Tax

Statement Recorded U/S 108 Of Customs Act Is Not Valid Evidence U/S 138B Of Customs Act: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that statement recorded under section 108 of the Customs Act not valid evidence under section 138B of the Customs Act. The Bench of Justice Dilip Gupta (President) and P.V. Subba Rao (Technical Member) was addressing the issue of whether the statement recorded under section 108 of the...

Valuation Of Company's Unquoted Equity Shares By 'Discounted Cash Flow' Method Permissible Under Income Tax Rules: Delhi High Court

The Delhi High Court recently rejected the appeal preferred by the Income Tax Department against an ITAT order allowing the valuation of a software company's unquoted equity shares by discounted cash flow [DCF] method.In doing so, a division bench of Justices Vibhu Bakhru and Tejas Karia held that DCF method “is one of the methods that can be adopted by the Assessee under Rule 11UA(2)(b) of...

Amount Deposited Under Protest Can't Be Treated As Admission Of Tax Liability: Himachal Pradesh High Court

The Himachal Pradesh High Court has held that when a taxpayer deposits an amount “under protest”, it does not amount to an admission of tax liability.A Division Bench of Justice Tarlok Singh Chauhan and Justice Sushil Kukreja observed as follows; “Once the petitioner had deposited the amount 'under protest', the same could not have been considered to be an admission of liability because...

Proceedings Against Assessee Unsustainable Once Discharge Certificate Is Issued Under SVLDRS Scheme: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that proceedings against assessee unsustainable once discharge certificate is issued under SVLDRS [Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019] Scheme. The Bench of Ashok Jindal (Judicial Member) and P. Anjani Kumar (Technical Member) was addressing the issue that in case where...

Packing/Re-Packing Of Parts Of Device Is Not Manufacture U/S 2(f)(iii) Of Central Excise Act; No Excise Duty: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that packing/re-packing of parts of vibrator compactor is not manufacture under Section 2(f)(iii) Of Central Excise Act and hence no excise duty is leviable. The Bench of Justice Dilip Gupta (President) and P.V. Subba Rao (Technical Member) was addressing the issue of whether the...

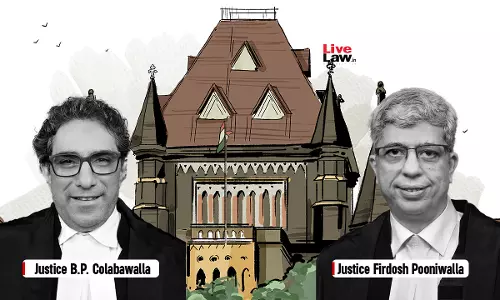

Design & Engineering Services To Foreign Entities Are Zero-Rated Supplies; Assessee Eligible For Refund Of Unutilized ITC U/S 54 Of CGST Act: Bombay HC

The Bombay High Court stated that design and engineering services to foreign entities are zero-rated supplies; assessee eligible for refund of unutilized ITC U/S 54 CGST. The Division Bench of Justices B.P. Colabawalla and Firdosh P. Pooniwalla observed that assessee is not an agency of the foreign recipient and both are independent and distinct persons. Thus, condition (v)...

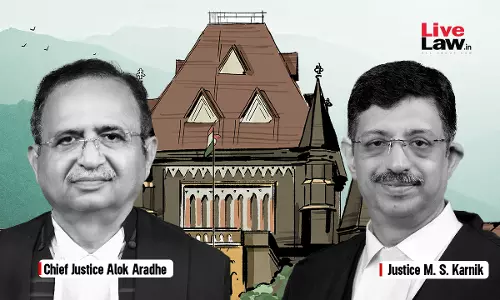

AO Cannot Alter Net Profit In Profit & Loss Account Except Under Explanation To S.115J Of Income Tax Act: Bombay High Court

The Bombay High Court stated that assessing officer do not have the jurisdiction to go behind net profit in profit and loss account except as per explanation to Section 115J Of Income Tax Act. The Division Bench consists of Chief Justice Alok Aradhe and Justice M.S. Karnik observed that “Section 115J of the 1961 Act mandates that in case of a company whose total income as...

GST | Separate Demands For Reversal Of Availed ITC & Utilisation Of ITC Is Prima Facie Duplication Of Demand: Delhi High Court

The Delhi High Court has observed that demand raised against an assessee qua reversal of availed Input Tax Credit (ITC) and qua utilisation of ITC prima facie constitutes double demand.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta thus granted liberty to the Petitioner-assessee to approach the Appellate Authority against such demand, and waived predeposit qua demand...

[Income Tax] Breach Of Article 265 Cannot Be Alleged Based On Inconclusive Opinion By Assessing Officer: Bombay High Court

The Bombay High Court stated that a breach of Article 265 of the constitution cannot be alleged or sustained based upon a tentative or inconclusive opinion formed by assessing officer. The Division Bench consists of Justices M.S. Sonak and Jitendra Jain stated that “If the communication dated 29 November 2018 is an order, it being like a preliminary, prima facie, or interlocutory...

Does Payment For Transponder Services Constitute 'Royalty' U/S 9(1)(vi) Of Income Tax Act? Bombay High Court Asks CIT To Decide

The Bombay High Court has asked the Commissioner of Income Tax to decide whether payment for transponder services constitutes 'royalty' under Section 9(1)(Vi) of Income Tax Act. The Division Bench of Justices M.S. Sonak and Jitendra Jain observed that “the authorities have held the payment to constitute 'royalty' under the domestic law as well as under the Treaty, but by holding...

State Tax Authorities Not Mandated To Issue DIN With Orders Or Summons: Gujarat High Court

The Gujarat High Court stated that state tax authorities not mandated to issue din with orders or summons. The Division Bench of Justices Bhargav D. Karia andP.M. Ravalobserved that “there is no mechanism of issuance of DIN on any of the communication, notice, summons, orders issued by the State Tax Authorities. In such circumstances, the contention raised on behalf of the...

Omission Of Rule 96(10) Of CGST Rules Operates Prospectively But Applies To All Pending Proceedings: Gujarat High Court

The Gujarat High Court stated that omission of Rule 96(10) Of CGST Rules, 2017 operates prospectively but applies to all pending proceedings. The Division Bench of Justices Bhargav D. Karia and D.N. Ray was addressing the issue where a group of petitions have challenged the vires of Rule 96(10) of the Central/State Goods and Services Tax Rules, 2017 as substituted by the Central...

![[Income Tax] Breach Of Article 265 Cannot Be Alleged Based On Inconclusive Opinion By Assessing Officer: Bombay High Court [Income Tax] Breach Of Article 265 Cannot Be Alleged Based On Inconclusive Opinion By Assessing Officer: Bombay High Court](https://www.livelaw.in/h-upload/2024/10/17/500x300_566535-justices-mahesh-sonak-and-jitendra-jain-bombay-hc.webp)