Tax

Revenue Cannot Re-Assess Time Barred Assessment Under KVAT Act Based On CAG Report: Kerala High Court

The Kerala High Court stated that revenue cannot re-assess time barred assessment under KVAT Act based on CAG report. The Division Bench of Justices A.Y. Jayasankaran Nambiar and Easwaran S. observed that “there cannot be an exercise of power under Section 25A of the KVAT Act beyond the period of limitation prescribed under Section 25(1) of the KVAT Act. In fact the provisions...

Advertising Agency Not Liable To Pay Service Tax On Amount Payable To Media Companies On Behalf Of Their Clients: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that the advertising agency being a pure agent is not liable to pay service tax on amount payable to media companies on behalf of their clients. The Bench of Dilip Gupta (President) and P. V. Subba Rao (Technical) has observed that, “The assessee has conceded about their liability to...

Joint Commissioner Has Jurisdiction To Initiate Proceedings Against Assessment Order Passed Pursuant To Remand: Kerala High Court

The Kerala High Court stated that Joint Commissioner has jurisdiction to initiate proceedings under Section 56 of the KVAT Act against assessment order passed pursuant to remand. The Division Bench of Justices A.K. Jayasankaran Nambiar and Easwaran S. observed that “when the fresh assessment order was passed consequence to the remand, the original assessment order ceased to exist...

Ayurvedic Treatment Is Only Incidental To Facilities Provided By Assessee In Resort, Liable To Be Taxed: Kerala High Court

The Kerala High Court stated that ayurvedic treatment is only incidental to facilities provided by assessee in a resort, hence liable to be taxed. “the main activities of the assessee as per the brochures produced before the assessing officer, are canoeing, motor boat cruises, houseboat stay, trekking, Alleppey beach visit, coir factory visit, elephant ride, Kathakali,...

Vehicles Registered As Goods Carriage Vehicles Can't Be Classified Under Different Head For Demanding One-Time Tax: Kerala High Court

The Kerala High Court stated that vehicles registered as goods carriage vehicles, could not be classified under a different head for the purposes of demanding one-time tax under the second proviso to Section 3(1) of the Kerala Motor Vehicles Taxation Act. The Division Bench of Justices A.K. Jayasankaran Nambiar and Easwaran S. stated that “the department cannot alter their...

Activity Of “Chilling Of Milk” Is A Service, Leviable To Service Tax: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that activity of chilling of milk is leviable to service tax. The Bench of Binu Tamta (Judicial Member) and P.V. Subba Rao (Technical Member) has observed that “the activity of chilling of milk during the post negative period amounts to rendering 'services' as defined in section 65B...

NRI's Entitled To Benefits Provided To 'Eligible Passengers' Under 2016 Baggage Rules: Delhi High Court

The Delhi High Court has held that a non-resident Indian is fully entitled to the benefit provided to an “eligible passenger” under the Baggage Rules, 2016 for the purposes of Customs on arrival to India.Eligible passenger was defined by the Finance Ministry via a Notification dated June 30, 2017, to mean a passenger of Indian origin or a passenger holding a valid Indian passport, coming...

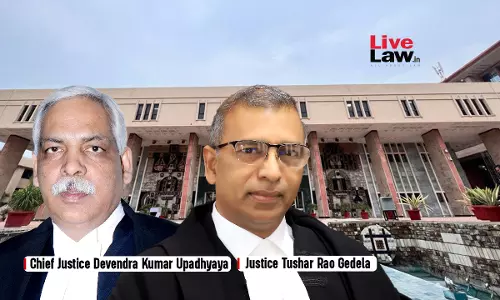

'Proof Beyond Reasonable Doubt' Is A Principle Of Criminal Law, Not Applicable To Tax Law: Delhi High Court

The Delhi High Court has made it clear that the principle of 'proof beyond reasonable doubt' cannot be made applicable to Section 148 of the Income Tax Act, 1961 which enables an assessing officer to open an assessment if he has 'reason to believe' that an assessee's income escaped assessment.A division bench of Chief Justice Devendra Kumar Upadhyaya and Justice Tushar Rao Gedela observed,...

Transfer Pricing | 'Resale Price Method' Most Appropriate To Determine ALP Where Distributor Makes No Value Addition To Imported Products: Delhi HC

The Delhi High Court has made it clear that where the distributor of an imported product makes no value addition to it before sale, Resale Price Method is the most appropriate method to determine the arm's length price in relation to its business with an Associated Enterprise.A division bench of Chief Justice Devendra Kumar Upadhyaya and Justice Tushar Rao Gedela thus dismissed the...

Notification Cannot Be Given Retrospective Effect To Deny Refund On Unutilised ITC Claimed Within Limitation Period: Madras HC Allows Gillette's Plea

Finding that the refund claim was filed within two years from the “relevant date” as defined in Explanation 2(a) to Section 54(14) of CGST Act , the Madras High Court recently clarified that a refund claim cannot be denied on the basis of retrospective operation of the Proviso to Rule 90(3) pf the CGST Rules.The High Court clarified this upon finding that the refund claims filed in the...

Delhi High Court Slams Directorate General Of Foreign Trade For Cancelling Trader's DEPB License 15 Yrs After SCN Was Issued

The Delhi High Court recently quashed a Directorate General of Foreign Trade (DGFT) communication cancelling the license issued to a trader involved in import and export of goods, citing almost fifteen years delay in culminating the show cause notice.Justice Sachin Datta cited Vos Technologies India Pvt. Ltd. v. The Principal Additional Director General & Anr. (2024) where the Delhi...

Delhi High Court To Examine Scope Of Customs Jurisdiction Under E-Cigarettes Act After Seizure Of "De-Addiction" Devices

The Delhi High Court is set to examine the extent of jurisdiction which can be exercised by the Customs Department under the Prohibition of Electronic Cigarettes (Production, Manufacture, Import, Transport, Sale, Distribution, Storage and Advertisement) Act, 2019.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta have sought the authority's response on a private...