Tax

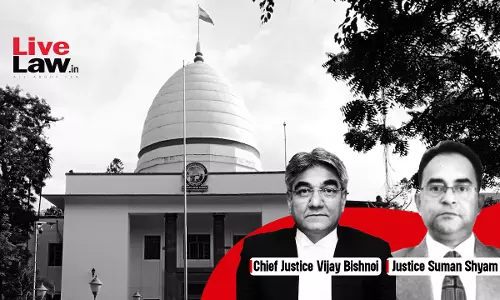

No Element Of Misstatement And Intention To Evade Payment Of Service Tax: Gauhati High Court Quashes Demand & Penalty

Finding that the Assessee company had provided every detail regarding availment of CENVAT Credit in the ST-3 Returns, and the same was considered by the Central Excise Commissioner, the Gauhati High Court held that the fact of wilful misstatement or suppression should specifically be mentioned in the show-cause notice. Since the Department had not misstated any fact with intent to...

Central Charges & International Taxation Charges Are Not Excluded From Purview Of Faceless Mechanism U/s 144B R/w/s 151A: Bombay High Court

The Bombay High Court held that the faceless mechanism would be applicable to all cases of Central Charges and International Taxation charges. However, the High Court clarified that it is only the assessment proceedings which would be required to be undertaken outside the faceless mechanism. Section 151A of the Income Tax Act empowers the Central Government to make a scheme...

Acquisition Of Flipkart Singapore Shares, Double Taxation Avoidance Treaty,No Invention To Evade Tax: Delhi High Court

While overturning the AAR ruling in the case of Tiger Global - Flipkart transaction, the Delhi High Court allowed India Mauritius DTAA (Double taxation avoidance agreement) benefit to petitioner/ assessee on ground that the transaction stands grandfathered by Article 13(3A) of India-Mauritius Treaty. Simultaneously, the High Court held that Tax Residency Certificate (TRC) issued by...

Failure TO Disclose All Material Facts Fully & Truly During Original Assessment Is Vital For Invoking Jurisdiction U/s 147: Bombay HC

The Bombay High Court recently clarified that it is not open to the Revenue to initiate reassessment on the premise that it can simply form a belief supported by its own reasons, thereby ignoring the explicit formulation of the jurisdiction within which reassessment may be initiated. The High Court therefore quashes the reassessment notice issued under old regime of Section 148...

Department Can Centralize Assessment At One Place If There Are Sufficient Reasons: Bombay High Court Upholds Transfer Order U/s 127

Finding that the Assessee had transactions with certain Indian citizens, who were subject to search operation and whose assessments were centralized with the Central Circle at New Delhi, the Bombay High Court find sufficient reasons for proposing of Assessee's case to be centralised at New Delhi. The High Court also found that the assessment of such persons would certainly...

Reopening Proceedings In Defiance Of Mandatory Procedure U/s 151A To Be Quashed: Bombay High Court

The Bombay High Court clarified that the Assessing Officer is required to adhere to the provisions of Section 151A read with CBDT Notification dated Mar 29, 2022 for resorting to a procedure u/s 148A and the consequent notice u/s 148. Section 151A of the Income Tax Act empowers the Central Government to make a scheme for the purpose of assessment, reassessment, or recompilation...

ITAT Weekly Round-Up: 18 To 24 August 2024

Income Tax Deduction Allowable To Interest Income 'Attributable' To Cottage Industry Business: ITATCase Title: Potheri Village Weaning Food Manufacturing Womens Development Industrial Coop Versus ITOThe Chennai bench of Income Tax Appellate Tribunal (ITAT) has held that the income tax deduction allowable to interest income 'attributable' to cottage industry business.Gift Received...

CESTAT Weekly Round-Up: 18 To 24 August 2024

SEZ Unit In India Is A Territory Deemed To Be Outside India, No Excise Duty Payable On Manufacturing Goods: CESTATCase Title: Commissioner Appeals – CGST & Central Excise Rajkot Versus M/S. Reliance Industries Ltd, Unit Of RSEZ JamnagarThe Ahmedabad Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT)has held that the SEZ Act exempts all duties in respect of the...

Incorrect Address Mentioned In Invoices Can't Be A Reason To Deny Cenvat Credit: CESTAT

The Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that an incorrect address mentioned in invoices cannot be a reason to deny CENVAT credit.The bench of Rachna Gupta (Judicial Member) has observed that the invoices with incorrect addresses issued by the input service providers contain all the requisite particulars as required under the proviso to Rule...

Indirect Tax Weekly Round-Up: 18 To 24 August 2024

Bombay High CourtNon-Submission Of “Bill Of Export” Can't Be Treated As Non-Discharge Of Export Obligation, If Supply To SEZ Unit Is Proved: Bombay High CourtCase Title: Phoenix Industries Limited Versus UOIThe Bombay High Court has held that if the party is able to show proof of supply to the Special Economic Zone (SEZ) Unit, then non-submission of the “Bill of Export” cannot be...

Direct Tax Weekly Round-Up: 18 To 24 August 2024

Delhi High CourtAmount Paid For Obtaining Mining Rights In E-Auctions Can't Be Construed As Income; Delhi High Court Quashes Reassessment OrderCase Title: Vedanta Limited Versus ACITCitation: 2024 LiveLaw (Del) 917The Delhi High Court has quashed the reassessment order and held that the amount paid for obtaining mining rights in e-auctions cannot be construed as income.Section 80-IA(7)...

Delay In Filing Appeal, Notices Uploaded On GST Portal , Copy Not Served: Madras High Court Condones Delay

The Madras High Court has condoned the delay of 285 days in filing the appeal on the grounds that the notices were uploaded on the GST portal but no hard copy was served on the assessee.The bench of Justice Krishnan Ramasamy has observed that the delay was not wilful but due to bona fide reasons, and a reasonable cause has been shown by the petitioner for the delay. The petitioner/assessee is...