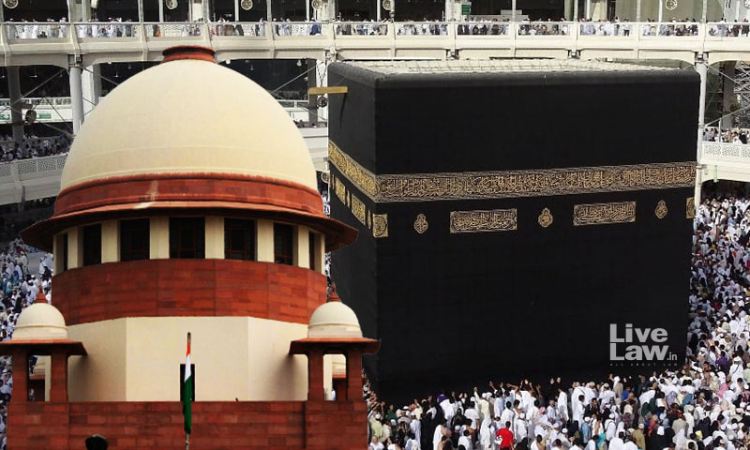

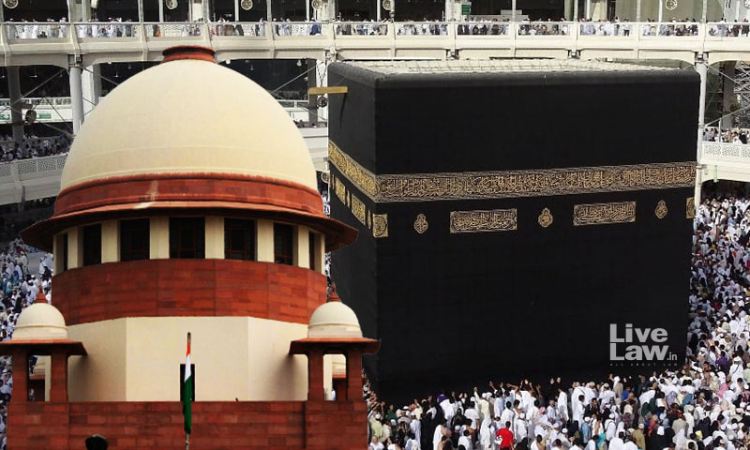

The Supreme Court on Thursday dismissed a batch of petitions filed by various private tour operators seeking exemption from the Goods and Services Tax for the Haj and Umrah services offered by them to pilgrims travelling to Saudi Arabia.A bench of Justices A. M. Khanwilkar, A. S. Oka and C. T. Ravikumar pronounced the judgment. Justice Oka, who read out the operative protion of the judgment,...