Tax

Excess Amount Paid In Service Tax Can Be Adjusted Against The Short Payment In Education Cess: CESTAT

The Kolkata Bench of the Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that the excess amount paid in service tax can be adjusted against the short payment in education cess.The bench of Ashok Jindal (Judicial Member) and K. Anpazhakan (Technical Member) has observed that the cenvat credit of basic central excise duty can be utilised for payment of education cess and...

GSTN Introduces Electronic Credit Reversal And Reclaimed Statement

The Goods and Service Tax Network (GSTN) has introduced the Electronic Credit Reversal and Reclaimed Statement.The government introduced certain changes in Table 4 of Form GSTR-3B so as to enable the taxpayers to report correct information regarding ITC availed, ITC reversal, ITC reclaimed, and ineligible ITC. The re-claimable ITC earlier reversed in Table 4(B)2 may be subsequently claimed...

Tax Cases Weekly Round-Up: 27 August To 2 September, 2023

Delhi High Court DGGI Can’t Be Stopped From Taking Intelligence-Based Enforcement Action When Investigation By Other Authority Is Going On: Delhi High Court Case Title: M/S. Hanuman Enterprises Pvt. Ltd. Versus The Additional Director General Directorate General Of GST Citation: 2023 LiveLaw (Del) 756 The Delhi High Court has held that the Directorate General of...

Tax Cases Monthly Round Up:August 2023

Indirect Taxes Supreme Court Excise Duty Exemption | To Determine If A Product Falls Under Description "Intravenous Fluids”, Its Composition & Not Its Use Matters : Supreme Court Case Title: Commissioner of Central Excise vs M/s Denis Chem Lab Ltd. & Anr. Citation : 2023 LiveLaw (SC) 650 The Supreme Court has ruled that in order to determine whether a...

Olivol Body Oil Takes Care Of The Skin, And Doesn’t Cure Skin, Attracts 28% GST: AAR

The West Bengal Authority of Advance Ruling (AAR) has ruled that Olivol Body Oil takes care of the skin but does not cure it. Olivol Body Oil is covered under tariff heading 3304.The bench of Tanisha Dutta and Joyjit Banik has observed that olivol body oil is commonly understood as preparations for the care of skin, thereby being considered a cosmetic product used to get soft and smoother...

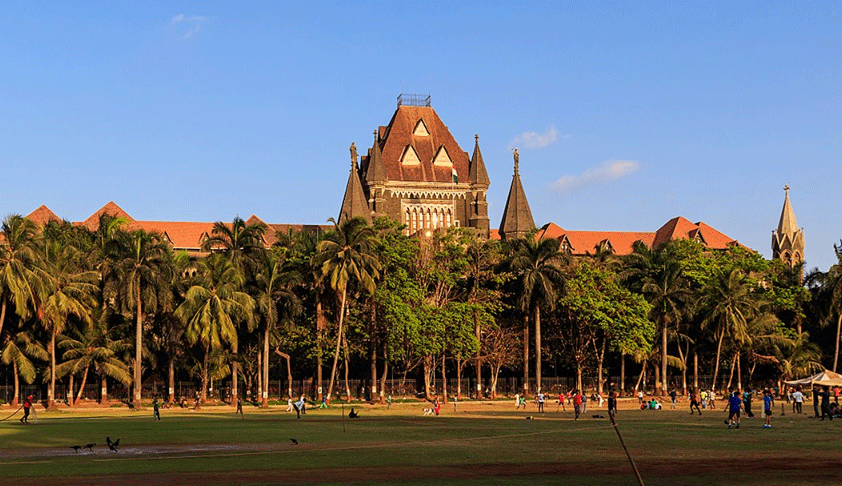

Bombay High Court Refuses 50% Entitlement Of Beneficial Ownership In Husband's Shareholding By Portuguese Civil Code For 'Deemed Dividend' Taxability

The Bombay High Court has refused 50% entitlement to beneficial ownership in a husband's shareholding under the Portuguese Civil Code for 'deemed dividend' taxability.The bench of Justice Valmiki SA Menezes has observed that Section 2(6A)(e) in the Income Tax Act, 1922, which is similar to the provisions of Section 2(22) of the Income Tax Act, 1961, creates a deeming fiction, by which...

AO Not Justified In Disallowing Part Of The Commission Payment To Indian Hume Pipe: Bombay High Court

The Bombay High Court has held that the Assessing Officer (AO) was not justified in disallowing part of the commission payment to Indian Hume Pipe.The bench of Justice G.S. Kulkarni and Justice Jitendra Jain has observed that the mere fact that the assessee, Indian Hume Pipe, establishes the existence of an agreement between him and his agent and the fact of actual payment leaves it to...

Payment Of Interest On Cash Loan Falls Within The Ambit Of Unexplained Expenditure: Calcutta High Court

The Calcutta High Court has held that the payment of interest on a cash loan falls within the ambit of unexplained expenditure within the meaning of Section 69C of the Income Tax Act.The bench of Chief Justice T.S. Sivagnanam and Justice Hiranmay Bhattacharyya has observed that it cannot be stated that the order passed under clause (d) of Section 148 is a non-speaking order, nor can the order...

CBDT Notifies Corrigendum To Include Leased Or Rented House For Valuing Rent-Free Accommodation Perquisite Provided By Employers

The Central Board of Direct Taxes (CBDT) has notified the corrigendum to Notification No. 65/2023 dated August 18, 2023, that notified amendments to the Income Tax Rules for valuing perquisites of rent-free or concessional accommodation by employers to employees.The corrigendum sought to insert the words “or taken on lease or rent” after the words “Provided also that where the...

GSTN Notifies Advisory On GST Registration Application Marked For Biometric-Based Aadhaar Authentication

The Goods and Service Tax Network (GSTN) has notified the advisory for applicants where a GST registration application is marked for Biometric-based Aadhaar Authentication.Rule 8 of CGST Rules has been amended to provide that those applicants who had opted for authentication of their Aadhaar number and identified on the common portal, based on data analysis and risk parameters, shall be...

No Assessment U/S 153A In Absence Of Incriminating Material Unearthed During The Course Of Search: Patna High Court

The Patna High Court has held that completed assessments can be interfered with by the Assessing Officer while making the assessment under Section 153A only on the basis of some incriminating material unearthed during the course of the search.The bench of Chief Justice K. Vinod Chandran and Justice Partha Sarthy has upheld the Tribunal’s Order and observed that the Tribunal was perfectly...

Section 67(2) Of The GST Act Does Not Empower Seizure Of Currency Available In Premises During Search: Delhi High Court

The Delhi High Court has held that Section 67(2) of the GST Act does not empower the seizure of currency available on premises during a search.The bench of Justice Vibhu Bakhru and Justice Purushaindra Kumar Kaurav has directed the department to remit the amount seized to the petitioner’s bank account within a period of two weeks, along with accrued interest.The petitioner sought the...