Tax

There Can Be No Protective Addition In Absence Of Substantive Addition: ITAT

The Delhi bench of the Income Tax Appellate Tribunal (ITAT) has held that protective addition presupposes the existence of substantive additions; there can be no protective addition in the absence of substantive addition.The bench of Yogesh Kumar U.S. (Judicial Member) and Pradip Kumar Kedia (Accountant Member) has observed that the assessment order was passed against the assessee on December...

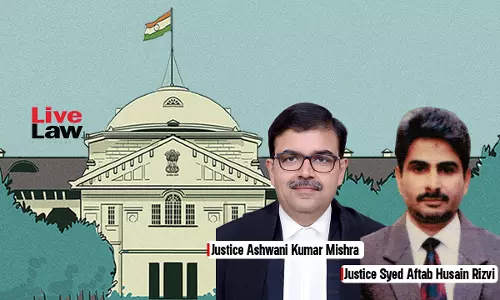

GST Act | If Invoice Or Any Other Specified Document Is Accompanying Goods, Then Consigner Or Consignee Are Deemed To Be Owner: Allahabad HC

The Allahabad High Court held that if goods are accompanied by invoices or any other document as specified, either the consignee or the consigner shall be deemed owner of the goods. Penalty, if any, should be imposed under Section 129(1)(a) of the Goods and Services Tax Act, 2017. Petitioner was transporting a consignment for M/s Tata Steel Ltd. from Odisha to Pilkhua. Due to breakdown of...

Tax Cases Weekly Round-Up: 17 September To 23 September, 2023

Delhi High Court Tax Authority Based In Delhi Lacks Jurisdiction On Withholding Tax Liability On Share Purchase Transaction: Delhi High Court Quashes Tax Demand Against Sumitomo Case Title: Sumitomo Mitsui Financial Group Inc. Versus CIT The Delhi High Court has deleted the tax demand against Sumitomo Mitsui Financial Group on the grounds of lack of jurisdiction. Delhi...

Fee Paid By TCS Towards The Brand To Tata And Sons Ltd. Is Not Capital In Nature, Royalty Not Chargeable: ITAT

The Mumbai Bench of Income Tax Appellate Tribunal (ITAT) has held that the fee paid by the assessee, Tata Consultancy Services (TCS), towards the brand to Tata and Sons Ltd. is not capital in nature for the reason that the brand is not owned by the assessee.The bench of Vikas Awasthy (Judicial Member) and Padmavathy S. (Accountant Member) has observed that there cannot be any royalty that...

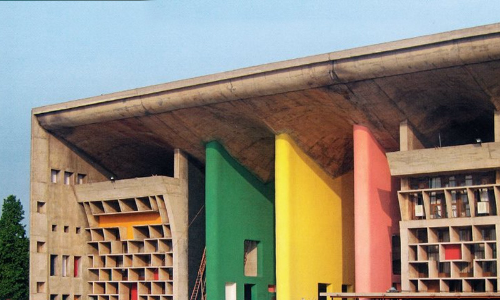

Innovation & Development Services Provided To A German Company Amounts To Export Of Service: Punjab & Haryana High Court

The Punjab and Haryana High Court has held that innovation and development services provided to a German company amount to an export of services.The bench of Justice Ritu Bahri and Justice Manisha Batra observed that the petitioner/assessee does not carry out any marketing of the products of Fresenius Kabi Deutschland GmbH Germany (FKDG) nor any product is delivered by FKDG to it. The...

Capital Gain Tax, No Retrospective Applicability Of Amendment Restricting Investment In India: Bombay High Court

The Bombay High Court has held that the amendment restricting investment in house property in India has retrospective applicability.The bench of Justice K. R. Shriram and Justice N. K. Gokhale has observed that the language of Section 54(F) of the Act before its amendment was that the assessee should invest capital gain in a residential house. It did not mention any boundaries. It is only...

ALP Adjustment Falls Within Tolerance Band Of +/- of 5%: ITAT Deletes TP-Adjustment On Payment For Consultancy, Professional Fees

The Delhi Bench of Income Tax Appellate Tribunal (ITAT) has deleted the TP adjustment on payment for consultancy and professional fees and other services by the assessee to its Associated Enterprises (AEs).The bench of Anubhav Sharma (Judicial Member) and M. Balaganesh (Accountant Member) has observed that ALP adjustment falls within the tolerance band of +/- of 5% as per the second proviso...

Service Tax Exemption On Renting Of Immovable Property Service For Transmission Or Distribution Of Electricity By TANGEDCO: CESTAT

The Chennai Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that service tax is not payable on the renting of immovable property services for the transmission or distribution of electricity by Tamil Nadu Generation and Distribution Corporation Limited (TANGEDCO).The bench of P. Dinesha (Judicial Member) and M. Ajit Kumar (Technical Member) has observed that...

Tax Authority Based In Delhi Lacks Jurisdiction On Withholding Tax Liability On Share Purchase Transaction: Delhi High Court Quashes Tax Demand Against Sumitomo

The Delhi High Court has deleted the tax demand against Sumitomo Mitsui Financial Group on the grounds of lack of jurisdiction.The bench of Justice Rajiv Shakdher and Justice Girish Kathpalia has observed that the jurisdiction on the withholding tax liability on the transaction of share purchase by the Assessee was already exercised by the tax authority based in Mumbai, thus the tax...

Waste, Gums, Fatty Acids Arising During Manufacturing Of Vegetable Oils Are Eligible For Excise Duty Exemption: CESTAT

The Chandigarh Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that waste, gums, fatty acids, etc. arising during the course of the manufacture of vegetable oils are eligible for the excise duty exemption.The bench of S. S. Garg (Judicial Member) and P. Anjani Kumar (Technical Member) has observed that waste, gums, fatty acids, etc. arising out of the manufacture...

Pre-Fabricated Shelters, Towers Essential Ingredient Of Telecommunication Service: CESTAT Allows Cenvat Credit

The Chandigarh Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that prefabricated shelters and towers are essential ingredients of telecommunication services and qualify as input services.The bench of S. S. Garg (Judicial Member) and P. Anjani Kumar (Technical Member) has observed that towers and pre-fabricated shelters form an essential ingredient in the...

AO Can’t Ask Assessee To Prove Non-Occurring Of An Event, ITAT Deletes Income Tax Addition Worth Rs. 2 Crores

The Delhi Bench of Income Tax Appellate Tribunal (ITAT) has deleted the income tax addition worth Rs. 2 crores and held that the AO cannot ask the assessee to prove the non-occurring of an event.The bench of Anubhav Sharma (Judicial Member) and Shamim Yahya (Accountant Member) has observed that it is not proper on the part of the AO to ask the appellant to prove with witnesses and...