Tax

CENVAT Credits Can’t Be Denied To Service Recipient Without Opening Assessment Of Service Extended By Service Provider: CESTAT

The Mumbai Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that without an opening assessment of the provision of service extended by the service provider, CENVAT credits cannot be denied to the recipient who had paid the required service tax through the service receiver in order to avail the input services.The bench of Dr. Suvendu Kumar Pati (Judicial Member)...

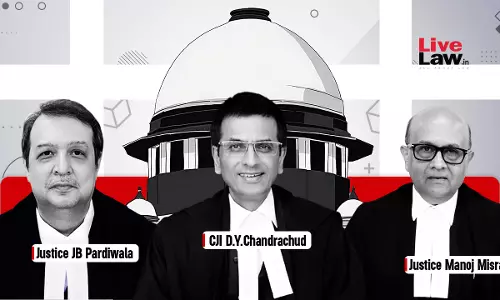

UP VAT Act | Definition Of “Goods” Under Sec. 2(m) And Sec. 13(1)(f) Includes Taxable As Well As Exempted Goods: Supreme Court

The Supreme Court has held that the definition of “Goods” under Section 2(m) of Uttar Pradesh Value Added Tax Act, 2008 (“UP VAT Act”) includes both taxable as well as exempted goods. Similarly, the word “goods” under Section 13(1)(f) of the UP VAT Act cannot be said to be qualified by the word “taxable”.The Bench comprising the Chief Justice Dr. Dhananjaya Y. Chandrachud,...

Tax Cases Weekly Round-Up: 05 November To 11 November, 2023

Delhi High Court CENVAT Credit Refund Can’t Be Denied In Absence Of Self-Assessed Return Having Been Questioned, Reviewed Or Re-Assessed: Delhi High Court Case Title: BT (India) Private Limited Versus UOI Citation: 2023 LiveLaw (Del) 1082 The Delhi High Court has held that a CENVAT credit refund cannot be denied in the absence of the self-assessed return having...

Allahabad High Court Grants Interim Relief To Anand And Anand, Stays Show Cause Notice Demanding Refund Of Rs.138 Crores

The Allahabad High Court has granted interim relief to Anand and Anand Law Firm by staying the proceedings initiated under the Goods and Service Tax Act, 2017.The bench comprising of Chief Justice Pritinker Diwaker and Justice Ashutosh Srivastava stayed proceedings initiated pursuant to the show cause notice issued against the law firm till the next date of listing. While dealing with...

UP VAT Act | Assessee Entitled To Claim Full Input Tax Credit On Exempted Goods Produced As By-Products Or Waste Products During Manufacturing Of Taxable Goods : Supreme Court

The Supreme Court while relying on Explanation (iii) to Section 13 of Uttar Pradesh Value Added Tax Act, 2008 (“UP VAT Act”), has held that if during the manufacture of any taxable good any tax exempted goods are produced as by-product/waste product, then it shall be deemed that the goods purchased from within the State for such manufacturing have been used in manufacture of taxable...

Bombay High Court Quashes Reassessment Proceedings Against Non-Existent Entity Despite Active PAN

The Bombay High Court has quashed the reassessment proceedings against non-existent entities despite an active PAN.“PAN was not deactivated, which would not help the revenue because there could be cases relating to various years when the company was in existence, and it is possible those PAN numbers are picked up for scrutiny or for the issuance of a refund. That, in our view, will not be...

Income Tax Adjudication Proceedings And Criminal Prosecution Are Independent To Each Other: Madras High Court

The Madras High Court has held that income tax adjudication proceedings and criminal prosecution are independent of each other; the pendency of one does not affect the other.The bench of Justice G.K. Ilanthiraiyan has observed that the adjudication proceedings and the criminal prosecution are independent of each other, and the pendency of any adjudication proceeding is not a bar to...

Firm Liable To Pay Tax On Distribution Of Capital Assets On Dissolution And Not Partner: Bombay High Court

The Bombay High Court has held that, as per Section 45(4) of the Income Tax Act, assuming that there was a distribution of capital assets upon dissolution of the firm, it is the firm and not the partner who has to pay the tax.The bench of Justice K. R. Shriram and Justice Dr. Neela Gokhale has observed that the amount of Rs. 28 crores can be considered the amount received by a partner...

Unsold Flats Which Are In Stock In Trade Should Be Assessed As "Business Income": ITAT

The Mumbai Bench of Income Tax Appellate Tribunal (ITAT) has observed that unsold flats that are in stock in trade should be assessed under the heading "business income".The bench of Kuldip Singh (Judicial Member) and S. Rifaur Rahman (Accountant Member) has observed that there is no justification for estimating the rental value of unsold flats and notionally computing the annual letting...

ITAT Deletes Income Tax Addition Of Rs.2.30 Crores As AO Failed To Mention Investment Outside The Books Of Accounts

The Delhi Bench of Income Tax Appellate Tribunal (ITAT) has deleted the income tax addition of Rs. 2.30 crores as the Assessing Officer (AO) did not mention any investment outside the books of accounts.The bench of Astha Chandra (Judicial Member) and N. K. Billaiya (Accountant Member) has observed that the assessee has explained the investment duly reflected in its bank statement, and...

CBDT Notifies Income Tax Exemption To Punjab Infrastructure Regulatory Authority

The Central Board of Direct Taxes (CBDT) has notified the Income Tax exemption to the Punjab Infrastructure Regulatory Authority under clause (46) of section 10 of the Income-tax Act, 1961.The ‘Punjab Infrastructure Regulatory Authority’ is an authority constituted by the Government of Punjab.The Board has exempted the Punjab Infrastructure Regulatory Authority from Income Tax in respect...

Rajasthan High Court Stays Cess Demand Against Hotelier, Who Is A Subsequent Purchaser

The Rajasthan High Court has stayed the cess demand against the hotelier, who was the subsequent purchaser.The bench of Justice Arun Monga acknowledged the fact that the cess can be levied only on the original owner, and the petitioner/assessee, being the subsequent purchaser, cannot be fastened with past liability.The petitioner/assessee, along with his two partners, purchased a property...