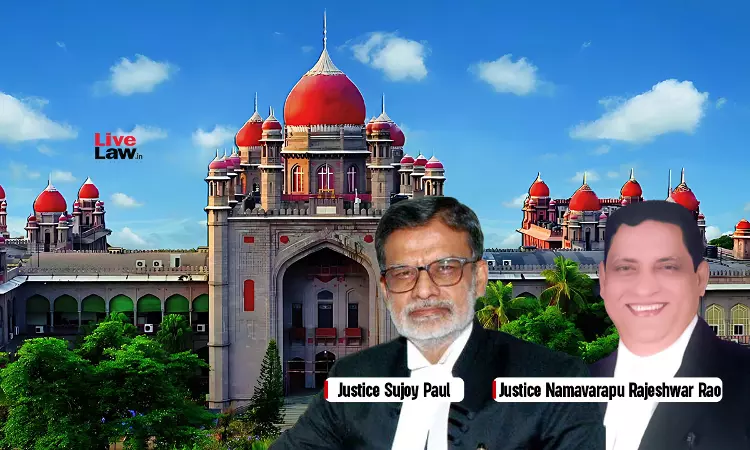

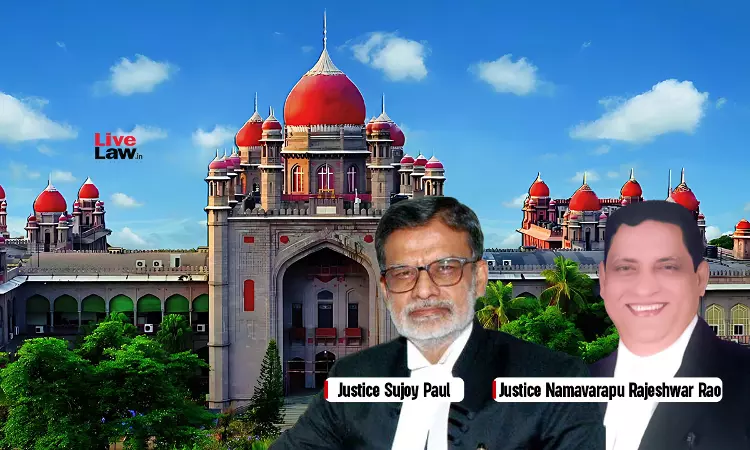

The Telangana High Court has held that the expenditure incurred by a hotel on replacement of damaged items is a current expenditure, allowable under Section 37 of the Income Tax Act, 1961. Section 37 of Income Tax Act states that any business expenditure, excluding capital expenditure and the individual's personal expenses, that is spent for the business's operations shall be...