Tax

Tax Weekly Round-Up: September 15 - September 21, 2025

SUPREME COURTSupreme Court Allows Customs Duty Exemption To LG Electronics For Smart Watch Import From KoreaCause Title: M/S L.G. ELECTRONICS INDIA PRIVATE LIMITED VERSUS COMMISSIONER OF CUSTOMSThe Supreme Court recently granted relief to LG Electronics India from paying customs duty on imported 'G Watch W7' smartwatches from South Korea, holding that a certificate of origin from a country...

CCTV Footage Of Assessee's Family Cannot Be Used By GST Dept, Violates Right To Privacy: Delhi High Court

The Delhi High Court has issued directions safeguarding the right to privacy in GST search proceedings, stating that any family-related CCTV footage which violates the privacy of family members cannot be used or disseminated in any manner. “Some of the concerns which are raised by the Petitioners such as right to privacy of the family being violated, etc., deserve to be...

Compensation Received From NHAI For Acquisition Of Land Not Taxable: Chhattisgarh High Court

The Chhattisgarh High Court held that the compensation received against the acquisition of land from the NHAI (National Highways Authority of India) is not exigible to tax under Section 96 of the RFCTLARR Act (Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013). Section 96 of the Right to Fair Compensation and Transparency in...

Customs Act | Provisional Release Of Seized Object Won't Extend Timelimit For Issuing Show Cause Notice In Pre-2018 Cases : Supreme Court

The Supreme Court recently upheld a Delhi High Court order directing release of an imported Maserati car seized by the Directorate of Revenue Intelligence (DRI), upholding the HC's view that failure to issue a show-cause notice within time prescribed under the Customs Act, 1962 entitles the person to release of the seized goods.A bench of Justice JB Pardiwala and Justice Sandeep Mehta...

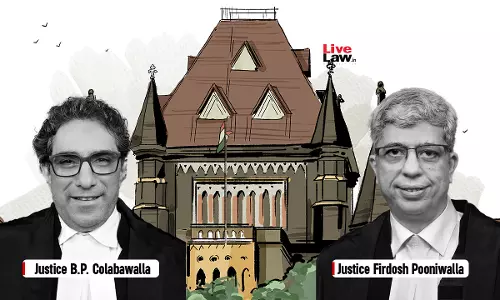

Income Tax Act | Payment To Consulting Doctors Appointed On Probation Is Not Salary; TDS Deductible U/S 194J, Not U/S 192: Bombay High Court

The Bombay High Court has held that payments to consultant doctors are not salary. Hence, TDS is deductible under section 194J and not under section 192 of the Income Tax Act. Justices B.P. Colabawalla and Firdosh P. Pooniwalla stated that there does not exist an employer-employee relationship between the assessee and consultant doctors, and the payments made to them by the...

In Tax Matters, Strict Letter Of Law Must Be Followed; No Tax Can Be Imposed By Inference Or Analogy : Supreme Court

The Supreme Court observed that no tax can be imposed by inference or analogy when the taxing statutes do not authorize the imposition of tax. It added that tax authorities cannot bypass statutory limitation periods by administrative sanction. “In construing fiscal statutes and in determining the liability of a subject to tax one must have regard to the strict letter of law. If the...

Income Tax Act | Draft Assessment Order Not Permissible U/S 144C(1) When TPO Makes No Variation: Bombay High Court

The Bombay High Court has held that a draft assessment order is not permissible under section 144C(1) of the Income Tax Act when the TPO (transfer pricing officer) makes no variation. Section 144C(1) of the Income Tax Act, 1961, provides that the Assessing Officer should forward a draft of the proposed assessment order to the eligible assessee if any variation of the income or...

Rajasthan High Court Partly Quashes CBIC Circular Restricting ITC Refund For Inverted Duty Structure Up To 18.07.2022

The Rajasthan High Court has quashed Point No. 2 of the Circular No. 181/13/2022-GST dated 10.11.2022, restricting ITC claims on the inverted duty structure prior to 18.07.2022. The bench, consisting of Justices Dinesh Mehta and Sangeeta Sharma, stated that if the impugned clarification is tested on the anvil of reasonableness, it falls foul to Article 14 of the Constitution of...

Failure To Mention Correct Value In GSTR-5A Filing Is Not Suppression U/S 74 CGST Act: Karnataka High Court

The Karnataka High Court has stated that a failure to mention the correct value in returns or apply the correct GST rate is not suppression under section 74 of the Central Goods and Services Tax (CGST). Justice S.R. Krishna Kumar stated that "...though the revenue alleged in the impugned SCN that the assessee failed to mention the value of services correctly in the GSTR-5A returns...

Compensation For Breach Of Agreement To Sell Land Not Taxable As Declared Service U/S 66E(e) Of Finance Act: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that compensation for breach of agreement to sell land is not taxable as declared service U/S 66E(e) of the Finance Act. Section 66E(e) of the Finance Act, 1994 lists out “declared services” for the purpose of levy of service tax. It deems 'Agreeing to the obligation to refrain from an...

Rajasthan GST Act | HC Calls For 'Purposive' Interpretation Of S.107, Asks Why Assessment Orders Cannot Be Sent On Assessee's Email

The Rajasthan High Court has questioned why the tax department can send attachment orders via email, but not assessment orders, to ward off any communication gap or confusion about the date of communication.The Court was hearing a petition filed against the order of the Appellate Authority, State Tax, that had rejected an appeal preferred by the petitioner under Section 107(1) of the...