Tax

Appeal Against Endorsement Seeking Production Of Account Books Lies Before Joint Commissioner Of Appeals: Karnataka High Court

The Dharwad Bench of the Karnataka High Court has held that the appeal against endorsement seeking production of account books lies before the joint commissioner of appeals.The bench of Justice Jyoti Mulimani has observed that there is an alternative efficacious statutory remedy under Section 62 of the KVAT Act, 2003.The petitioner/assessee is a partnership firm running a bar, restaurant,...

CHA's Employees Can't Be Penalised On Charge Of Wrong Availment Of Drawback By Exporter: CESTAT

The Ahmedabad Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that the employees of Customs House Agent (CHA) cannot be penalized on charge of wrong availment of drawback by the exporter.The bench of Ramesh Nair (Judicial Member) and Raju (Technical Member) has observed that the appellants are neither the exporter of the goods nor the CHA. The entire case...

Sale Consideration Invested In Purchase Of Property, With Prior Permission Of Charity Commissioner; ITAT Deletes Disallowance

The Mumbai Bench of Income Tax Appellate Tribunal (ITAT) has held that no disallowance can be made as the sale consideration was invested in the purchase of property with the prior permission of the charity commissioner.The bench of Sandeep Singh Karhail (Judicial Member) and Narendra Kumar Billaiya (Accountant Member) has observed that whenever the properties are purchased, they are shown...

Liquidator Never Informed Of Reassessment Proceedings, Patna High Court Quashes Order

The Patna High Court has quashed the order as the liquidator was not informed of the reassessment proceedings.The bench of Chief Justice K. Vinod Chandran and Justice Partha Sarthy has observed that the liquidator should be noticed and participate in the reassessment proceedings. The notices were all issued to the email of the assessee after the liquidator was appointed, which makes it clear...

Mistake In Calculation Of Tax As Per Sec 115BBE Can Be Rectified U/s 154 And Not U/s 263: Ahmedabad ITAT Quashes Revision Made By PCIT

Finding that all the additions made by the Assessing Officer u/s 68 r/w/s 115BBE are in consonance with the Income Tax Statute, the Ahmedabad ITAT quashed the revisional exercise of power by the PCIT u/s 263. The power under section 263 of the Income tax Act can be exercised where the order of the Assessing Officer is erroneous and prejudicial to the interest of the...

Income Already Offered For Taxation Can't Be Taxed Again As Unexplained Cash Credit: Ahmedabad ITAT Deletes Double Taxation By ITO

The Ahmedabad ITAT held that sum credited to sales account can't be treated as unexplained cash credits u/s 68 if they are already included in the total sales declared and taxed. As per Section 68 of Income tax Act, where any sum is found credited in the book of an assessee maintained for any previous year, and the assessee offers no explanation about the nature and source thereof...

Cash Deposits Made By Taxpayer Out Of His Known Source Of Income: Ahmedabad ITAT Deletes Addition U/s 68

The Ahmedabad ITAT held that no addition is permitted u/s 68 once assessee had properly substantiated that cash deposits are made out of his known source of income. Section 68 of Income Tax Act aims to ensure individuals and corporations transparently disclose their income by addressing unexplained cash credits in their books of accounts, placing the responsibility on the taxpayer...

Common Order Without Satisfactorily Recording Concurrence With AO, Can't Be Considered As Valid Sanction U/s 151: Delhi High Court

Finding that the order of sanction passed by the Competent Authority is a general order of approval for 111 cases, and there was not even a whisper as to what material had weighed in the grant of approval u/s 151, the Delhi High Court held that although the PCIT is not required to record elaborate reasons, he must record satisfaction after application of mind. Since the sanction...

Value Of Shares Allotted Under Employees Stock Purchase Scheme Can't Be Treated As Perquisite As Per Sec 17(2)(Iiia): Delhi High Court

While emphasizing that no tax can be levied on notional income, the Delhi High Court held that Valuation Report obtained by employer could have no application to a share which was subject to a lock-in stipulation and could not be sold in the open market. Since there was a complete embargo on the sale of those shares, the High Court held that value of shares allotted to the...

Interest Receipts From Non-Convertible Debentures Of Indian AE Are Not Subject To Dividend Distribution Tax: Delhi HC

The Delhi High Court has quashed the reassessment proceedings initiated against the Assessee on the ground that interest income on Nonconvertible debentures (NCDs) derived from Indian AE had been mischaracterized as interest instead of dividend. While holding so, the High Court rejected the argument put forth by the Department that although the funds were taken out in the form...

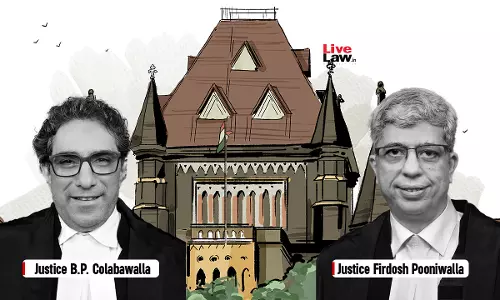

VSV Scheme Is Non-Tax Benefit Applicable Even To Medium Enterprise, Clarifies Bombay High Court

While granting benefit under the 'Vivad Se Vishwas I-Relief for MSMEs Scheme' (VSV Scheme) to the Assessee, even when it was re-classified as 'not an MSME', the Bombay High Court held that even though the Petitioner was re-classified as “not an MSME” for a period of three years from May 09, 2023, it was entitled to avail of all non-tax benefits available to a Medium...

No Service Tax Payable On Clinical Trial On Drugs Supplied By Foreign Service Recipient: CESTAT

The Ahmedabad Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has observed that no service tax is payable on the activity of clinical trials on the drugs supplied by the foreign service recipient.The bench of Ramesh Nair (Judicial Member) and C.L. Mahar (Technical Member) has observed that the activity of clinical trials on the drugs supplied by the foreign service...