Tax

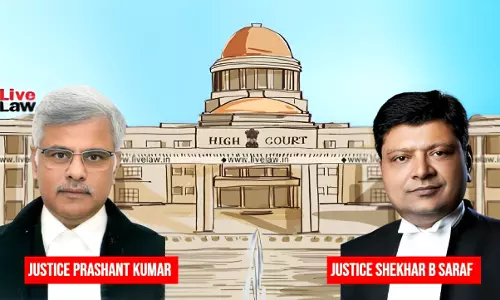

Taxpayer Cannot Be Left At Mercy Of Assessing Officer Who Chooses To Delay Payment Of Genuine Refunds: Allahabad High Court

While dealing with a writ petition for refund of Tax Deducted at Source (TDS), the Allahabad High Court has held that when the documents for TDS are provided by the assesee, the Assessing Officer must process the refund and cannot delay payment of refund in genuine cases. The bench of Justice Shekhar B. Saraf and Justice Prashant Kumar held “a taxpayer should not be left at...

Printing Digital Images/Letters On Paper Constitutes Services, Attracts 18% GST Not 12%: Kerala High Court

The Kerala High Court has held that printing digital images/letters on paper constitutes services, and attracts 18% GST not 12%.The question before the bench was to determine whether the assessee's printing activities ie. converting the figures, letters, photographs etc., in a digital form, into physical format by printing it on paper were liable to GST at 12% or 18%.Justice Ziyad Rahman...

Input Tax Credit Can't Be Blocked If Credit Balance Is Nil: Bombay High Court

The Bombay High Court on Tuesday held that Input Tax Credit (ITC) cannot be blocked under Rule 86-A of the Central Goods and Services Tax Rules, 2017, if the electronic credit ledger of a taxpayer shows a nil balance on the date of the blocking order. A Division Bench of Justice M S Sonak and Justice Advait M Sethna observed, “Therefore, on a plain reading of the rule, if on...

Delhi High Court Drops Suo Moto Contempt Action Against Income Tax Officer For Allegedly Passing Unreasoned Order

The Delhi High Court has dropped the civil contempt proceedings initiated against a Principal Commissioner of Income Tax (now retired) six years ago, for alleged wilful disobedience of its order to give reasons for insisting an assessee to deposit 20% demand in appeal.The proceedings were initiated suo moto in 2019 on a prima facie opinion but on a closer scrutiny, Justice Vikas Mahajan now...

Customs | FERA Penalty U/S 50 Not Applicable For Export Shortfall Below 10%; Exporter Can Write-Off Unrealised Bills: Madras High Court

The Madras High Court stated that the FERA (Foreign Exchange Regulation Act) penalty under Section 50 is not applicable for export shortfall below 10%; the exporter can write off unrealised bills. Justices S.M. Subramaniam and C. Saravanan stated that even otherwise, since Section 18(1)(a) of the Foreign Exchange Regulation Act is to be read along with Section 18(2) and Section 18(3)...

Income Tax Act | Assessee Can Challenge Cash Credit Addition U/S 68 In Remand Proceedings; Tribunal's Direction Not Binding: Kerala High Court

The Kerala High Court held that the assessee is free to challenge the cash credit addition under Section 68 of the Income Tax Act in remand proceedings; the tribunal's directions are not binding. As per Section 68 of the Income Tax Act, 1961, any sum found credited in the books of a taxpayer, for which he offers no explanation about the nature and source thereof or the...

Appointment Of Senior Practitioners At ITAT Should Be Timely, Not At Very End Of Their Professions: CJI BR Gavai

CJI BR Gavai on Wednesday said that the eligibility criteria for appointment of senior practitioners at the Income Tax Appellate Tribunal (ITAT) should be timely, where their experience can be applied effectively and not at the very end of their careers. Underscoring that the appointment procedures at ITAT must remain transparent, CJI said:“Eligibility criteria should be adapted to...

[Finance Act] Retrospective Abolition Of ITSC Doesn't Nullify Settlement Applications Filed Between Feb 1 To Mar 31, 2021: Delhi High Court

The Delhi High Court has held that the Finance Act 2021, which retrospectively abolished the Income Tax Settlement Commission (ITSC), responsible for enabling compromise between the state and its tax payers, cannot create a void.For context, the Finance Act 2021 envisaged replacing the ITSC with a body known as the Interim Board of Settlements from 01.02.2021. However, the Act came into force...

Supreme Court Upholds Tax On Ink & Chemicals Used To Print Lottery Ticket; Says Their 'Deemed Sale' Occurs With Lottery Sale

The Supreme Court on Tuesday (October 7) held that the ink and chemicals used in printing the lottery tickets is a taxable item under the Uttar Pradesh Trade Tax Act, 1948 (“Act”). A bench of Justices JB Pardiwala and KV Viswanathan dismissed the appeal filed by an assessee, who is engaged in the business of printing lottery tickets and had been taxed on the value of ink and chemicals...

Delhi High Court Asks GST Appellate Tribunal To Examine 'Profiteering' Allegations Against Tata Play

The Delhi High Court recently asked the GST Appellate Tribunal to re-look into the profiteering allegations levelled against DTH services provider Tata Play.The direction was made by a division bench comprising Justices Prathiba M. Singh and Shail Jain while dealing with the company's appeal against the show cause notice and consequential order passed against it by the erstwhile...

CESTAT Quashes ₹56.47 Crore Customs Duty Demand On Dish TV Over Smart Card Classification

The Customs, Excise and Service Tax Appellate Tribunal (CESTAT), Principal Bench, New Delhi, recently set aside a ₹56.47 crore customs duty demand against Videocon D2H Limited (now Dish TV India Ltd) in a dispute over the classification of imported smart cards. A coram of Justice Dilip Gupta (President) and Technical Member P V Subba Rao quashed an order dated April 28, 2020, passed...

Tax Weekly Round-Up: September 29 - October 05, 2025

HIGH COURTSAllahabad HCWho Is Prescribed Authority For Appeal U/S 54 U.P. Water Supply & Sewerage Act? Allahabad High Court Asks StateCase Title: Hindustan Aeronautics Limited Transport Aircraft Division Chakeri v. State Of U.P. And 3 OthersRecently, the Allahabad High Court has asked the State to clarify as to who is the prescribed authority under Section 54 of the U.P. Water Supply...

![[Finance Act] Retrospective Abolition Of ITSC Doesnt Nullify Settlement Applications Filed Between Feb 1 To Mar 31, 2021: Delhi High Court [Finance Act] Retrospective Abolition Of ITSC Doesnt Nullify Settlement Applications Filed Between Feb 1 To Mar 31, 2021: Delhi High Court](https://www.livelaw.in/h-upload/2020/02/05/500x300_369852-delhi-high-court-intervenes-in-the-control-of-experiments-on-animals.jpg)