Tax

Rampant Misuse Of S.16 GST Act For Wrongful Availment Of ITC Will Create 'Enormous Dent' In GST Regime: Delhi High Court

The Delhi High Court has once again flagged concerns over rampant misuse of Section 16 of the Central Goods and Services Tax Act 2017 by traders, for wrongful availment of Input Tax Credit.The provision enables businesses to get input tax on the goods and services which are manufactured/ supplied by them in the chain of business transactions. It is meant as an incentive for businesses who...

Whether Compensation Cess Is Leviable On Goods Supplied To Merchant Exporter: Gujarat High Court Asks GST Council To Decide

The Gujarat High Court has referred a matter to the GST Council to decide on whether the compensation cess is leviable on goods supplied to merchant exporter. The Division Bench of Justices Bhargav D. Karia and D.N. Ray observed that “……..no notification is issued by the Central Government or State Government under the Compensation Cess Act and therefore, the assessee...

Supreme Court Upholds Constitutional Validity Of S.5A, Kerala General Sales Tax Act and S.7A, Tamil Nadu General Sales Tax Act

The Supreme Court recently upheld the constitutional validity of Section 5A of the Kerala General Sales Tax Act, 1963 and Section 7A of the Tamil Nadu General Sales Tax Act, 1959."The challenge to the constitutional validity must be rejected on the basis of the ratio elucidated by this Court in Kandaswami (supra), Hotel Balaji (supra) and Devi Dass (supra)...Hotel Balaji (supra)...

Jharkhand HC Quashes Provisions Of RTE Amendment Rules Levying Inspection Fee, Security Deposit On Private Schools

The Jharkhand High Court has partly allowed a batch of writ petitions challenging the Jharkhand Right of Children to Free and Compulsory Education (First Amendment) Rules, 2019. The Court struck down as unconstitutional the provisions requiring private schools to pay application and inspection fees and to maintain a security deposit for recognition, holding that the State lacked legal...

GST | Delhi HC Rebukes Trend Of Persons Who Wrongfully Avail ITC By Invoking Writ Jurisdiction; Imposes ₹1 Lakh Cost

The Delhi High Court has criticized the “pattern” of persons, who either availed fraudulent Input Tax Credit or enabled the availment of fraudulent ITC, invoking Court's writ jurisdiction to challenge orders imposing penalty under Section 74 of the Central Goods and Services Act 2017, on technical grounds.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta...

When Assessee-Company Can Prove Genuineness Of Transaction, Delhi HC's 'NR Portfolio' Judgment Not Applicable: Calcutta HC

The Calcutta High Court has made it clear that the Delhi High Court decisions in NR Portfolio and Navodaya Castles will hold no value where an assessee-company establishes the identity of its shares subscribers, creditworthiness of the share subscribers and genuineness of the transactions.In CIT v. NR Portfolio Private Limited (2014) and in CITA v. Navodaya Castles Private Limited (2014),...

Tax Weekly Round-Up: May 05 - May 11, 2025

HIGH COURTSAndhra Pradesh HCSale Of Liquid Carbon Dioxide Is Liable To Be Taxed At 5%: Andhra Pradesh High CourtCase Title: Punjab Carbonic (p) Ltd. v. The Commercial Tax Officer and OthersCase Number: WRIT PETITION NO: 12529/2024The Andhra Pradesh High Court stated that the sale of liquid carbon dioxide is liable to be taxed at 5%.The Bench consists of Justices R Raghunandan Rao and K...

Consultancy Services Rendered To Foreign University/Foreign Group Entity Are Not “Intermediary Services”; Service Tax Not Leviable: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that the consultancy services rendered by the assessee to the foreign university/foreign group entity do not fall under the category of “intermediary services” and the assessee are eligible for the benefit of “export of services”. The Bench of Binu Tamta (Judicial Member) and...

Disputed Amount Paid Under Protest Much After Clearance Of Goods Is Not Covered Under Unjust Enrichment: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that disputed amount paid under protest much after clearance of goods is not covered by unjust enrichment. The Bench of Binu Tamta (Judicial Member) has observed that “once the supplies have already been made, any amount paid thereafter, as tax or deposit, the burden of such amount cannot...

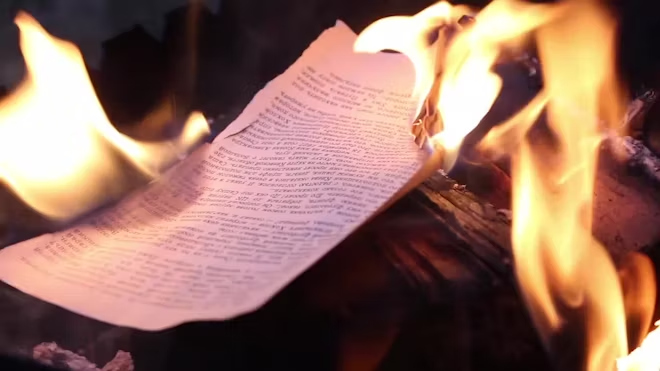

Patna High Court Upholds ₹25 Lakh Service Tax Demand Against Travel Agency Which Failed To Disclose Transactions & Claimed Records Were Lost In Fire

The Patna High Court has recently upheld a service tax demand of ₹25.25 lakh against a travel agency, dismissing its defence that crucial business records had been lost in a fire. The Division Bench comprising Justice Rajeev Ranjan Prasad and Justice Ashok Kumar Pandey observed, “this petitioner having surrendered his service tax registration had not disclosed the transactions in ST-3....

Dept Cannot Be Blamed If Assessee Is Not Diligent In Checking GST Portal For Show Cause Notice: Delhi High Court

The Delhi High Court has made it clear that an assessee cannot claim he was not granted an opportunity of hearing before an adverse order is passed, if he fails to check the GST portal for show cause notice and respond to the same.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta observed,“Since the Petitioner has not been diligent in checking the portal, no reply to...

Orders Under Omitted Rule 96(10) Of CGST Rule, 2017 Post 8th Oct, 2024 Not Valid; No Savings Clause: Uttarakhand High Court

The Uttarakhand High Court stated that orders passed under omitted Rule 96(10) Of CGST Rule, 2017 post 8th Oct, 2024 is not valid. The Division Bench of Chief Justice G. Narendar and Justice Alok Mahra stated that there was no scope for the department to pass any order by invoking the provisions of rule 96(10) of CGST Rule, 2017 after the same was omitted on 8th October, 2024 without...