Tax

Assessee Can't Be Absolved Of Responsibility As Registered Person To Monitor The GST Portal: Madras High Court

The Madras High Court held that the assessee cannot be absolved of responsibility as a registered person to monitor the GST portal.The bench of Justice Senthilkumar Ramamoorthy has observed that an audit was conducted and that an audit report dated 15.09.2023 was issued. An intimation and show cause notice preceded the impugned order. It is noticeable that the tax proposal was confirmed...

Gujarat High Court Quashes Demand Notice And Assessment Order In Absence Of Any Claim Not Forming Part Of Resolution Plan

The Gujarat High Court has quashed the demand notice and assessment order in the absence of any claim not forming part of the resolution plan (RP).The bench of Justice Bhargav D. Karia and Justice Niral R. Mehta has observed that, as per the Insolvency and Bankruptcy Code (IBC), the demand that was raised pursuant to the order dated March 13, 2023, by issuing the demand notice dated March...

Refund More Than 10% Of Tax As Determined On Regular Assessment, CEAT Entitled To Interest On Refund Of Rs. 5.24 Cr.: Bombay High Court

The Bombay High Court has held that Ceat Limited is entitled to interest on a refund of Rs. 5.24 crore as the refund is more than 10% of tax as determined on regular assessment.The bench of Justice K. R. Shriram and Justice Neela Gokhale has observed that the words “amount of refund” must mean the whole of the refund of Rs. 5,24,29,950 and not an artificial split as canvassed by...

No Service Tax Can Be Demanded On Sale Of Goods Or By Way Of Including Value Of Goods In The Service: CESTAT

The Ahmedabad Bench of Customs, Excise and Service Tax Appellate Tribunal (CESTAT) has held that no service tax can be demanded on the sale of goods or by way of including the value of goods in the service.The bench of Ramesh Nair (Judicial Member) and Raju (Technical Member) has observed that as per the contract and the transaction made thereunder there is clear distinction between...

Bombay High Court Quashes SCN Demanding GST On Ocean Freight On Transportation Of Goods From Outside India

The Bombay High Court has quashed the show cause notice (SCN) demanding GST on ocean freight on transportation of goods from outside India.The bench of Justice G. S. Kulkarni and Justice Firdosh P. Pooniwalla has relied on the decision of the Supreme Court in the case of Mohit Minerals and observed that the verdict applies to both free on board (FOB) and sum of cost, insurance, and freight...

Intention To Smuggle Prohibited Goods Can't Be Equated With Attempt To Export Prohibited Goods: CESTAT

The Hyderabad Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that intention to smuggle prohibited goods cannot be equated with an attempt to export prohibited goods.The bench of Anil Choudhary (Judicial Member) and A.K. Jyotishi (Technical Member) observed that the appellant was intercepted by the CISF officials outside the customs area. The appellant...

Telangana High Court Holds 'Handling Of Cargo In Customs Areas Regulations, 2009' As Ultra Vires Of The Customs Act, 1962

The Telangana High Court holds 'Handling of Cargo in Customs Areas Regulations, 2009' by way of which cost of living expenses were recoverable from the Customs Cargo Service Provider as ultra vires of the Customs Act, 1962.“In the absence of any special authorization to levy cost recovery charges, appellants have no authority to impose cost recovery charges by means of a Regulation....

“Certainly The High Court Should Not Scrutinise An Order Of The ITSC As An Appellate Court,” Says Bombay High Court

The Bombay High Court has held that interference with the orders of the Income Tax Settlement Commission (ITSC) should be avoided, keeping in mind the legislative intent. The scope of interference is very narrow, and certainly the High Court should not scrutinize an order of the ITSC as an appellate court. Unsettling reasoned orders from the ITSC may erode the confidence of assessees. The...

Opportunity For Hearing Was Refused Due To Assessee's Failure To Click On Appropriate Button, Madras High Court Quashes Faceless Assessment Order

The Madras High Court has quashed the order as the opportunity for hearing was refused due to the assessee's failure to click on the appropriate button.The bench of Justice Mohammed Shaffiq has observed that the personal hearing ought to have been extended, though the assessee might have failed to click on the appropriate button. The bench, while quashing the order, was directed to pass the...

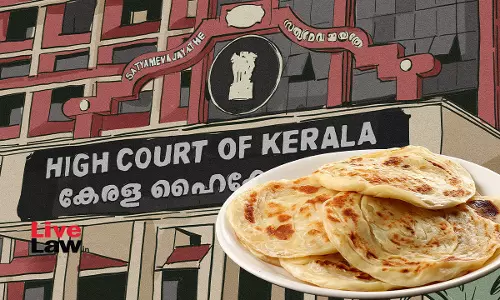

Malabar 'Parota' Is Akin To 'Bread', Exigible To 5% GST: Kerala High Court

The Kerala High Court has held that Malabar 'Parota' is akin to 'bread' and is exigible at the rate of 5% GST and not 18% GST.The bench of Justice Dinesh Kumar Singh has observed that Malabar 'Parota' and Whole Wheat Malabar Parota are exigible at the rate of 5% GST and not 18% as held by the Advance Ruling Authority and Advance Ruling Appellate Authority.The petitioner is in the business...

Cash Sales Already Offered As Income Can't Be Taxed In Garb Of Inflation Sales To Cover Up Demonetization Currency: Delhi ITAT

The New Delhi ITAT recently clarified that the cash sales already been offered as income, cannot be taxed in the garb of inflation sales to cover up demonetization currency. The Bench of N.K. Billaiya (Accountant Member) and Astha Chandra (Judicial Member) observed that “Merely because there was a minor variation in the cash sales during the alleged period compared to previous...

Money Received As Security Deposit If Subsequently Refunded To Developer, Is Irrelevant For Determining Taxability U/s 56(2)(Vii)(A): Mumbai ITAT

While deleting the enhancement made u/s 56(2)(vii)(a) of the Income Tax Act, the Mumbai ITAT explained that as per the provisions of section 56(2)(vii)(a), any sum of money, the aggregate of which exceeds Rs.50,000, received by an individual without consideration is taxable as income from other sources, and thus, u/s 56(2)(vii)(a), the incidence of taxation is at the stage of receipt...