Tax

Tax Weekly Round-Up: October 06 - October 12, 2025

SUPREME COURTSupreme Court Issues Notice To IndiGo On Plea Of Customs Dept & GST Council Against Ruling On IGST Exemption For Imported PartsCase : Principal Commissioner of Customs Acc (Import) and others v. Interglobe Aviation LtdCase no.: Diary No. 49140-2025The Supreme Court on Monday sought a response from IndiGo's parent company, InterGlobe Aviation, on a petition filed by the...

Income Tax | Manual Filing Of Appeal By NRI Valid For DTVSV Scheme Benefits: Gujarat High Court

The Gujarat High Court held that the manual filing of an appeal by an NRI is valid for DTVSV (Direct Tax Vivad Se Vishwas Scheme, 2024) Scheme Benefits. Justices Bhargav D. Karia and Pranav Trivedi were addressing the case where the petitioner/assessee has challenged the communication issued by the respondent authorities, whereby the declaration made by the assessee under the Direct...

Proceedings Under Rule 16/16A Drawback Rules Are Merely Execution Proceedings; Cannot Modify Value In Shipping Bills: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that proceedings under Rule 16/16A Drawback Rules are merely execution proceedings; cannot modify value in shipping bills. Justice Dilip Gupta (President) and P.V. Subba Rao (Technical Member) stated that the proceedings to recover the drawback under Rules 16/16A of the Drawback Rules are...

Delhi High Court Dismisses Revenue's Demand Against Casio India In Transfer Pricing Case

The Delhi High Court has recently dismissed a transfer pricing demand against Casio India, a wholly-owned subsidiary of the Japanese watchmaker, related to advertising, marketing and promotion expenses for the assessment year 2017-18The Division Bench of Justice V Kameswar Rao and Justice Vinod Kumar ruled that the issue had already been settled in Casio's favour in previous years and...

Incorrect Declaration In Bill Of Entry Attracts Penalty U/S 114AA Of Customs Act: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that Justice Dilip Gupta (President) and P.V. Subba Rao (Technical Member) stated that imports and filing of the Bill of Entry are transactions of business under the Customs Act. Section 114AA would squarely apply to those transactions. In this case, the importer filed a Bill of Entry...

Delhi High Court Directs Registry To Add 'DIN Field' In GST Writ Petitions To Avoid Conflicting Rulings

In order to avoid duplication of GST cases, the Delhi High Court has asked its Registry to add a new field for filing of writ petitions to record DIN (Document Identification Number) and date of order being challenged.A division bench of Justices Prathiba M. Singh and Shail Jain passed the direction on observing that multiple writ petitions were being filed challenging same impugned...

IRCTC's Licensing For Operation Of Food Plazas Not Liable To Service Tax Under 'Renting Of Immovable Property': CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that IRCTC's (Indian Railway Catering & Tourism Corporation Ltd.) licensing for the operation of food plazas is not liable to service tax under 'renting of immovable property'. The Tribunal observed that the agreement was purely related to the transaction of business whereby the assessee...

Tax Quarterly Digest: July - September, 2025

SUPREME COURTStem Cell Banking Services Qualify As "Healthcare Services" In Service Tax Exemption Notification : Supreme CourtCase : M/S. STEMCYTE INDIA THERAPEUTICS PVT. LTD vs COMMISSIONER OF CENTRAL EXCISE AND SERVICE TAX, AHMEDABAD - IIICase no.: CIVIL APPEAL NOS. 3816-3817 OF 2025The Supreme Court held that stem cell banking services, including enrolment, collection, processing, and...

Govt Examination Board Not Liable To Pay Service Tax On Examination Fees Collected From Candidates: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that the government examination board is not liable to service tax on examination fees collected from candidates. Binu Tamta (Judicial Member) and Sanjiv Srivastava (Technical Member) stated that the examination fees collected from the candidates appearing for the examination being...

Gauhati High Court Quashes ₹19.5 Crore GST Notice Against PepsiCo

The Gauhati High Court recently quashed a ₹19.5 crore show cause notice (SCN) issued to food and beverage giant PepsiCo India Holdings Pvt. Ltd. under the CGST Act, ruling that the GST department failed to comply with the mandatory process of return scrutiny before initiating tax demand proceedings.In a judgment delivered on September 19, 2025, a single bench of Justice Soumitra Saikia...

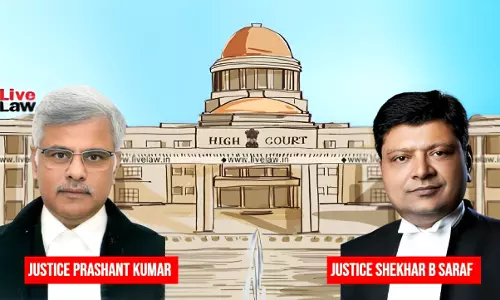

Taxpayer Cannot Be Left At Mercy Of Assessing Officer Who Chooses To Delay Payment Of Genuine Refunds: Allahabad High Court

While dealing with a writ petition for refund of Tax Deducted at Source (TDS), the Allahabad High Court has held that when the documents for TDS are provided by the assesee, the Assessing Officer must process the refund and cannot delay payment of refund in genuine cases. The bench of Justice Shekhar B. Saraf and Justice Prashant Kumar held “a taxpayer should not be left at...

Printing Digital Images/Letters On Paper Constitutes Services, Attracts 18% GST Not 12%: Kerala High Court

The Kerala High Court has held that printing digital images/letters on paper constitutes services, and attracts 18% GST not 12%.The question before the bench was to determine whether the assessee's printing activities ie. converting the figures, letters, photographs etc., in a digital form, into physical format by printing it on paper were liable to GST at 12% or 18%.Justice Ziyad Rahman...