Tax

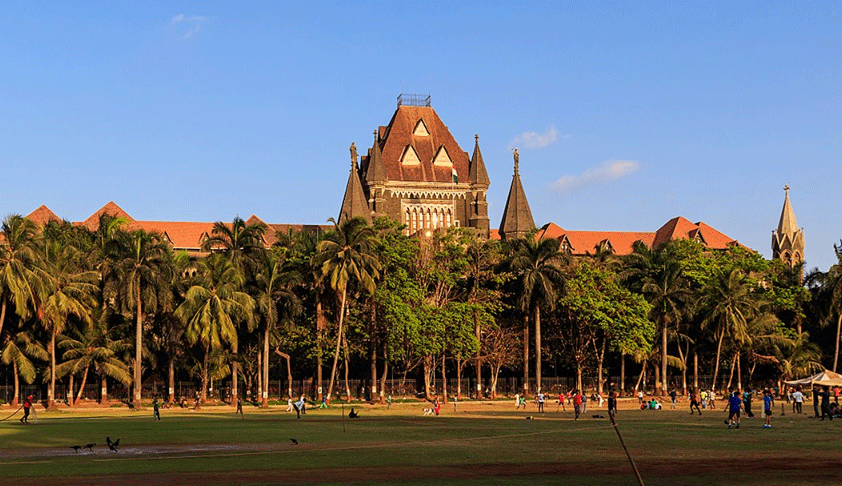

Bombay High Court Quashes Reassessment Notice Issued After 3 Years Without Proper Approval

The Bombay High Court has quashed the reassessment notice issued after 3 years without proper approval.The bench of Justice K.R. Shriram and Justice N. K. Gokhale has observed that the approval of the specified authority in terms of Section 151(ii) of the Income Tax Act is a jurisdictional requirement, and in the absence of complying with this requirement, the reopening of assessment...

Overlooking Assesssee’s Reply Demonstrates Non-Application Of Mind By The AO: Delhi High Court

The Delhi High Court has quashed the draft assessment orders, final assessment orders, and consequential demand on the grounds that the assessing officer inadvertently overlooked the email reply of the assessee, in which the assessee disclosed vital facts pertaining to its case.The bench of Justice Rajiv Shakdher and Justice Girish Kathpalia has observed that the denial of sufficient time...

Receipts From Provision Of Background Screening And Investigation Services To Clients In India Is Not Royalty/FTS: ITAT

The Delhi Bench of the Income Tax Appellate Tribunal (ITAT) has held that receipts from the provision of background screening and investigation services to clients in India are not royalties or fees for technical services (FTS).The bench of G.S. Pannu (President) and Astha Chandra (Judicial Member) has observed that the services rendered by the assessee do not involve any technical skill...

Bombay High Court Directs Dept. To Refund TDS Amount Deposited By Assessee Under Protest

The Bombay High Court, while invoking the doctrine of unjust enrichment, directed the department to refund the TDS amount deposited by the assessee under protest.The bench of Justice K. R. Shriram and Justice N. K. Gokhale has observed that technically, even though the amount deposited by the petitioner would be called ‘tax deductible at source’, what the petitioner paid was ‘an ad...

CISF Lacked Clarity About Leviability Of Service Tax On The Security Services; CESTAT Quashes Penalty

The Ahmedabad Bench of the Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has quashed the penalty on the Central Industrial Security Force (CISF) on the grounds that CISF lacked clarity about the leviability of service tax on the security services.The bench of Ramesh Nair (Judicial Member) and C. L. Mahar (Technical Member) observed that since there was a lack of clarity about...

Development Agreement Not To Be Treated As Transfer Of Possession Of Land: Bombay High Court Quashes Reassessment Notice

The Bombay High Court has quashed the reassessment notice and held that the granting of a licence for the purpose of development of the flats and selling the same could not be said to be granting possession.The bench of Justice K. R. Shriram and Justice N.K. Gokhale has relied on the decision of the Supreme Court in the case of Seshasayee Steels (P) Ltd. v. Assistant Commissioner of Income...

Undisclosed Income Taxed In The Hands Of Flagship Company Can’t Be Again Subjected To Tax In The Hands Of Assessee Companies: Delhi High Court

The Delhi High Court has held that undisclosed income taxed in the hands of flagship companies cannot be again subjected to tax in the hands of assessee companies.The bench of Justice Rajiv Shakdher and Justice Girish Kathpalia has observed that since the undisclosed income, which is the subject matter of the present dispute, had already been taxed in the hands of the flagship company Surya...

Delhi High Court Upholds Validity Of Rule 8 of Chewing Tobacco And Unmanufactured Tobacco Packing Machines Rules 2010

The Delhi High Court has upheld the validity of Rule 8 of the Chewing Tobacco and Unmanufactured Tobacco Packing Machines (Capacity Determination and Collection of Duty) Rules 2010 (CTUT), which deals with the alteration in the number of operating packing machines.The bench of Justice Yashwant Varma and Justice Dharmesh Sharma has observed that Rule 8 notes that in case a machine is added to...

Income Tax Raid, ITAT Finds Money Laundering, Directs Assessing Officer To Inform SEBI, PMLA Authorities

The Mumbai Bench of the Income Tax Appellate Tribunal (ITAT) has directed the AO to share information on all persons allegedly involved in the racket of money laundering.The bench of Sandeep Singh Karhail (Judicial Member) and Prashant Maharishi (Accountant Member) has issued the directions to the AO to communicate vital details on 32,855 beneficiaries involved in accommodation...

GST | Show Cause Notice Must Clearly Indicate Reasons For Which Registration Cancellation Is Proposed: Delhi High Court

Delhi High Court has recently set aside show cause notice proposing to cancel GST registration and the consequential order cancelling the same on the ground that reasons for cancelling registration of assesee were not clearly mentioned in the show cause notice. A bench comprising of Justices Vibhu Bakhru and Amit Mahajan held “At the least, the Show Cause Notice must clearly indicate...

No Income Tax Payable On Bonus Shares Under The Head ‘Income From Other Sources’: ITAT

The Delhi Bench of the Income Tax Appellate Tribunal (ITAT) has held that income tax is not chargeable on bonus shares under the heading ‘income from other sources’.The bench of Anubhav Sharma (Judicial Member) and M. Balaganesh (Accountant Member) has observed that the bonus shares are issued only out of the capitalization of existing reserves in the company. The AO had not disputed the...

Taxpayers, Having Aggregate Annual Turnover Above Rs. 5 Crore To Use At Least 6 Digit HSN W.e.f 1 October 2023

The Goods and Service Tax E-way Bill System has notified that new HSN Code requirements will be effective from October 1, 2023.As per Notification No. 78/2020 dated October 15, 2020, the taxpayers, having Aggregate Annual Turnover (AATO) above Rs. 5 Crore, shall use at least 6 digit HSN code in the e-Invoices and e-Waybills and other taxpayers shall use at least 4-digit HSN code in E-Invoices...