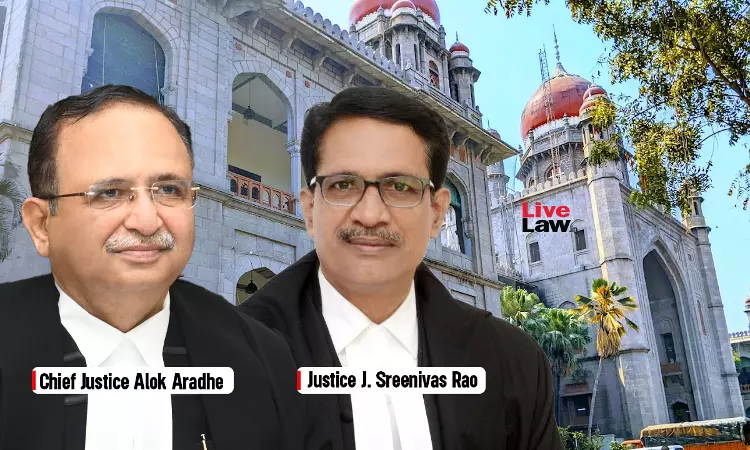

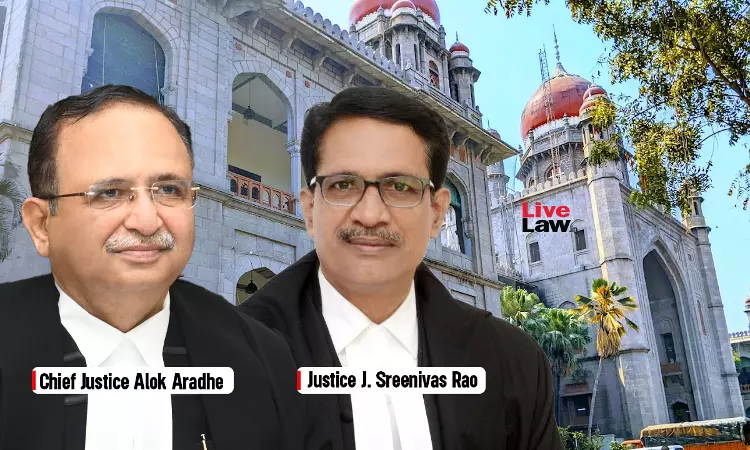

The Telangana High Court has held that the loss of fixed deposit investments by an assessee does not qualify as a 'trading loss' for the purposes of claiming deduction from income under Section 28 of the Income Tax Act, 1961. Under Section 28, one may deduct expenses that are fully and solely incurred in the course of operating a business or practicing a profession. In the case...