judiciary. A division bench of Justice Bharati Dangre and Justice Sarang Kotwal emphasised that the State as well as the High Court on the Administrative side will have to act...

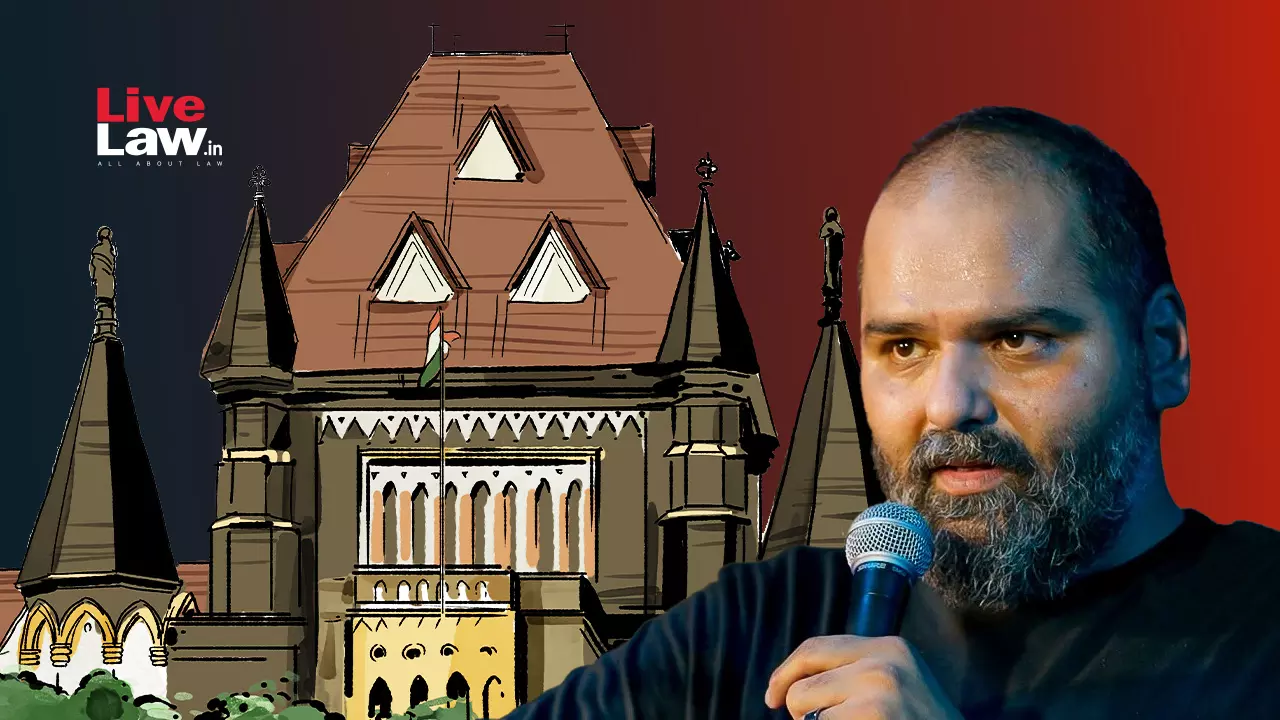

Kunal Kamra Moves Bombay High Court Challenging 'Sahyog Portal' & 2025 Amendment To IT Rules Allowing Blocking Of Social Media Content

Satirist Kunal Kamra has approached the Bombay High Court challenging the constitutional validity of the 'Sahyog Portal' and the 2025 amendment to Rule 3(1)(d) of the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021. The challenge is directed against provisions which enable the blocking of content posted on social media intermediaries. Earlier,...

Bombay High Court Denies Emergency Parole To Abu Salem Over Brother's Death After He Declines To Pay Police Escort Charges

The Bombay High Court on Wednesday refused permission to underworld gangster Abu Salem to travel to his native place in Azamgarh, Uttar Pradesh, to mourn the death of his brother, Abu Hakim Ansari.A division bench comprising Justices Ajay Gadkari and Shyam Chandak upheld the order of the Appellate Authority which had allowed Salem emergency parole only on the condition that he pays Rs 17.60...

![[s. 323 CrPC] Magistrate Cannot Commit Case To Sessions Court Merely Due To Higher Punishment, Must Record Reasons: Bombay High Court [s. 323 CrPC] Magistrate Cannot Commit Case To Sessions Court Merely Due To Higher Punishment, Must Record Reasons: Bombay High Court](https://www.livelaw.in/h-upload/2025/08/21/500x300_616526-justice-pravin-s-patil.webp)

![[Maharashtra Stamp Act] Power To Impound Affects Property Rights; Can Only Be Exercised By Registering Officer: Bombay High Court [Maharashtra Stamp Act] Power To Impound Affects Property Rights; Can Only Be Exercised By Registering Officer: Bombay High Court](https://www.livelaw.in/h-upload/2025/07/04/500x300_607990-justice-amit-borkar.webp)