Tax

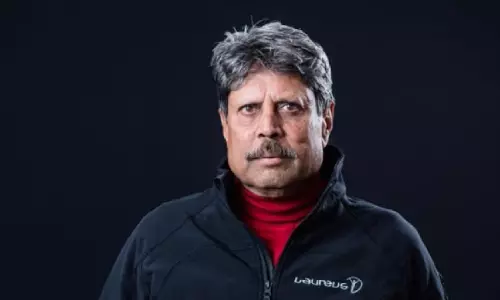

ITAT Exempts Tax On ₹1.5 Crore Granted By BCCI To Kapil Dev In Recognition Of His Services To Cricket

The Income Tax Appellate Tribunal at Delhi allowed renowned cricketer Kapil Dev to claim exemption on Rs. 1.5 crore one-time benefit granted to him by the BCCI in 2013, in recognition of his services.Noting that the cricketer had offered the amount for tax under ignorance, bench of M. Balaganesh (Accountant Member) and MS Madhumita Roy (Judicial Member) said,“It is trite law that right...

Supreme Court Issues Notice In Challenge To West Bengal Taxes On Entry Of Goods Act

The Supreme Court is set to examine the constitutional validity of the West Bengal Taxes on Entry of Goods into the Local Areas Act, 2012, as amended by the West Bengal Finance Act, 2017, along with related Rules and notifications.A bench of Justice JB Pardiwala and Justice R Mahadevan recently issued notice returnable on April 22, 2025 in a batch of petitions challenging the...

Customs Can Clone Data Of Seized Electronic Devices As Per Statutory Procedure, Need Not Retain Devices Throughout Prosecution: Delhi HC

The Delhi High Court has called upon the Customs Department to clone the required data from seized electronic devices of persons allegedly involved in smuggling and other violations under the Act, instead of retaining such devices throughout prosecutions.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta observed that such a practice will not only ensure that the...

Supreme Court Directs Customs Authorities To Upgrade Lab Facilities For Proper Testing Of Disputed Articles On All Parameters

In a key decision, the Supreme Court today overturned the confiscation of imported goods labelled as "Base Oil SN 50," which customs authorities had classified as High-Speed Diesel (HSD), which only the State entities can import. The Court found that the Customs Department failed to provide conclusive evidence proving the goods were High-Speed Diesel (HSD), due to inadequate laboratory...

Order Restraining Revenue From Taking Coercive Steps For Recovery Of Demand Can Interdict Adjustment Of Refunds: Delhi HC

The Delhi High Court has held that when an appellate authority has asked the Income Tax Department to not take any coercive steps against an assessee for recovery of outstanding demands, the same can in some cases interdict the Department from adjusting the outstanding amount from refunds due to the assessee.A division bench of Justices Vibhu Bakhru and Tejas Karia took note of a Punjab...

S.110 Customs Act | SCN Cannot Be Issued After One Year, Detention Of Goods Impermissible: Delhi High Court

The Delhi High Court has held that detention of goods by the Customs Department cannot continue beyond a period of one year, if a show cause notice was not issued to the assessee within such period.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta cited Section 110 of the Customs Act, 1962 which prescribes a period of six months. Further, subject to complying with...

Can GST Act Timelines Be Relaxed For Bonafide Errors? Supreme Court Appoints Amicus Curiae, Issues Notice To CBIC

The Supreme Court recently issued notice to the Central Board of Indirect Taxes and Customs (CBIC) over the recurrent issue of not allowing rectification of bonafide errors made after the lapse of prescribed deadlines under the CGST Act. The bench of CJI Sanjiv Khanna and Justices Sanjay Kumar and KV Viswanathan was hearing a challenge by the Union against the decision of the Bombay High...

'Timelines To Rectify Bonafide GST Form Errors Must Be Realistic' : Supreme Court Asks CBIC To Re-examine Provisions

The Supreme Court recently underscored the need for the Central Board of Indirect Taxes and Customs to fix realistic timelines for correcting bonafide errors by the assesses in forms when filing GST returns. The bench of CJI Sanjiv Khanna and Justice Sanjay Kumar was hearing a challenge to the Bombay High Court order which allowed an assesee to rectify its form GSTR-1 after missing the...

Jurisdictional Assessing Officer Lacks Jurisdiction To Issue Reassessment Notices U/S 148 Of Income Tax Act: Rajasthan High Court

The Rajasthan High Court stated that the Jurisdictional Assessing Officer (JAO) lacks jurisdiction to issue income tax reassessment notices under section 148 of the Income Tax Act, 1961. The Bench of Justice Pushpendra Singh Bhati and Munnuri Laxman observed that “the JAO shall not have the jurisdiction to issue notices under Section 148 of the Act of 1961, as it would not only...

Income Tax Act | Order Passed By Commissioner U/S 263 Can't Be Construed As Closed Remand, No Need To Challenge Order Separately: Kerala High Court

The Kerala High Court stated that the order passed by the Commissioner of Appeals under Section 263 of the Income Tax Act cannot be under any circumstances construed as a closed remand and there is no requirement to challenge the order under Section 263 separately. The Division Bench of Justices A.K. Jayasankaran Nambiar and Easwaran S. observed that “In as much as the Commissioner...

Customs Broker Cannot Be Faulted For Trusting Government-Issued Certificates: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that when a government officer issues a certificate or registration with an address to an exporter, the Customs Broker cannot be faulted for trusting the certificates so issued. The Tribunal opined that “If there are documents issued by the Government Officers which show that the...

Customs Department Can't Invoke Expired Bank Guarantees: Kerala High Court

The Kerala High Court stated that invocation of the expired bank guarantees by Customs Department is not permissible under law. The Division Bench of Justices A.K. Jayasankaran Nambiar and Easwaran S. was addressing the issue of whether customs department can invoke expired bank guarantees. The assessee/appellant has filed an appeal challenging the order of Single Judge who...