Tax

Gujarat High Court Quashes Non-Speaking Cryptic Order Of GST Registration Cancellation

The Gujarat High Court has clarified that an order for the cancellation of registration passed without providing any reasons is a non-speaking order and therefore is liable to be set aside. The above ruling delivered by the division bench of Justices Vipul M Pancholi and Devan M Desai, came in response to a petition filed by Om Trading, a registered business under the Goods and...

State GST Dept. Doesn’t Have Jurisdiction To Retain Amount Of Tax On Export Transactions: Bombay High Court

The Bombay High Court has held that CGST/MGST authorities would not have jurisdiction to retain the amount of tax on export transactions.The bench of Justice G. S. Kulkarni and Justice Jitendra S. Jain has directed the state government to transfer the amount to the Central Government.The petitioner was required to deposit tax on the export transaction in question with the authorities under...

Gujarat High Court Grants Assessee Permission to Pay Tax Liability in Installments, Lifts Bank Account Attachment

The Gujarat High Court has overturned the decision of the Adjudicating Authority and granted permission to an assessee to fulfill their tax liability through installment payments, consequently lifting the provisional attachment of the assessee’s bank account. The above order delivered by Justice NV Anjaria and Devan M Desai, came in response to a Special Civil Application, whereby...

CBDT Notifies 'Yamuna Expressway Industrial Development Authority’ For Exemption Under Sec. 10(46)

The Central Board of Direct Taxes (CBDT) has recently notified the Yamuna Expressway Industrial Development Authority under section 10(46) of the Income Tax Act, 1961. Section 10(46) of the Income Tax Act exempts the income of a body or development authority, such as a board, trust, or commission (not a company), that provides public utility services. The provision was...

No Notice For GST Recovery Issued Against The Applicant, Was Illegally Arrested: Allahabad High Court Grants Bail

The Allahabad High Court has granted bail on the grounds that no notice for GST recovery was issued against the applicant, who was illegally arrested.The bench of Justice Sanjay Kumar Pachori has observed that the applicant was arrested without assigning any reason to believe or any satisfaction to justify his arrest.The bail application has been filed on behalf of the applicant under Section...

50th GST Council Recommends Notification Of GST Appellate Tribunal By The Centre With Effect From 01.08.2023

The 50th meeting of the Goods and Services Tax (GST) Council was held under the chairpersonship of Union Finance and Corporate Affairs Minister Smt. Nirmala Sitharaman recommended the notification of the GST appellate tribunal by the centre with effect from 01.08.2023.The Council recommended the measures for the facilitation of trade in the form of Goods and Services Tax Appellate...

50th GST Council Recommends GST Exemption on Cancer-Related Drugs, Medicines For Rare Diseases And Food Products For Special Medical Purposes

The 50th meeting of the Goods and Services Tax (GST) Council was held under the chairpersonship of Union Finance and Corporate Affairs Minister Smt. Nirmala Sitharaman recommended exemption of cancer-related drugs, medicines for rare diseases and food products for special medical purposes from GST.It has been decided to exempt IGST from a cancer medicine, Dinutuximab (Quarziba) medicine...

50th GST Council Meet: Casino, Horse Racing And Online Gaming To Be Taxed At The Uniform Rate Of 28% On Full Face Value

The 50th meeting of the Goods and Services Tax (GST) Council was held under the chairpersonship of Union Finance and Corporate Affairs Minister Smt. Nirmala Sitharaman.A Group of Ministers (GoM) was constituted to look into issues related to taxation on casinos, horse racing, and online gaming. The GoM submitted its first report in June 2022, and it was placed before the GST Council in its...

50th GST Council: GST Rate Cut On Uncooked, Unfried & Extruded Snack Palettes, Fish Soluble Paste, LD slag

The 50th meeting of the Goods and Services Tax (GST) Council was held under the chairpersonship of Union Finance and Corporate Affairs Minister Smt. Nirmala Sitharaman recommended bringing down rates from 18 per cent to 5 per cent on 4 items - Uncooked, unfried & extruded snack palettes, fish soluble paste, LD slag to be at par with blast furnace slag, and imitation zari thread.It has...

50th GST Council Recommends Measures For Streamlining Compliances In GST

The 50th meeting of the Goods and Services Tax (GST) Council was held under the chairpersonship of Union Finance and Corporate Affairs Minister Smt. Nirmala Sitharaman recommended measures for streamlining compliance with GST.In accordance with the recommendations of the Group of Ministers (GoM) on the implementation of the E-way bill requirement for the movement of Gold/ Precious stones...

Bank Guarantee Rates Cannot Be Considered For Benchmarking Corporate Guarantee Fee: ITAT

The Mumbai Bench of the Income Tax Appellate Tribunal (ITAT) has held that bank guarantee rates cannot be considered for benchmarking corporate guarantee fees.The bench of Kavitha Rajagopal (Judicial Magistrate) and Prashant Maharishi (Accountant Member) has remanded the file back to the assessing officer with a direction to the assessee to show the benchmarking of corporate guarantee fees...

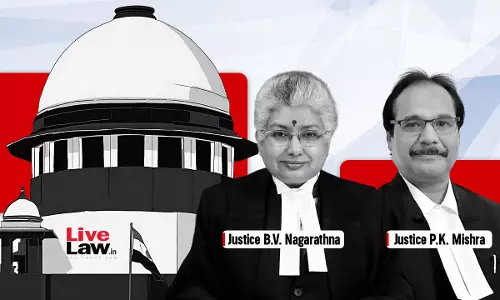

Revenue Dept Can't Recover Refunded Cess Amount Because Refund Was Based On A Judgment Which Was Later Overruled : Supreme Court

The Supreme Court has upheld the decision of the Jammu and Kashmir and Ladakh (J&K&L) High Court where the court had held that the assessee was not liable to return the Education Cess and Secondary & Higher Education Cess in view of the law subsequently laid down by the Supreme Court in M/s Unicorn Industries vs. Union of India, (2020) 3 SCC 492.In the present case Commissioner...